- The US dollar demonstrated another rally early on Wednesday against the Japanese yen, although it appears to be somewhat overextended.

- Nevertheless, my bias remains bullish for the long term.

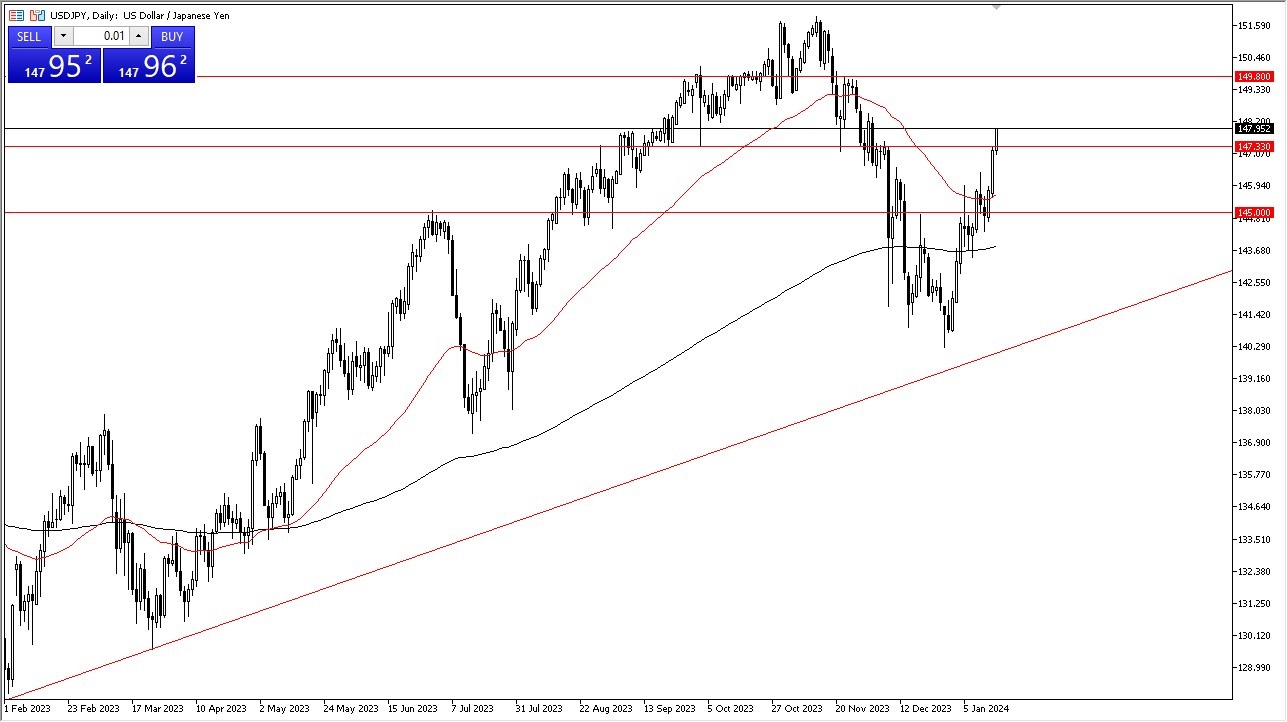

Examining the USD/JPY pair, we observe that it continued to climb during Wednesday's trading session. However, as previously mentioned, the possibility of a pullback looms on the horizon, and I anticipate such a pullback to present a buying opportunity.

The 50-day Exponential Moving Average beneath the current price level should serve as support, potentially around the 147.33 mark. However, I believe that if a pullback occurs, it could extend further than that. The prevailing interest rate differential between the US dollar and the Japanese yen continues to favor the US dollar. Consequently, I see no compelling argument for shorting this currency pair.

On the upside, the 149.80 level represents a notable resistance area and could be the next target for the pair. Examining the long-term charts, we find that the overall trend remains bullish. Despite a significant sell-off towards the end of the previous year, it is evident that the Bank of Japan is unlikely to take measures to stabilize the Japanese yen due to concerns regarding interest rates.

Top Regulated Brokers

Bank of Japan

Japan's substantial debt burden presents a significant challenge. The nation faces a choice between maintaining a strong currency with high-interest rates or a weaker currency with lower rates. It is unfeasible to achieve both simultaneously. It seems that the Bank of Japan is beginning to acknowledge this dilemma.

On the other hand, the Federal Reserve in the United States may potentially reduce rates in the coming year. However, it is my belief that it will be a considerable amount of time before the Federal Reserve reaches the interest rates seen in Japan. Consequently, holding onto this currency pair is likely to remain profitable, with daily swap rates further incentivizing such a position.

In the end, the US dollar's recent strength against the Japanese yen may prompt a pullback in the near term. However, the long-term outlook remains bullish due to the interest rate differential favoring the US dollar. Resistance lies at the 149.80 level, with the overall trend pointing upwards. Japan's debt challenges and the contrasting monetary policies of the Bank of Japan and the Federal Reserve underpin this bullish outlook. Holding onto this currency pair appears to be a rewarding strategy, particularly considering the daily swap rates.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.