- During Monday's trading session, the US dollar had a significant rally against the Japanese yen, despite limited liquidity due to the observance of Martin Luther King Jr. Day in the United States.

- This upward movement suggests the market's intent to maintain its uptrend overall, something that I believe may catch some people off guard.

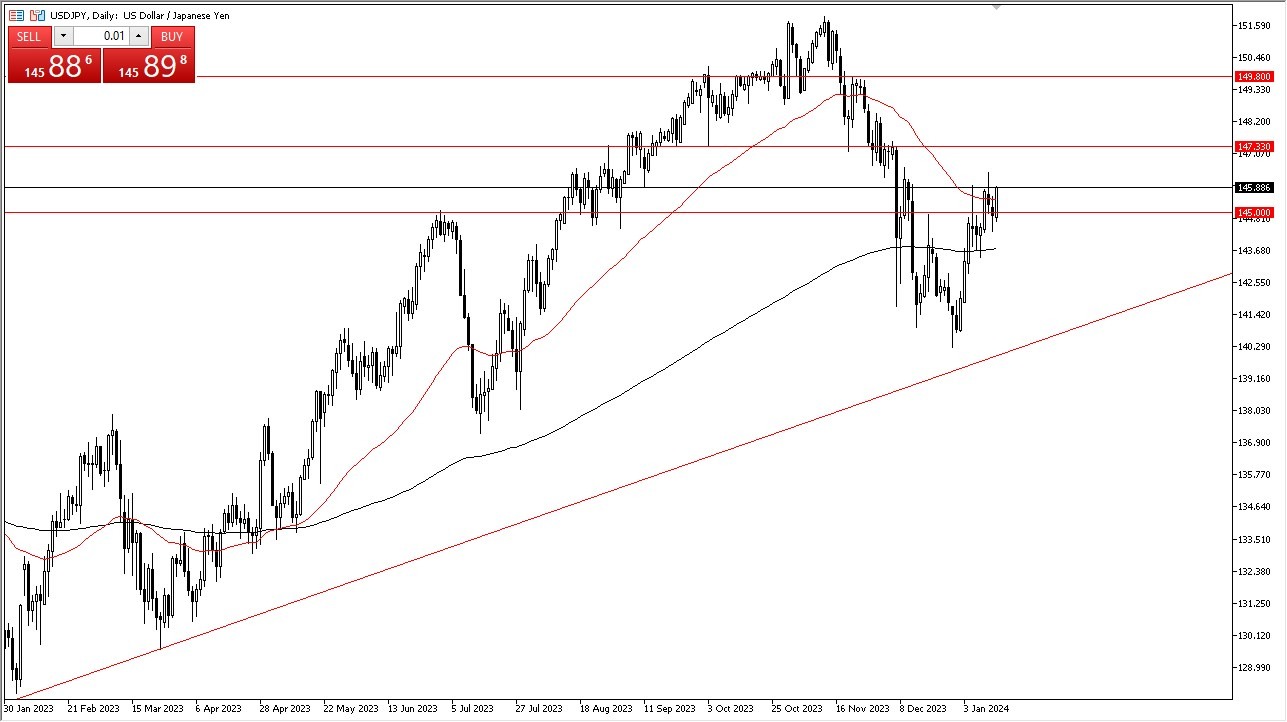

The currency pair USD/JPY, which represents the US dollar against the Japanese yen, saw early gains on Monday. It is important to note that holidays (check out our Holiday Season Trading Schedule article) in the US typically lead to reduced market participation, affecting liquidity. The pair is currently testing a key resistance level formed by a shooting star pattern observed last Thursday. A successful break above this resistance level could potentially drive the US dollar towards the 147.33 level.

The Japanese yen has been under pressure due to the Bank of Japan's continued policy of maintaining negative real interest rates, which essentially means that holding onto the yen results in a loss of value over time. Additionally, market sentiment has suggested that the Federal Reserve might implement aggressive interest rate cuts in 2024, which initially weighed on the US dollar's performance.

Top Regulated Brokers

Solid support?

However, recent price action indicates that the US dollar has found support and regained momentum. It has managed to stay above the 200-day Exponential Moving Average, a key technical indicator that signifies an uptrend for many traders. This repositioning has reinforced the overall bullish sentiment in the market.

Even in the event of a break below the 200-day EMA, a sustained downtrend would only occur if the pair fell below the 140 yen level, which has held as support in recent weeks. From a multi-month perspective, the market continues to maintain a bullish outlook.

Ultimately, the US dollar's recent rally against the Japanese yen reflects a market that is resilient despite reduced liquidity due to the holiday. The Japanese yen's weakening position, driven by negative interest rates, and the US dollar's ability to hold above key technical levels have contributed to this renewed bullish sentiment. Traders are inclined to view pullbacks as potential buying opportunities, considering the market's overall uptrend and the historical pattern of buyers returning after corrections. Selling this pair is not the current strategy, as market participants look for opportunities to buy into this resilient trend.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.