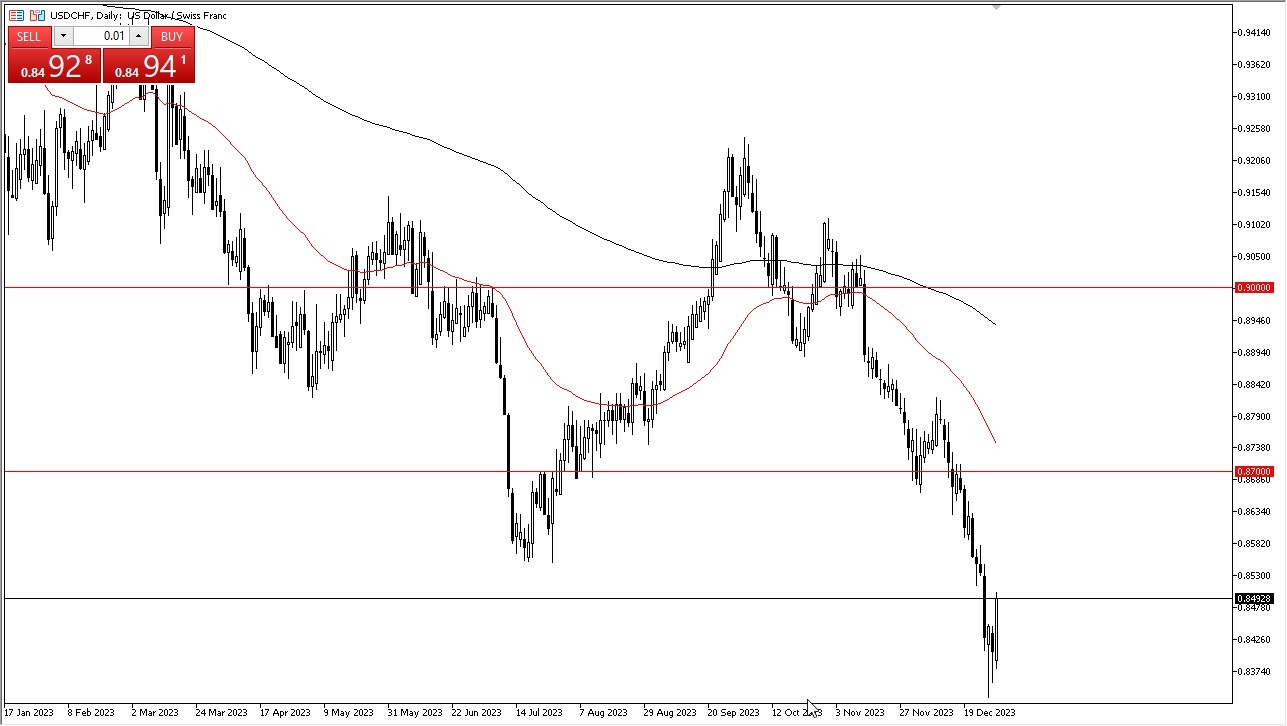

- Taking a look at the dollar Swiss franc and we've had a nice bounce to kick off the year.

- We have to ask a lot of questions down here because the Swiss national bank is known to get involved if the Swiss franc strengthens too much.

- However, I would also point out that the US dollar has had a very decent day against most things, not only currencies but the gold market, the silver market, etc. With this, it makes sense that the pair continues to see strength because of this as well.

There might be a little bit much to read into it, but it's worth noting that the previous two candlesticks were hammers, so I think a bounce is in the cards, and that is starting to play out in real time. The market is currently testing the 0.85 level. If we can break above there, we could rally another two handles before we see major resistance again.

Franc Could Be Pushed Around a Bit

That features the 50-day EMA, the 0.87 level, an area that has been both supportive and resistance over the longer term, and therefore, I think a lot of people will be paying close attention to it. When you zoom out to the monthly chart, you see just how oversold we are. This is an area where the Swiss National Bank has gotten involved in the past, so they may be intervening stealthily. Stay tuned, we will see at this point.

Top Regulated Brokers

They have been known to do that and then the news comes out months later. Unlike the bank of Japan, they don't always make a big bang in the market. They just simply get involved in the Frank, which is one of the smallest of the major currencies, so therefore it can be pushed around a bit. I have no interest in shorting this market, at least not from here, maybe at 0.87. But right now, I think we are going to continue to see the U S dollar try to recover against this chart whether or not the jobs market has a major influence on Friday we'll have to wait and see but we also have inflation numbers so a lot of moving pieces but definitely oversold.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.