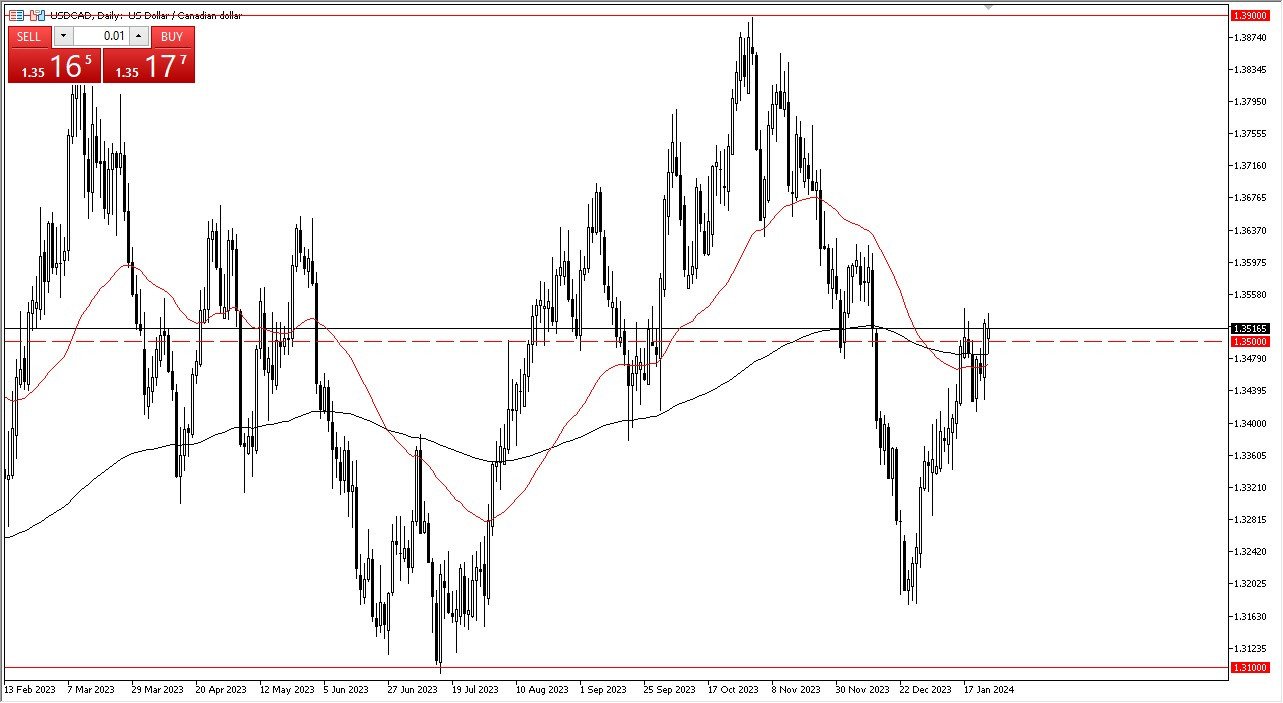

- The US dollar has been back and forth against the Canadian dollar during the trading session on Thursday, as we continue to hang around the 1.35 level.

- The 1.35 level is an area that of course is a large, round, psychologically significant figure, and therefore attracts a lot of attention.

- With that being the case, I think we’ve got a situation where you will continue to see a lot of choppy behavior.

After all, the crude oil markets have a major influence on the Canadian dollar, and of course they are doing everything they can to break out. That being said, the reality is that the market is going to continue to be very noisy, as although oil has looked somewhat bullish, the reality is that the US dollar is also starting to strengthen during the day, and therefore we are hanging around just below the 200-Day EMA. The 200-Day EMA is an indicator that a lot of people pay close attention to.

Noisy Behavior

I anticipate that we will continue to see a lot of noisy behavior in the USD/CAD pair, which makes quite a bit of sense that we would see volatility, because quite frankly traders around the world have no idea what to do right now. The Bank of Canada has just stated that rate hikes are not completely out of the question, and of course the Federal Reserve is expected to do rate cuts in 2024, but if that is a being the case, it could be a very bad sign for the economy. Remember, the Canadian economy is highly levered to the US economy, as the United States is by far the biggest customer for Canadian raw materials.

Top Regulated Brokers

If we break above the 1.3550 level, then it opens up a move to the 1.36 level, where we have seen a significant amount of resistance previously. On the other hand, if we turn around and break down below the 1.34 level, then it’s likely that we will go down to the 1.33 level. I do think that eventually we will get some type of bigger move, but right now we just don’t have enough confidence in anything to have a bigger move in a lot of currency pairs, and this one of course will not be any different. In the short term, I think low timeframe trading with a range bound indicator might be the best way to approach it.

Ready to trade our Forex daily analysis and predictions? Here are the best Canadian online brokers to start trading with.