Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the 29.80 level.

- Place a stop loss point to close below the 29.65 support level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 29.99.

Best-selling entry points

- Entering a sell deal with a pending order from the 29.99 level.

- The best points for placing a stop loss are closing the highest level of 30.09.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 29.80

The USD/TRY opened weekly trading on the rise, with continued pressure on the price of the Turkish Lira, which witnessed a decline to record levels. The expectations of financial institutions for the price of the lira during the current year ranged between levels of 38 to 40 liras per dollar, while the most optimistic forecasts expected the lira to decline to levels of only 33 per dollar during 2024.

Meanwhile, Mehmet Simsek, the Turkish Minister of Treasury and Finance, announced his government's economic program during 2024, which includes three main goals: continuing monetary tightening, maintaining financial discipline, and supporting structural reforms in an attempt by the Turkish government to correct the Turkish economic path. The Turkish Minister previously stressed, through a post on Twitter, the necessity of reducing the budget deficit per the European Maastricht standards to control the high inflation rate, as the new economic team that was appointed in the wake of the presidential elections last May aims to bring inflation to a level that does not exceed average. Inflation rates for EU countries with lower rates are more than 1.5 points.

At the same time, the government aims to ensure that the budget deficit about GDP does not exceed 3%. With the government pursuing structural reforms aimed at sustaining economic growth.

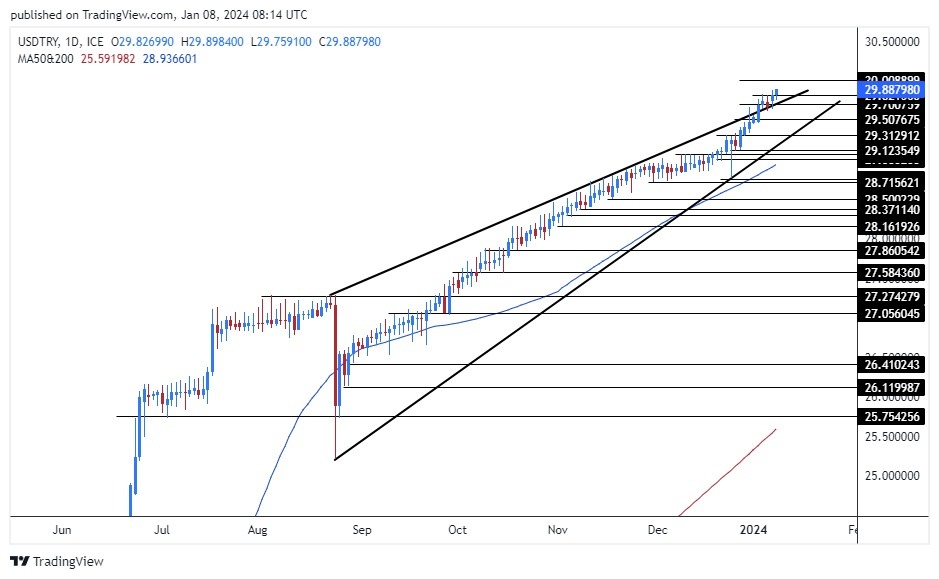

USD/TRY Technical Analysis

The USD/TRY maintained its gains during the beginning of this week, as the Turkish lira recorded its lowest level ever against the dollar at levels of 29.88, approaching the psychological barrier of 30 liras per dollar. The pair is trading above the upper border of the rising wedge pattern on the daily time frame shown on the chart. At the same time, the price maintained its trading above the 50 and 200 moving averages on the daily and four-hour time frames, respectively, indicating the strong general upward trend that dominates the pair in the long term.

Top Regulated Brokers

If the pair maintains its gains, it targets levels of 30 and 30.15, respectively, while if the price declines, it targets levels of 29.80 and 29.75, respectively. The Turkish Lira price forecast includes an increase in the pair, especially after it breached the upper border of the wedge pattern shown in the chart. Please adhere to the mentioned recommendation points and maintain capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.