Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the 29.70 level.

- Place a stop loss point to close below the 29.55 support level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 29.99.

Best-selling entry points

- Entering a sell deal with a pending order from the 29.95 level.

- The best points for placing a stop loss are closing the highest level of 29.99.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 29.70

The USD/TRY stabilized relatively during Thursday's trading, after a series of declines that continued throughout the week, as the lira fell to its lowest level ever near the psychological level of 30 lira per dollar. Investors followed mixed data this week, the most important of which was the inflation figures, which accelerated the inflation rate in December, with the annual rate rising to 64.77%, which is a lower percentage than expectations.

In other data - Turkey's trade deficit as a whole last year declined by about 3.2% to reach 106 billion dollars, as the volume of exports increased by 0.6% to reach 255.8 billion. At the same time, the volume of imports recorded a decline by 0.5% to reach 361.8 billion. Dollars, according to preliminary data published by the Turkish Ministry of Trade.

In this regard, Turkish President Recep Tayyip Erdogan announced that, according to preliminary figures issued by the Ministry of Commerce, Turkey's exports reached an unprecedented level of $255.809 billion in 2023, a slight increase of 0.6% compared to the previous year. In his direct address to the nation, Erdogan noted that as of October 2023, Turkey's annual services exports had risen to a record high of $99.254 billion. He noted that over the past five months, there has been a continuous decline in the country's foreign trade and current account deficit. Erdogan expressed his optimism that this trend will continue in the future. In addition, it was stated that Turkey's trade deficit saw a decrease of 3.2% in 2023, reaching a total of $106 billion.

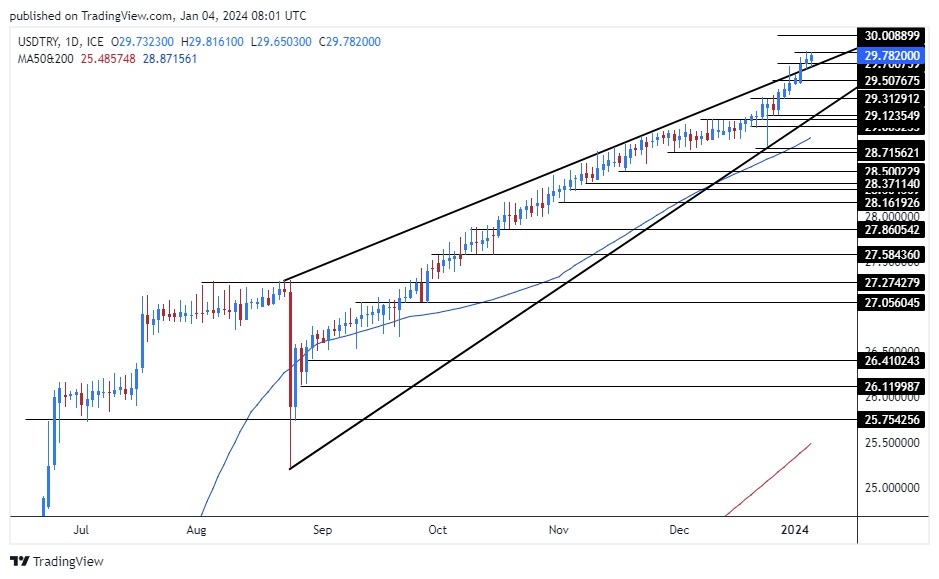

USD/TRY Technical Analysis

The USD/TRY recorded a slight increase during trading on Thursday morning. The pair settled at 29.77, near its all-time high. The pair continues its strong overall upward trend over several months. This is confirmed by the price trading above the bullish intersection of the 50 and 200 moving averages, respectively, on the daily time frame, as well as on the four-hour time frame, in a reflection of buyers’ control over the price.

Top Regulated Brokers

Currently, the price is trading above the upper border of the rising wedge pattern on today's time frame, shown on the chart. If the dollar continues to rise against the lira, the pair will target the resistance levels, which are concentrated at the levels of 29.95 and 29.99, respectively, while on the other hand, if the pair declines, it will target the levels of 29.70 and 29.55, respectively. Expectations for the price of the Turkish Lira include the pair's continued rise, especially after it breached the upper border of the wedge pattern shown in the chart. Please adhere to the mentioned recommendation points and maintain capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.