Top Regulated Brokers

Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the 29.50 level.

- Place a stop loss point to close below the 29.35 support level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 29.95.

Best-selling entry points

- Entering a sell deal with a pending order from the 29.75 levels.

- The best points to place a stop loss are closing the highest level of 29.85.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 29.50

The dollar pair rose against the Turkish lira during early trading on Tuesday, as the Turkish currency continued its losses against the dollar, which have continued at a strong pace since the second half of last month. Despite the successive positive data witnessed by the Turkish economy during the second half of the year, the Turkish government’s decision to raise the minimum wage in 2024 to 17,002 Turkish liras was driven by the ruling party’s ambitions to gain a majority in the major cities in the local elections expected next March. The decision raised the risk of increased demand and the return of pressure on inflation, which the Turkish Central Bank is struggling to control.

In this regard, and despite the government increase in the minimum wage, the Turkish Federation of Trade Unions announced that the cost of living reached 18,796 Turkish liras last December, which is higher than the minimum announced by the government. At the same time, data from the Federation of Trade Unions included that the increase in the minimum spending for a family of four people rose by approximately 3 percent last December.

At the same time, investors followed the statements of Turkish Finance Minister Mehmet Simsek, who said that 2024 will be the year in which inflation rates will begin to decline. The Turkish Minister also expected an increase in the volume of foreign reserves in exchange for ending the Turkish lira deposit system protected from exchange rate fluctuations.

TRY/USD Technical Analysis

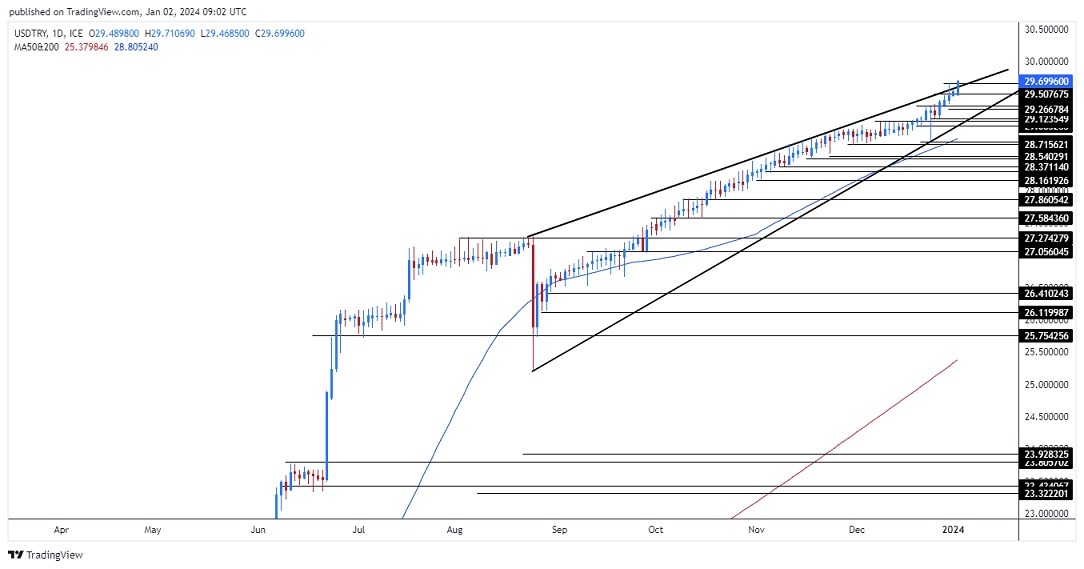

The dollar continued to rise against the lira during trading this morning, as the price recorded its highest levels ever at 29.70. The pair is trading within a rising wedge pattern that is trying to breach its upper border on today’s time frame, reflecting the strong general upward trend that the pair has been following over several months. This is confirmed by the price trading above the bullish intersection of the 50 and 200 moving averages, respectively, on the daily time frame, as well as on the four-hour time frame, in a reflection of buyers’ control over the price.

If the dollar continues to rise against the lira, the pair will target the resistance levels, which are concentrated at the levels of 29.75 and 29.99, respectively, while on the other hand, if the pair declines, it will target the levels of 29.60 and 29.45, respectively. Expectations for the price of the Turkish Lira include the pair's continued rise, especially if it breaches the upper border of the wedge pattern shown in the chart. Please adhere to the mentioned recommendation points and maintain capital management.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to check out.