- The S&P 500 exhibited a minor retreat during Wednesday's trading session, reflecting an ongoing period of consolidation at elevated levels.

- This makes a lot of sense as the markets have gotten far too ahead of themselves, which happens at times, especially since the interest rate markets continue to favor risk taking.

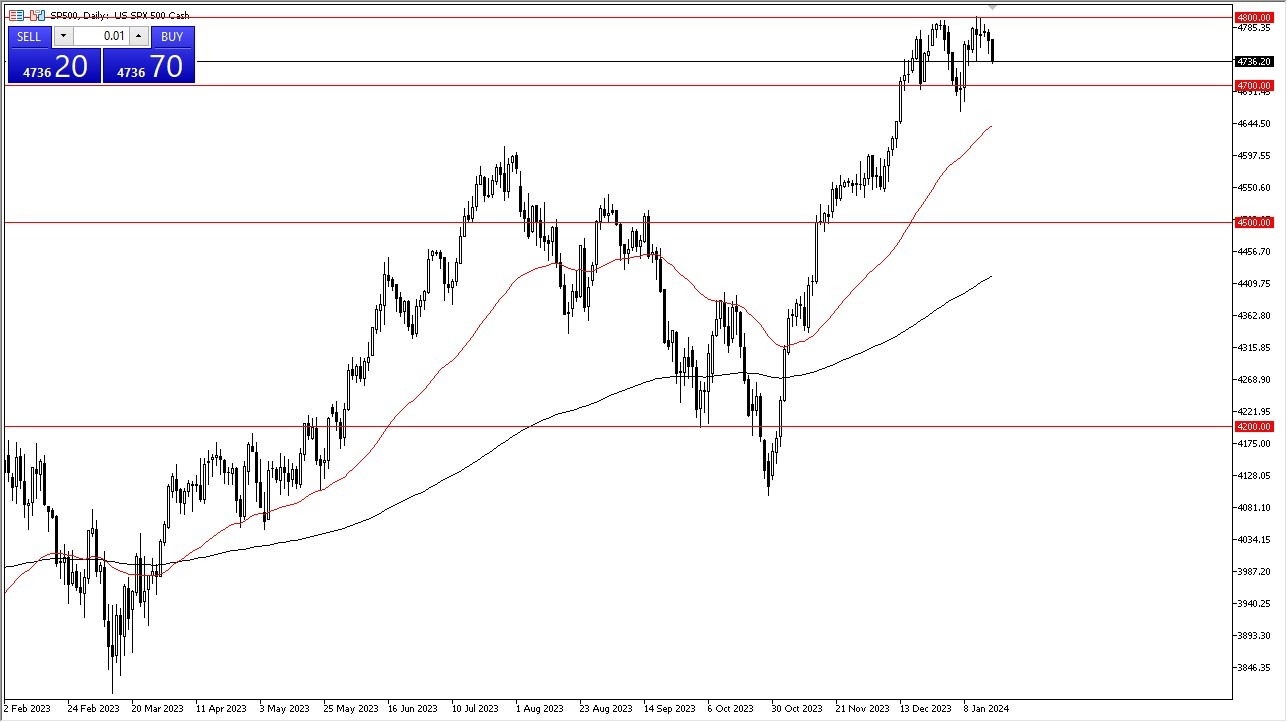

Analyzing the S&P 500, we observe an initial pullback at the start of Wednesday's trading session, emphasizing the prevailing consolidation trend. Notably, the 4800 level serves as a significant resistance point, while the 4700 level below functions as notable support. This situation implies that the market finds itself in a state of relative stagnation. It's essential to recognize that markets do not sustain a unidirectional trajectory indefinitely, as momentum tends to be transitory.

The market may be undergoing a process of readjustment, potentially shedding excess exuberance. Consequently, we must consider the market's current state as an attempt to reestablish equilibrium. In such a scenario, it is reasonable to anticipate short-term oscillations, particularly given the steep ascent witnessed in the final months of 2023. Additionally, the 50-day Exponential Moving Average is approaching the 4700 level, which could act as supplementary support.

Top Regulated Brokers

Breaking Below Support…

However, a breach below the 4650 mark could indicate a more significant correction for the S&P 500. Such a development could be viewed as constructive from a longer-term perspective, as a modest pullback, even by a few hundred points, can facilitate the discovery of value. The influence of gravity is starting to manifest, with the 4800 level appearing increasingly crucial. Surpassing this level may pave the way for a target of 4900, followed by the psychologically significant milestone of 5000. While reaching 5000 seems inevitable, a short-term pullback serves the purpose of establishing a healthier market environment, considering the rapid ascent witnessed during the winter of 2023.

At the end of the day, the S&P 500's recent retracement indicates a consolidation phase at elevated levels. The 4800 resistance and 4700 support levels are currently pivotal. Short-term fluctuations are expected, given the need for market equilibrium. A more extensive correction, signaled by a break below 4650, could be beneficial in the long run, promoting a more balanced market. Ultimately, while reaching 5000 appears likely, a temporary pullback allows for a more measured and sustainable ascent, especially considering the market's previous exuberance in the winter of 2023.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.