- The S&P 500 had a rather subdued electronic trading session overnight due to the observance of Martin Luther King Jr. Day in the United States, which kept the underlying index closed for regular trading.

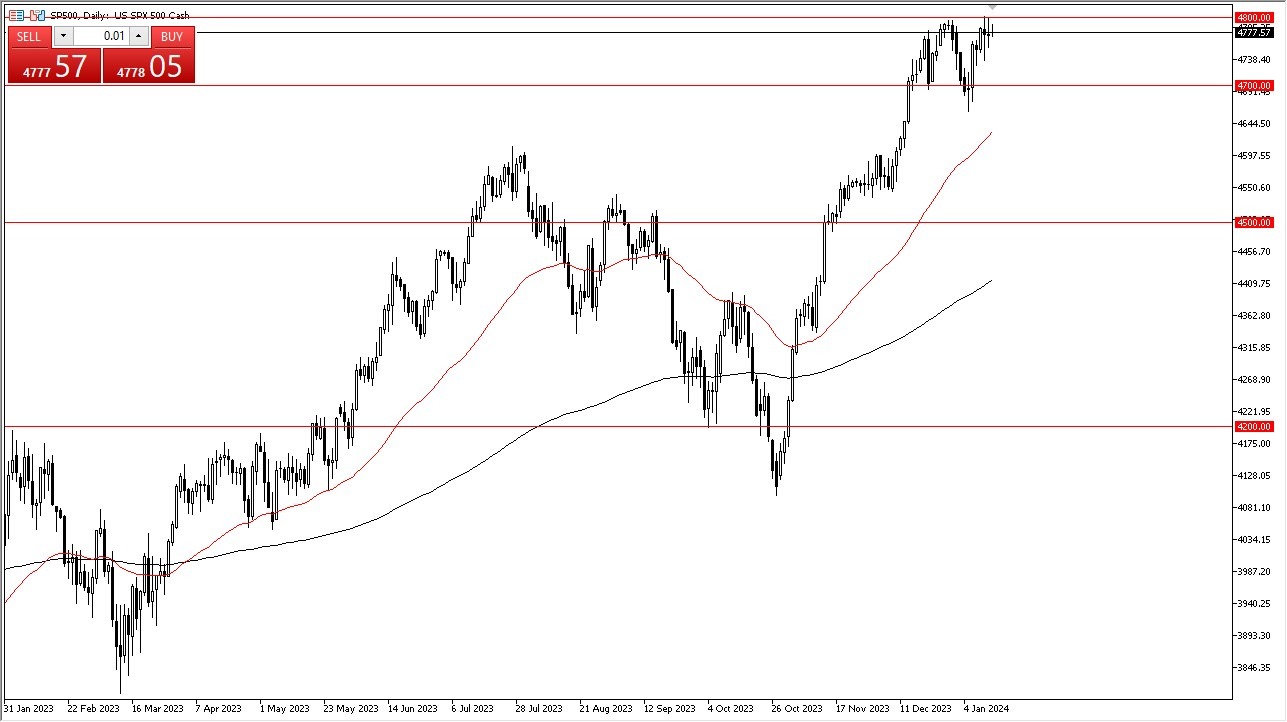

During the same day, the S&P 500 showed minimal activity. This was in line with expectations, considering that while it was a holiday in the U.S., the Contract for Difference (CFD) markets and futures markets were open for a limited period. The market appeared to be making efforts to break out to the upside, with particular focus on the 4800 level, which has historically served as significant resistance.

Conversely, the 4700 level remains a crucial support level, and a breach below this point would be considered negative, possibly leading to a test of the 50-day Exponential Moving Average. The trajectory of the S&P 500 is closely linked to interest rates in the United States and the movement of the 10-year yield. An increase in the 10-year yield could have adverse effects, while a decrease could lead to a significant rally.

Federal Reserve is the only game in town

It is noteworthy that, in the current market environment, the focus has shifted from economic fundamentals to the actions of the Federal Reserve. Many traders anticipate multiple rate cuts in the upcoming year, which could bode well for stocks in the short term. While economic realities may regain significance under exceptional circumstances, the prevailing trend suggests a buy-on-the-dip approach.

In this landscape, it's important to recognize that a handful of companies significantly influence the S&P 500. Names like Tesla, Microsoft, Nvidia, and Amazon play a dominant role in driving market momentum. Wall Street remains committed to propelling the S&P 500 higher, with the actions of these few key players often determining the direction of the entire index.

Top Regulated Brokers

At the end of the day, the S&P 500 exhibited limited activity on a day marked by a public holiday (check out our Holiday Season Trading Schedule article) in the United States. Market participants closely watch key support and resistance levels, with a focus on interest rates and the Federal Reserve's actions. While the market may appear influenced by only a select few companies, its dynamics remain integral to the broader financial landscape. In other words, it’s the same game we have been playing for a while now.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.