- https://www.dailyforex.com/forex-glossary/volatility/374Silver witnessed a decline in Monday's trading session, a reflection of the persisting market volatility.

- Support remains steadfast around the $23 level, with the possibility of a further decline towards the $22 level should this level break.

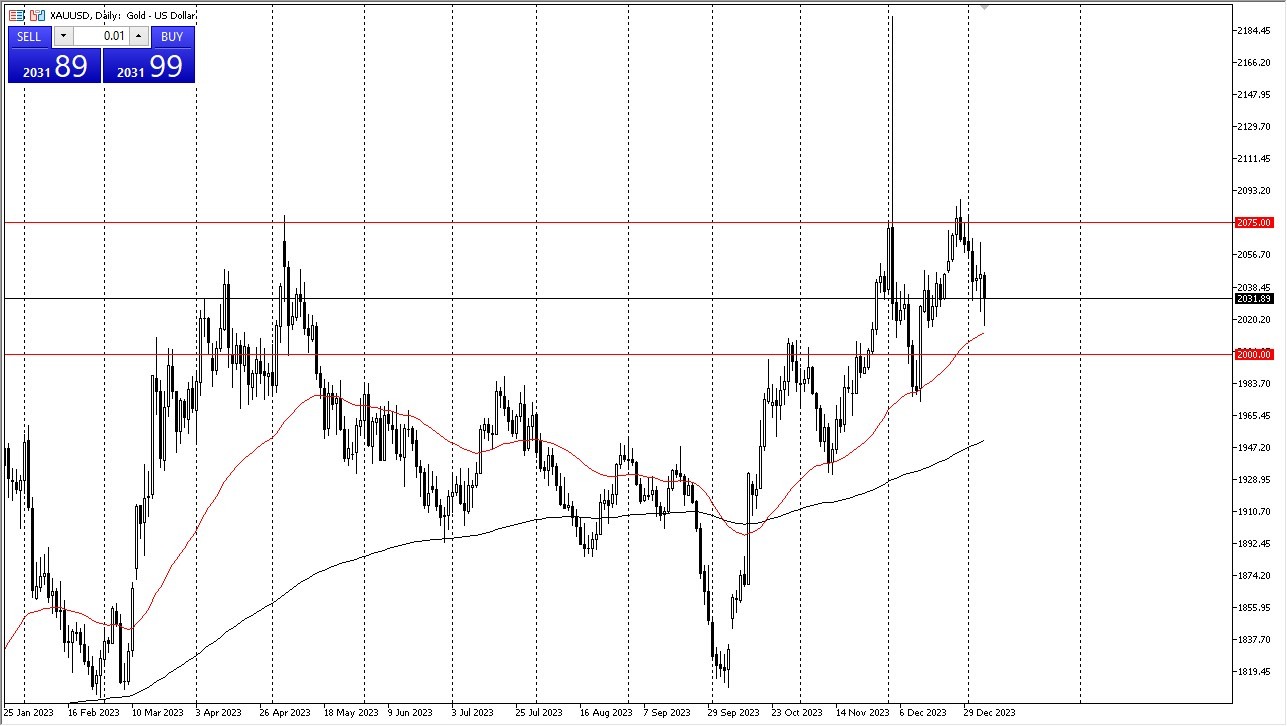

The 200-day Exponential Moving Average above has demonstrated significant resistance. A breakthrough above this level could pave the way for a potential test of the 50-day EMA. It is important to note that silver has been entrenched within a prolonged consolidation phase. Concerns about industrial demand loom large, as it is closely linked to economic activity. A slowdown in the economy typically results in reduced silver demand. Additionally, silver's performance is highly sensitive to fluctuations in interest rates, particularly the 10-year yield.

A resurgence in interest rates could potentially undermine the value of silver and precious metals more broadly. Currently, the market positions itself closer to the lower end of the established range. Consequently, investors may be on the lookout for signs of support or a rebound before committing funds. Silver can exhibit substantial volatility, especially in periods of uncertainty, as seen in the current landscape.

Early Days for 2024

The early part of the year often witnesses traders building positions in the hope of establishing trends for the year. In the longer term, it is anticipated that the market will continue to operate within its established range. For the time being, the $22 level appears to serve as a short-term support level. A breakthrough beyond the 200-day EMA could make a case for a potential move towards the $24.50 level, or possibly even $26 in the longer run.

Top Regulated Brokers

Ultimately, silver experienced a decline in line with ongoing market volatility. The $23 level remains a robust support zone, with a potential move towards $22 if this level is breached. The 200-day EMA above acts as a notable resistance point. The silver market has been entrenched in a consolidation phase and faces concerns regarding industrial demand, which is tied to economic activity. Interest rates, particularly the 10-year yield, exert a significant influence on silver's performance. The market currently positions itself closer to the lower end of its range, prompting a watchful stance for signs of support or a rebound before deploying capital. Silver's tendency for volatility, especially during uncertain periods, underscores the need for caution. As the year progresses, traders may seek opportunities to establish trends. In the long term, the market is expected to continue within its established range, with the $22 level serving as a short-term floor and potential targets of $24.50 or $26 on the horizon if the 200-day EMA is surpassed.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.