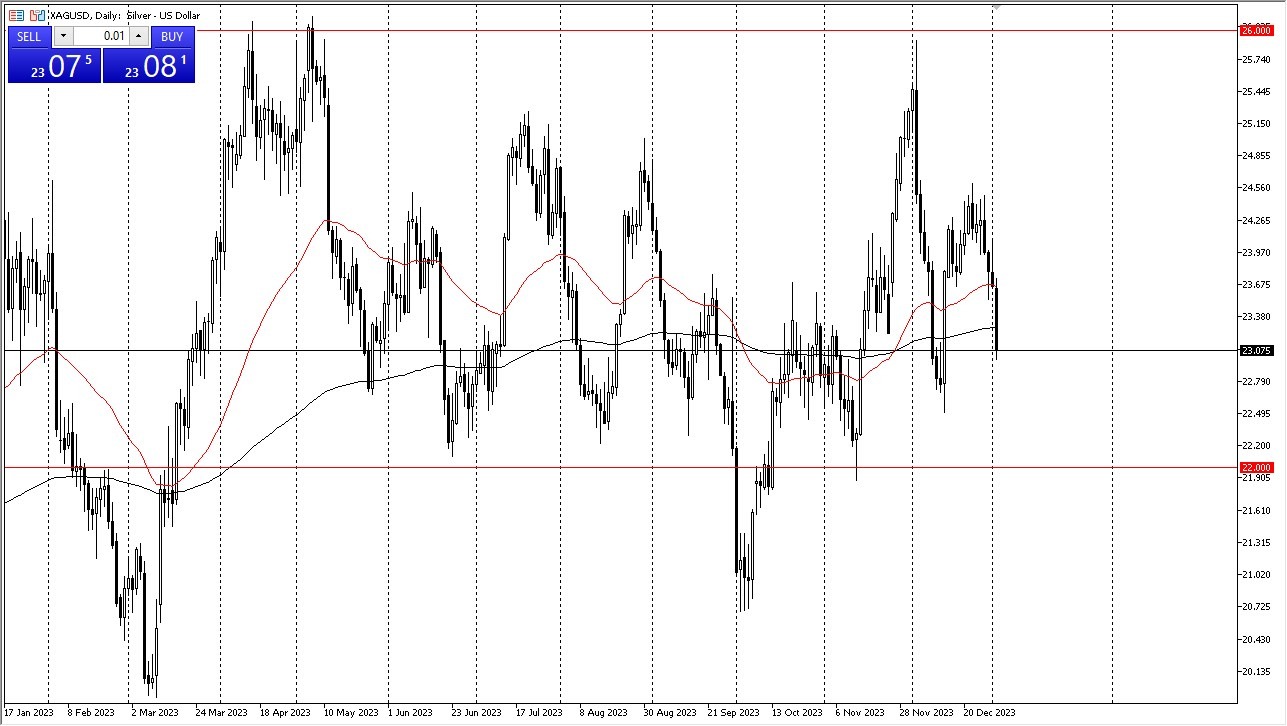

- On Wednesday, silver experienced a decline, reaching a critical point at the 200-day Exponential Moving Average. The candlestick pattern observed was not particularly favorable, but it's essential to recognize that the market remains in a period of consolidation.

- Several factors contribute to the uncertainty, including upcoming ISM numbers, the jobs report, and the return of traders to the market, leading to varying levels of liquidity over the next few sessions.

- Despite these challenges, it's not necessarily anticipated that silver will undergo a significant breakdown, although there have been several consecutive negative days.

Silver's behavior differs somewhat from that of the gold market due to its classification as an industrial metal. If economic conditions exhibit signs of slowing down, it could result in decreased demand for silver. Presently, there appears to be substantial support around the $22 level, with possible minor support around $23. These are key levels to monitor for any potential price rebound.

A breakdown below $22 could potentially lead to a decline towards $21. Conversely, surpassing the $24 level and moving higher could propel the silver market toward the recent high at $26. The current market for silver is characterized by its erratic and noisy range-bound nature, which is typical of this commodity.

The Market Could Offer Trading Opportunities Soon

Silver is known for its extreme volatility, necessitating a cautious approach regarding position size, especially when the next catalyst for silver's movement remains uncertain. This caution is particularly relevant in the first week of January when traders are reestablishing their positions, and economic data may be limited. That being said, I think this is a market that could offer trading opportunities soon.

Top Regulated Brokers

Ultimately, silver experienced a decline during Wednesday's session, reaching a critical juncture at the 200-day EMA. The market remains in a consolidation phase, marked by uncertainty related to economic indicators and the return of traders to the market. While several negative days have been observed, a significant breakdown is not necessarily expected. Silver's status as an industrial metal introduces additional dynamics to its behavior. Key support levels at $22 and potentially $23 are areas of interest for potential rebounds. A breakdown below $22 could target $21, while surpassing $24 could pave the way for a move towards the recent high at $26. Silver's characteristic volatility necessitates prudent position sizing, especially in a period of limited economic information during the early weeks of January.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.