- Silver has shown a somewhat subdued performance in the past 24 hours, which can be attributed to technical factors and the looming Federal Open Market Committee meeting.

- This event is expected to exert a significant influence not only on silver but also on precious metals as a whole.

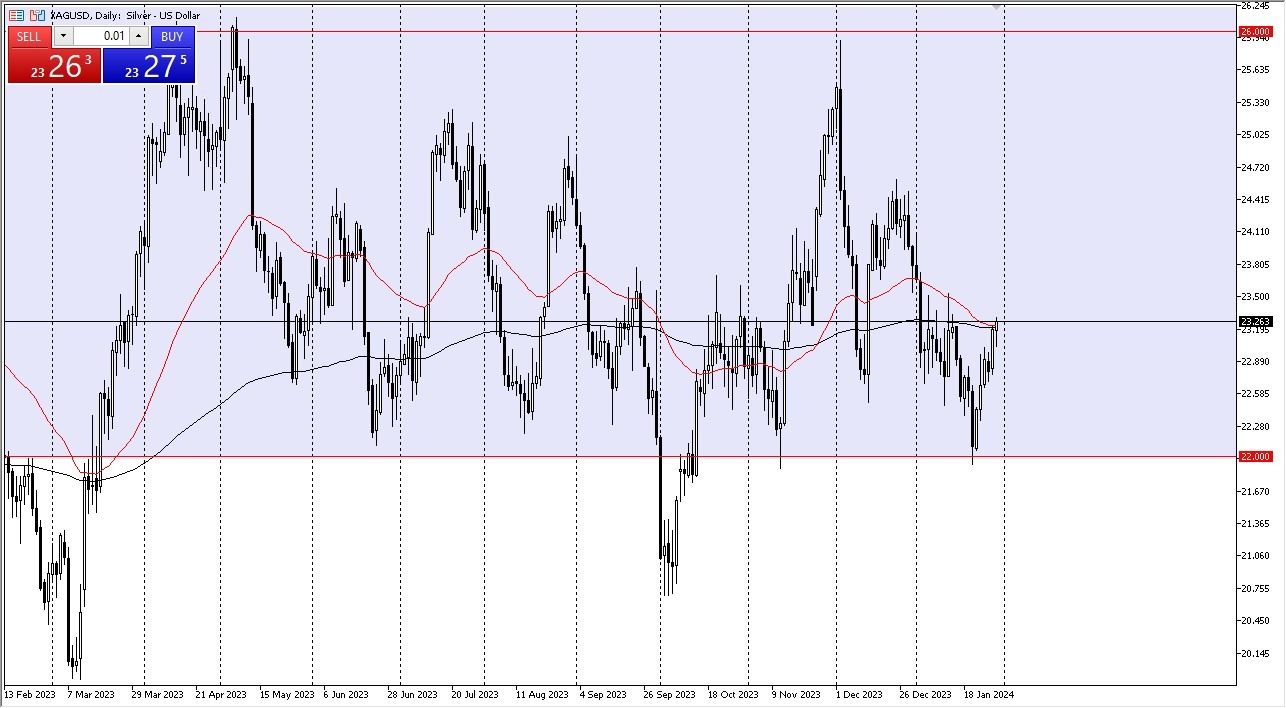

During the early hours of Tuesday's trading session, silver experienced a minor pullback, primarily due to the resistance encountered from the 200-day Exponential Moving Average. The market is currently navigating a phase marked by fluctuating and noisy behavior. To provide context, we find ourselves in the lower range of the broader consolidation phase, with the $22 level serving as a critical support point. Historical data indicates that $22 has held as a reliable level of support over the past couple of years. Therefore, any pullback at this stage could present an opportunity for value-seeking investors.

A potential scenario to watch for is a rally that surpasses the $23.50 level, which could pave the way for further gains toward $24.50 and potentially $26, the upper limit of the overarching consolidation pattern. The forthcoming FOMC meeting, and more crucially, the post-meeting press conference, will provide insights into the monetary policy direction for the year. This, in turn, will significantly impact silver prices as they are closely tied to interest rates. Typically, higher interest rates tend to suppress silver rallies, while rate cuts can stimulate silver's performance.

Top Regulated Brokers

Silver and Industry

Silver also has industrial applications, so market watchers are keeping an eye on signs of industrial activity. However, when examining the long-term charts, it becomes evident that the battleground for silver has predominantly ranged between $22 and $26 over the past three years. There is no compelling reason to expect a deviation from this pattern shortly.

Given this backdrop, it is advisable to pay close attention to the outer boundaries of the consolidation range, as they can provide favorable trade setups. Currently, with silver trading closer to the $22 level, there is a prevailing sentiment among buyers to seize opportunities during dips.

In the end, silver's recent performance reflects a broader context of technical factors and anticipation surrounding the upcoming FOMC meeting. Investors are closely monitoring the potential impact of monetary policy on silver prices. The historical consolidation pattern between $22 and $26 remains a key reference point, suggesting that value-seeking investors may find opportunities in buying the dips, especially as silver hovers near the $22 support level.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.