- Silver has maintained a relatively stable position in recent trading sessions, with limited changes observed.

- The trading environment on Monday was influenced by Martin Luther King Jr. Day in the United States, resulting in minimal electronic trading in the futures markets.

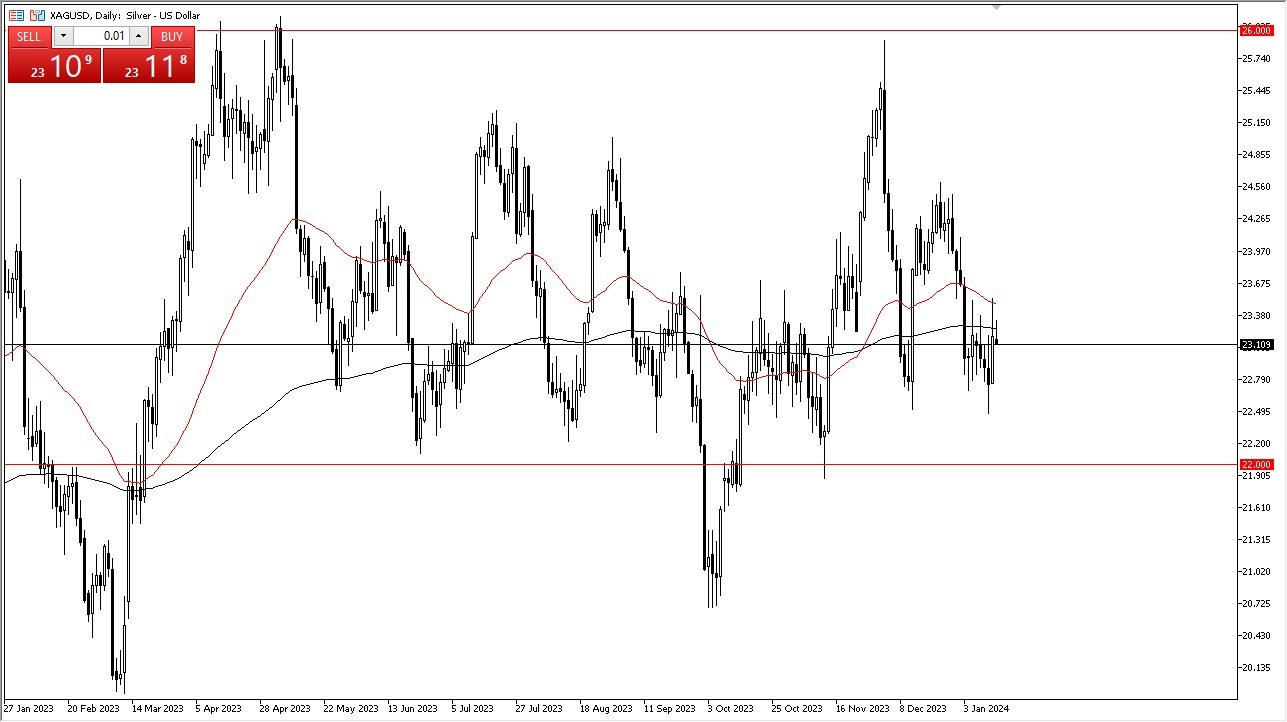

During the early trading session on Monday, Silver exhibited a subdued performance, consistent with expectations given the holiday (check out our Holiday Season Trading Schedule article) in the United States. The market is currently approaching the 200-day Exponential Moving Average, which acts as both a technical and psychological resistance point. Because of all this, I think there is a little bit of a natural support barrier underneath that a lot of people will be paying close attention to. With this, it does offer a little bit of a floor in general.

The 50-day EMA is also under scrutiny, suggesting a potential attempt to breach this level in the near future. A successful breakthrough could lead to a test of the $24.50 level. Despite the market's current proximity to the $22 bottom and $26 top of the overall consolidation area, caution is advised when considering positions.

A gradual increase is what I see

While a gradual increase in silver prices is anticipated, jumping into the market immediately or establishing a substantial position is not recommended. Silver's reputation for volatility requires careful consideration. A buy-on-the-dip strategy is preferable, starting with a cautious approach and expanding the position if it proves favorable.

Silver's inherent noise, coupled with broader uncertainties such as bond yields, global growth, and geopolitical concerns, contributes to the market's current complexity. The ongoing multifaceted issues create an environment where prudence is essential, and the messy nature of silver's recent performance is expected to persist. After all, silver has been known to blow up more than one account due to the volatility, so with that being the case I don’t think it will change anytime soon. With this, the most important thing you can pay attention to when trading silver is going to be your position sizing.

Top Regulated Brokers

Given the prevailing uncertainties, exercising caution in committing to significant positions is crucial. The current situation does not preclude the possibility of buying or selling, but a prudent strategy involves waiting for favorable value conditions, in other words looking for lower pricing. The noisiness of various factors in the market signifies the need for a measured and patient approach to navigate the volatility associated with silver trading.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.