- The silver market exhibited limited activity in the early hours of Wednesday as market participants awaited further clarity.

- Currently, the market finds itself positioned closer to both the lower and upper boundaries of its overall range, presenting a potential opportunity for patient traders.

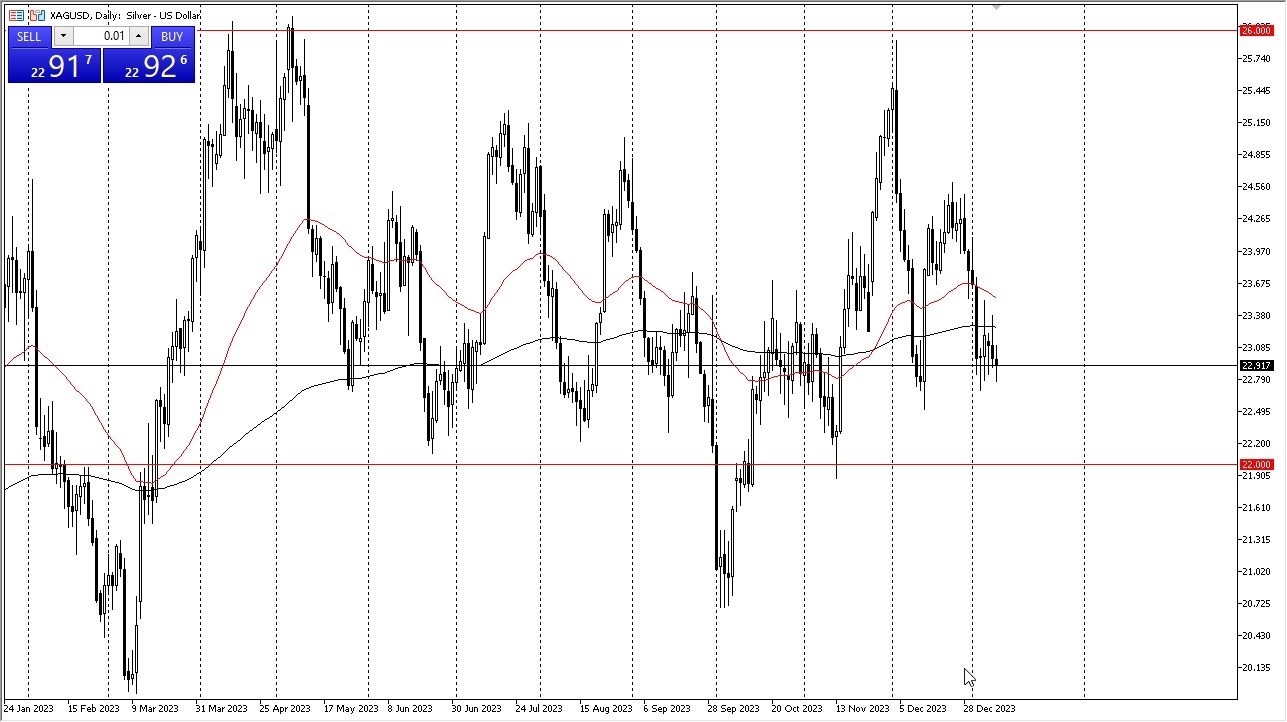

Analyzing the silver market, Wednesday's trading session remained subdued as market participants awaited a plethora of inflation-related data. The upcoming Consumer Price Index (CPI) figures on Thursday and the Producer Price Index (PPI) figures on Friday are poised to wield considerable influence over the market's direction. Consequently, the market will likely continue to hover in its current vicinity. The 200-day Exponential Moving Average is positioned just above, serving as a notable indicator closely monitored by many traders. A breakdown from the current range could potentially lead to a decline toward the $22 level, a support zone that has proven resilient on multiple occasions and marks the lower boundary of the prevailing range.

Conversely, a breakout above the 200-day EMA could pave the way for an ascent toward the 50-day EMA, followed by the $24 level, and eventually the $26 level. The market is anticipated to maintain its range-bound behavior for the year, as silver is historically characterized by its propensity for range-bound trading. This behavior is attributed to various actors in the silver market who influence its dynamics.

10-Year Note Influence on Silver

Additionally, monitoring 10-year note interest rates is essential, as lower rates tend to benefit the silver market. Simultaneously, paying attention to industrial demand is crucial, given silver's status as an industrial metal. This aspect often is overlooked by retail traders, and it is contingent on economic conditions and their impact on demand for silver. It is important to acknowledge that silver is known for its extreme volatility, necessitating caution in position sizing until a trade is validated as correct. While maintaining a bullish outlook, adopting a measured approach and refraining from entering with a substantial position is advisable.

Top Regulated Brokers

At the end of the day, the silver market experienced minimal activity in the early hours of Wednesday, with a focus on forthcoming inflation-related data. The market's positioning relative to its range boundaries presents a potential opportunity for patient traders. The CPI and PPI figures scheduled for release are expected to exert significant influence. The 200-day EMA serves as a key indicator, and a breakdown could lead to a decline toward the $22 level, marking the range's lower boundary. Conversely, a breakout could propel the market higher. Silver's historical range-bound behavior is attributed to various market participants. Monitoring 10-year note interest rates and industrial demand is pivotal, considering their impact on silver's performance. Recognizing silver's volatility underscores the importance of cautious position sizing.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.