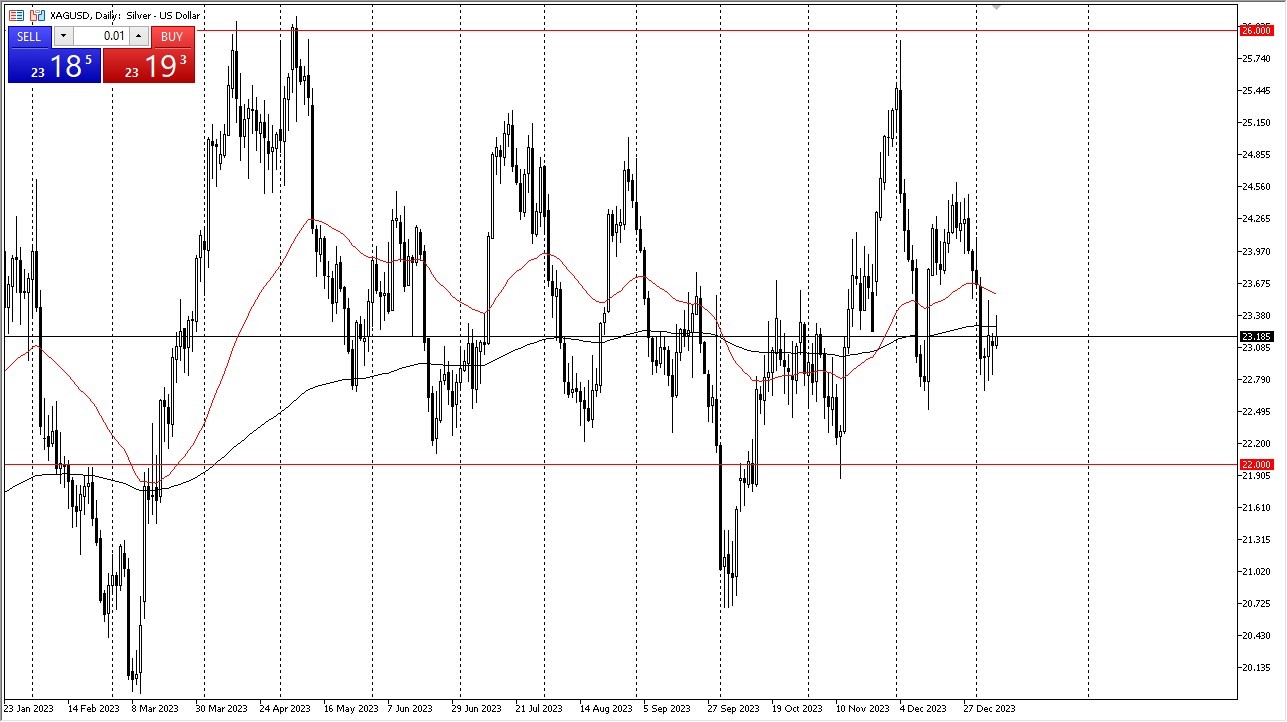

- Silver has experienced a minor upturn during today's trading session, yet it appears that it is encountering some resistance from the 200-day EMA.

- Currently, we find ourselves in proximity to a level that could potentially act as a short-term support, specifically around the $22.50 mark.

- However, it's essential to note that this range extends downward to approximately $22.

Given this scenario, it's prudent to view this as an opportunity to buy during a market dip. Should we manage to breach the recent candlestick highs from last Friday, which essentially equates to surpassing the 50-day EMA, it could pave the way for a move towards the $24.50 range. Regardless, it is imperative to closely monitor the 10-year yield in the United States, as it serves as a reliable indicator of general interest rate trends. Lower interest rates typically correspond to an increase in the value of precious metals.

Don’t Forget the Industrial Use of Silver

Furthermore, it's worth acknowledging that silver possesses an industrial aspect, setting it apart from gold. This distinction may introduce some complications, particularly if there is an industrial slowdown that impacts demand. There is a considerable amount of complexity within this market as a result, and therefore you need to keep in mind that it’s not just the interest rates in America that can move this market but is also the perceived demand coming from so-called “green technologies” the demand so much silver usage. Yes, in the longer term, we are always short of supply when it comes to silver, but this is also a market that’s highly manipulated by a handful of players who are willing to pay millions of dollars in fines every few years to profit from it.

Top Regulated Brokers

Ultimately, when scrutinizing the long-term charts, it becomes evident that a range has been established, with a floor around $22 and a ceiling at approximately $26. This observation suggests that a rebound is probable shortly. However, it's essential to exercise patience to capitalize on this consistently reliable range. Consequently, those who exhibit patience may encounter an attractive swing trading opportunity. Given our proximity to the bottom end of this range rather than the top, my inclination remains towards buying rather than selling. Nevertheless, it is crucial to acknowledge that multiple variables are concurrently influencing this situation.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.