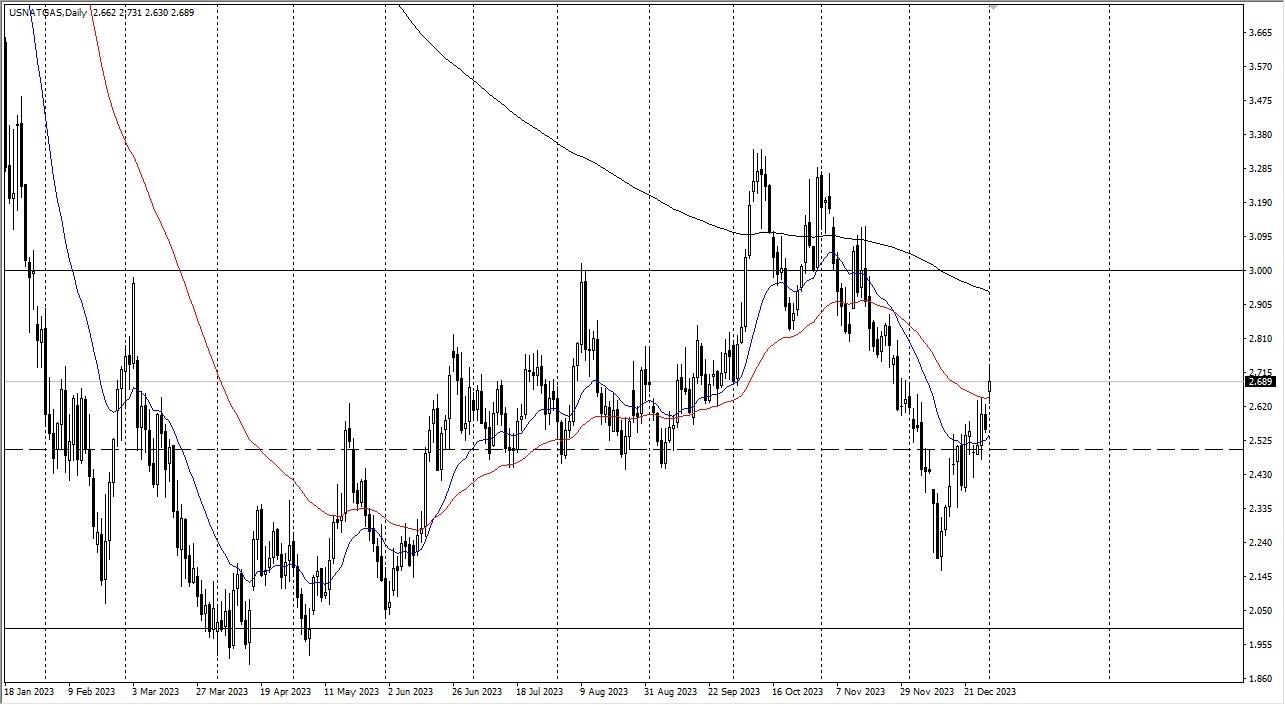

- Natural gas markets experienced a notable surge at the start of the trading week, marked by a significant gap up and a break above the 50-day Exponential Moving Average.

- It's important to consider that these markets witnessed substantial selloffs in the previous year, which raises questions about whether this recent uptick is merely a response to the prior volatile activity.

While occasional rallies may occur, it's worth noting that futures markets are already factoring in February. There may be room for another substantial move upward, but beyond that, attention will turn to the months of March, April, and May when natural gas demand typically declines. Economic concerns linger, but the possibility of Federal Reserve rate cuts in 2024 has generated expectations of increased energy demand. Nevertheless, the most likely scenario for natural gas markets in the current year is a range-bound trajectory, especially given the lackluster winter performance. The market seemed poised for growth initially, but that potential quickly dissipated.

The $3 level, located just above the 200-day EMA, stands as a significant resistance point. Below that, the $2.50 level is anticipated to represent fair value throughout the year. Currently trading slightly above this level, the market could witness a modest rally before gravitating back towards it. Any dip below $2.50 could trigger further declines, with potential support levels at $2.33 and possibly as low as $2, which is considered a floor for the market.

Looking for Opportunities at Pullbacks

For traders considering short-term positions, opportunities may arise during pullbacks. However, it's essential to exercise caution and remain agile, given the unpredictable nature of natural gas markets. These markets are heavily influenced by the latest weather reports emanating from the northeastern United States, particularly areas like Boston, New York, and Washington, D.C. Unless one possesses a deep understanding of regional weather patterns, navigating this market can prove challenging.

Top Regulated Brokers

At the end of the day, natural gas markets have shown signs of life but are likely to remain within a range-bound pattern throughout the year. Factors such as seasonal demand fluctuations and economic uncertainties contribute to this outlook. Traders must be vigilant and adaptable, considering the market's sensitivity to weather conditions in key regions. This is a situation where retail traders have a handicap due to the idea that they don’t have access to the same kind of meteorological information.

Ready to trade FX Natural Gas? Here are the best commodity trading platforms to choose from.