- The natural gas market experienced another decline on Wednesday, marking a retreat from the significant surge caused by the winter storm affecting the northeastern United States.

Analyzing the natural gas markets, it's evident that they continued to decrease during Wednesday's trading session. This decline indicates that the natural gas markets are likely to keep selling off after the recent spike, as the weather conditions in the United States are expected to change rapidly. This pattern is a common occurrence during winters, with prices fluctuating in response to temperature fluctuations.

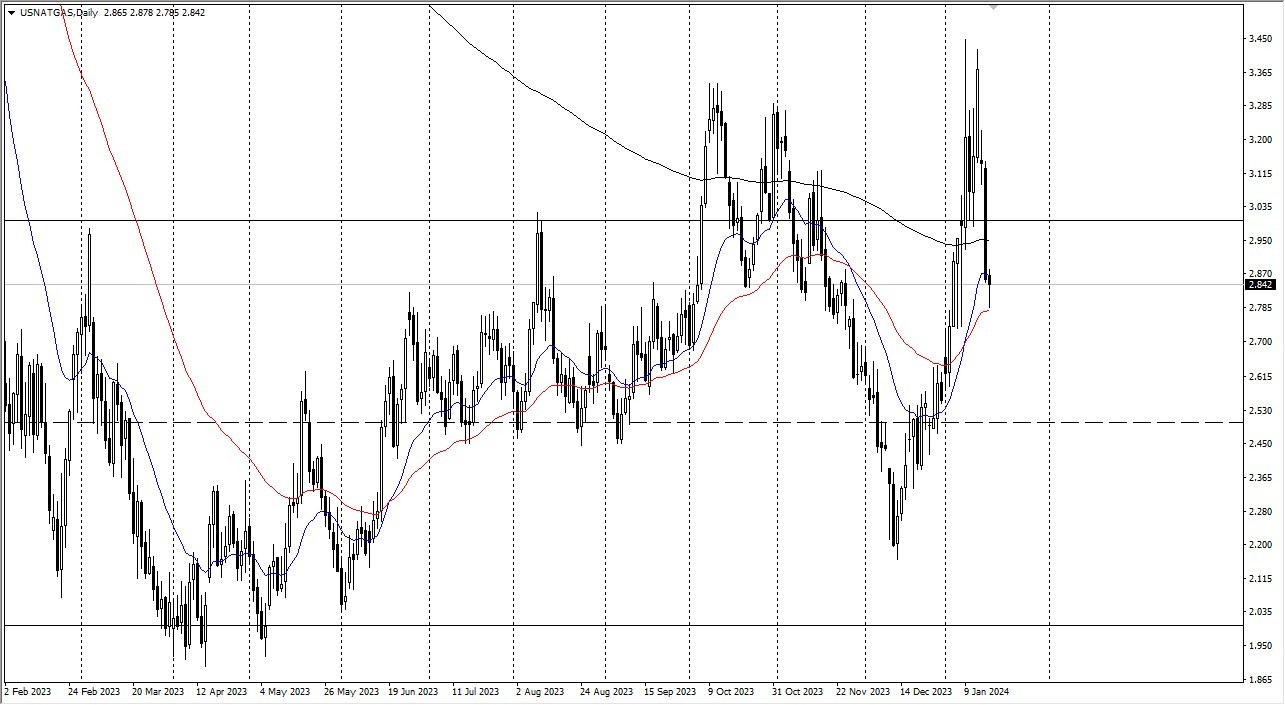

The natural gas market is highly sensitive to the latest weather reports, particularly in the northeastern United States. Traders closely monitor these reports for potential shifts in market dynamics. As the market approaches the 50-day Exponential Moving Average, it's reasonable to expect traders to view it as a possible technical support level, as it has often functioned as such in the past. However, there are no guarantees in trading.

Should the market break below this level, it could head towards the $2.50 mark. Natural gas remains abundant, and this situation is unlikely to change soon. Futures traders are already factoring in trading for the upcoming February to early March contracts, and as March approaches, demand tends to diminish, and so do the prices.

Continuation of Selling Pressure Ahead Most Likely

Top Regulated Brokers

In essence, the prevailing outlook suggests a continuation of the downside for natural gas prices. However, it's important to note that this doesn't necessarily indicate a complete collapse in the market. Natural gas markets have a tendency to experience fluctuations, and a return to a more balanced state, likely around the $2.50 level, is anticipated. Beneath this level, significant support lies at $2, which is considered the market's floor. Any drop below this threshold would be unexpected and could have dire consequences for the market.

In the end, the natural gas market's recent decline is a reaction to the initial spike driven by the winter storm in the northeastern United States. Market behavior is strongly influenced by weather reports, and as temperatures change, so do prices. While a continuation of the downward trend is expected, it doesn't signify a complete market collapse. Instead, natural gas prices are likely to find equilibrium around $2.50, with $2 serving as a crucial support level.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.