- The natural gas market showed limited activity on a recent Monday session, which aligns with expectations due to the observance of Martin Luther King Jr. Day in the United States, resulting in reduced trading hours in the futures markets.

Natural Gas Performance

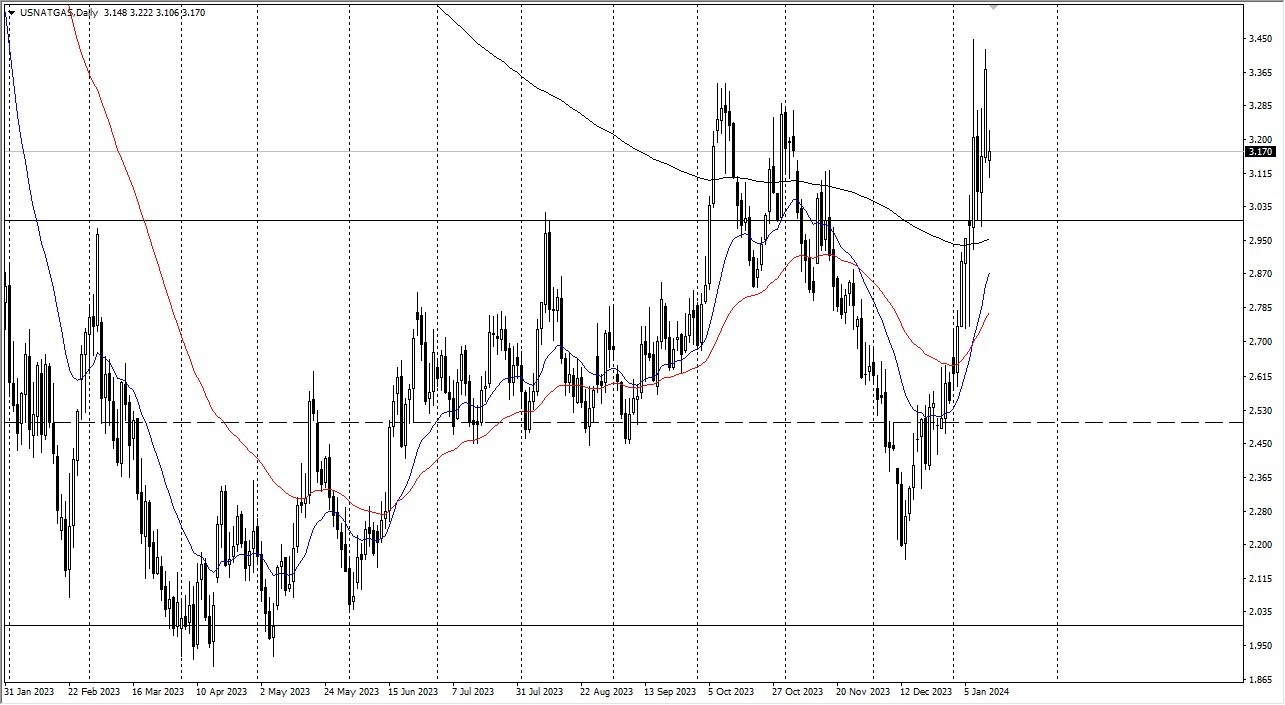

During the early hours of Monday's trading session, natural gas prices exhibited a back-and-forth movement, primarily influenced by ongoing monitoring of weather conditions in the northeastern United States. It is worth noting that the market has experienced a degree of overextension, raising questions about its future trajectory.

A key level of interest in recent market behavior has been the $3.33 resistance point. The current stall in price movements around this level appears rational. A breakthrough above the $3.45 level could indicate potential for further upward movement. Conversely, a breach below the $3.00 support level would be considered negative. Given the time of year, with winter progressing, expecting substantial natural gas price gains may not be prudent. Consequently, bullish investors in natural gas should exercise caution, ready to secure profits at the earliest signs of market instability.

Short-Term Outlook

The recent surge in natural gas prices can be attributed to a short-term weather phenomenon – a winter snap in the northeastern United States. This event was anticipated, and it did indeed lead to a price spike. However, it remains questionable whether this momentum can be sustained. As futures markets transition into the month of March, it is customary for them to undergo a downward correction, subsequently affecting the CFD market.

Natural Gas Supply

Notably, natural gas supplies in the United States have been depleting at a rapid pace. However, it is important to acknowledge that the wells that experienced freezing over the weekend will thaw in the coming days. Within a week or two, these wells are expected to return to their typical storage capacity levels. Although a definitive sell signal has not emerged, there is an anticipation that the market may experience a decline from its current position, reverting to its previous trading range.

Top Regulated Brokers

In conclusion, the recent behavior of the natural gas market can be largely attributed to a short-term weather-driven phenomenon. While the market experienced a surge due to the anticipated winter snap, the sustainability of this momentum remains uncertain. As we move forward, it is essential to monitor the market closely, considering the customary dynamics associated with the transition into March and the potential for market corrections.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.