- The month of January has been somewhat noisy for the gold market, but quite frankly I think we are just taking a bit of a breather after shooting straight up in the air previously.

- Ultimately, there are a lot of different things affecting the gold market right now, but I do think that things are starting to line up for a very strong year.

- The biggest question of course at this point is going to be the timing.

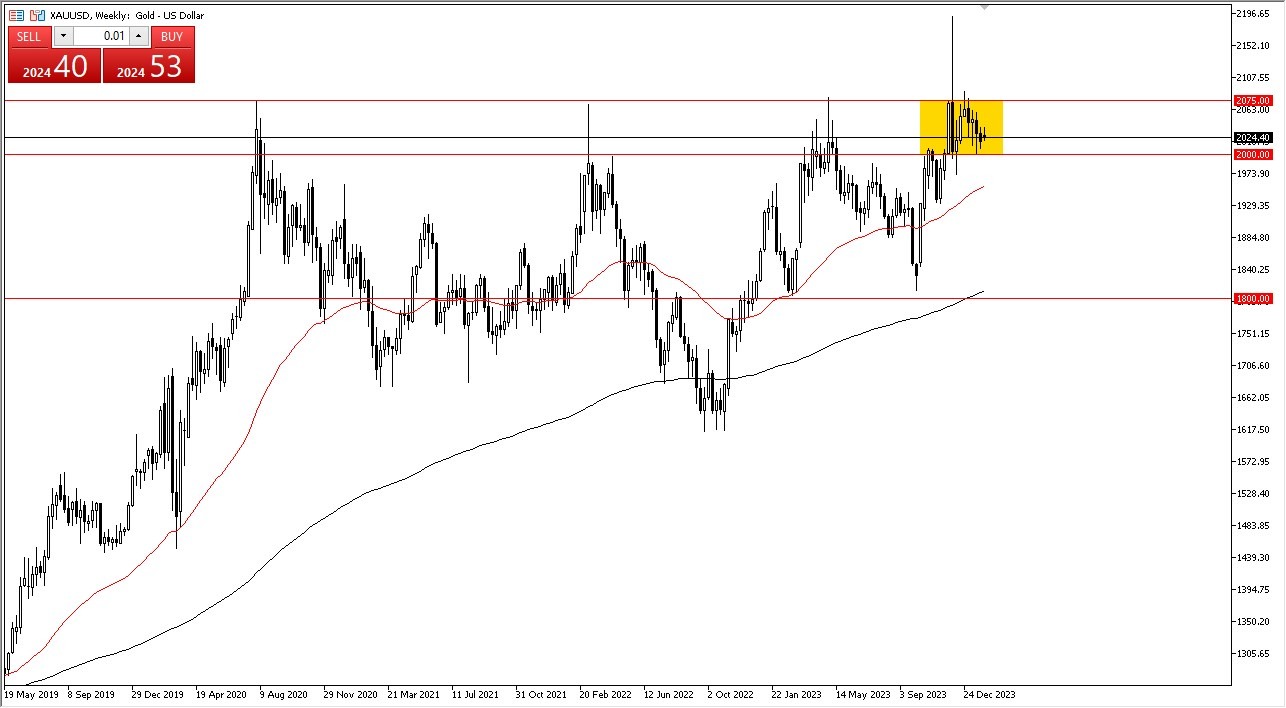

Looking at the $2000 level on the chart, I can see just how crucial it is, and therefore I think it remains significant support. The $2000 level also has quite a bit of support just underneath it that extends down to the $1980 level, and it’s probably worth noting that the 50-week EMA is racing toward that same general region as well. Ultimately, the technical analysis does suggest that short-term pullbacks will be buying opportunities that people should be paying close attention to.

Top Regulated Brokers

Plenty of Reasons for Gold to Shine

While I don’t necessarily know the timing of anything, because quite frankly there are a lot of things out there that could move the market, the reality is that central banks around the world are going to have to loosen monetary policy sooner rather than later. What we already know is that the Federal Reserve is likely to cut rates several times in 2024, what is just now starting to come to the forefront is the idea that the European Central Bank is going to have to do the same. As a general rule, when interest rates drop around the world, gold suddenly becomes much more attractive because you do not have to worry about bonds providing a strong yield alternative.

Beyond that, we have a lot of geopolitical turmoil out there just waiting to seize the headlines, so you have to think that it’s probably only a matter of time before there is a rush to safety. That being said, the alternative scenario is that we break down below the $1950 level, which would be a big concern. I do think it is more likely that we touch the $2075 barrier in the month of February than break down below that massive support level. I remain bullish, but recognize that just about anything can happen.

Ready to trade our Gold monthly forecast? Here’s a list of some of the best XAU/USD brokers to check out.