- Gold experienced a decline during Monday's trading session, reflecting the ongoing volatility in the broader financial markets.

- Buyers will likely emerge eventually, but it may require probing the immediate short-term support area just above.

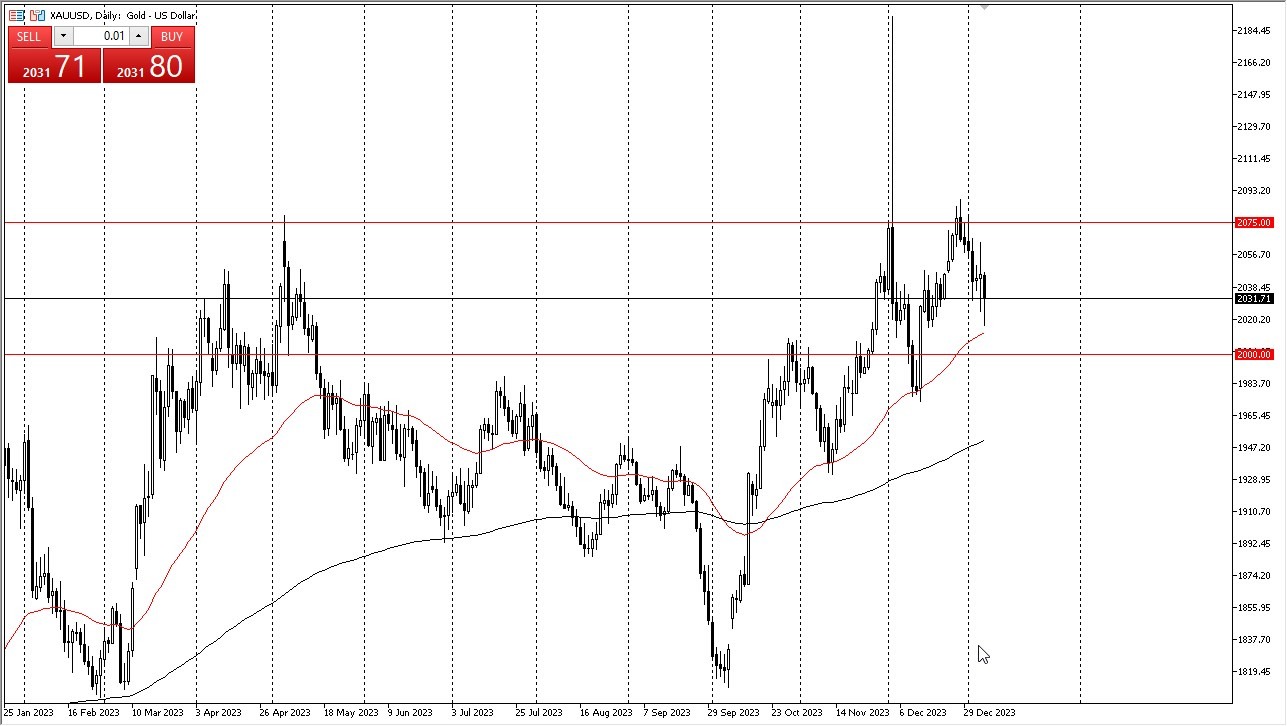

- This support region primarily encompasses the 50-day Exponential Moving Average and the $2,000 level. A reaction from the market is anticipated soon, although market behavior will dictate the specifics.

Bond markets and interest rates raise significant questions, and their dynamics exert a considerable influence on the gold market. As a result, we might witness a period of back-and-forth movement, potentially leaning toward a negative bias in the upcoming sessions. However, the approach is cautious yet opportunistic, with a willingness to initiate a small position as we approach the $2,000 level, and the possibility of scaling it up if market conditions shift favorably.

A Barrier Above

The $2,075 level represents a notable barrier, and a daily close above it could open the door to further gains toward the $2,200 level. Conversely, breaking below the $2,000 level prompts an exploration of support levels underneath. Multiple potential support zones exist, but any move below $2,000 may raise concerns among market participants.

Top Regulated Brokers

Monitoring the 10-year yield in the United States is essential, as rising yields typically exert downward pressure on gold prices, and vice versa. The US dollar can serve as an indicator, although there have been instances in the past when both gold and the US dollar rallied concurrently due to safe-haven demand. Regardless, maintaining reasonable position sizes is prudent given the current market uncertainties spanning various factors.

Ultimately, gold witnessed a decline amid overall market volatility. Potential buyers are expected to emerge, contingent on probing the nearby short-term support area comprising the 50-day EMA and the $2,000 level. The interplay between bond markets, interest rates, and gold dynamics is crucial. Expectations point to a period of fluctuation, possibly favoring a negative bias. However, a cautious approach involves initiating a small position near $2,000, with potential for sizeable adjustments if market conditions change. The $2,075 level stands as a key resistance point, while a breach of $2,000 could prompt exploration of lower support levels. Monitoring the 10-year yield and the US dollar remains vital, as both can influence gold's movements. Amidst market uncertainties, maintaining reasonable position sizes is wise.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.