- Gold experienced a slight decline in response to the moderately stronger-than-expected jobs report from the United States, a reaction closely tied to movements in interest rates.

- However, it is worth noting that the market had been experiencing a pullback over the past few days, raising questions about whether some individuals may have already been aware of this development.

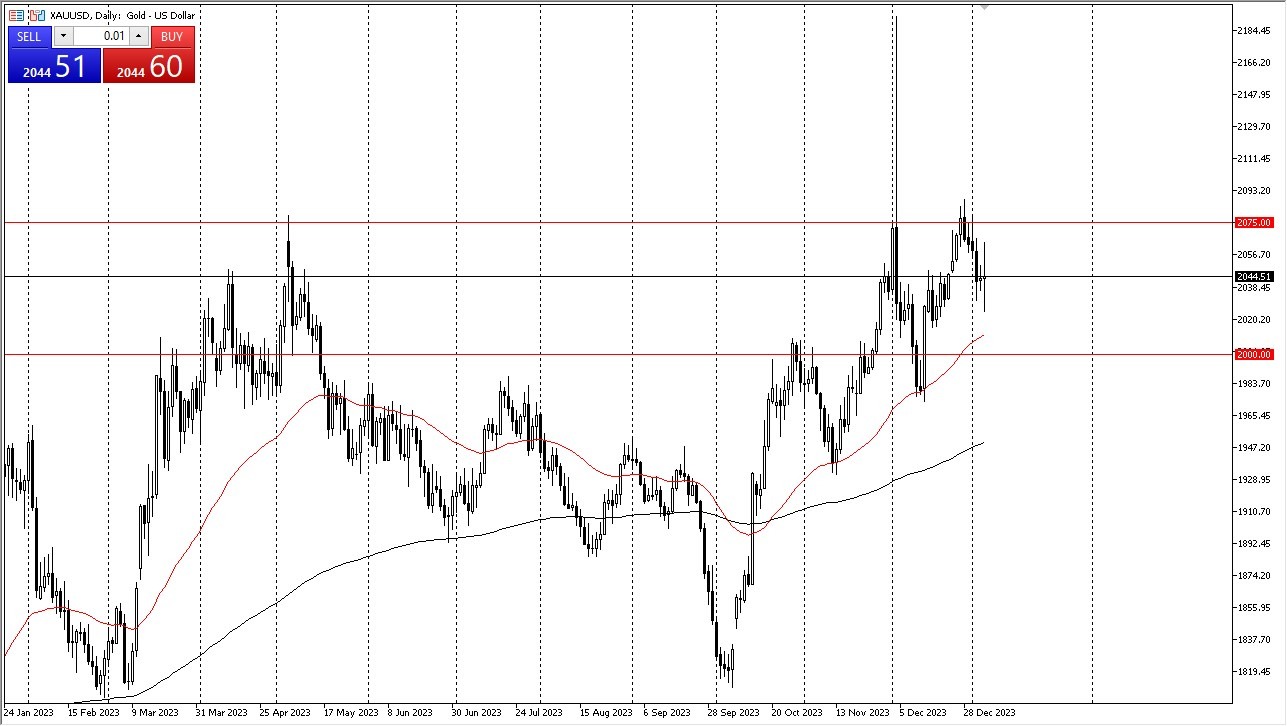

In this context, there appears to be a potential opportunity for a buy on the dip scenario. As I have previously mentioned, I would favor entering the market closer to the 50-day Exponential Moving Average or even around the $2,000 level. I do not foresee an imminent collapse in the gold market. However, it is essential to closely monitor the 10-year yield, as a significant rise in the United States could exert a negative influence on the gold market, as has been observed in the past.

At present, it seems that traders are strongly inclined towards the expectation of a lenient Federal Reserve policy in 2024. This sentiment is likely to persist, driving upward momentum in the gold market. After all, Wall Street loves a loose Federal Reserve monetary policy, which has them buying almost everything.

Have we reached a high again?

Nonetheless, there remains the possibility that we may have reached another high. As it stands, a discernible channel appears to align nicely with the $2,000 region. Additionally, it's crucial to bear in mind that the Friday candlestick reflects a session that encompassed not only the release of non-farm payroll data but also exhibited a relative lack of liquidity.

Top Regulated Brokers

Many traders have not yet returned from the holiday season, which could result in exaggerated market movements or outcomes that deviate from the usual expectations. Currently, the prudent approach may involve standing aside and monitoring the market for signs of a potential rebound before taking advantage of the situation.

At the end of the day, gold witnessed a modest decline influenced by the stronger jobs report and related interest rate dynamics. A buy-on-the-dip opportunity may present itself, potentially near the 50-day EMA or around the $2,000 level. Market sentiment continues to lean towards expectations of an accommodative Federal Reserve policy, which could drive gold prices higher. However, the current situation may be influenced by the ongoing holiday season, leading to unpredictable market movements.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.