- Gold initially attempted to rally but retraced its gains during Wednesday's early hours, facing several short-term challenges.

- These challenges likely stem from investors adjusting their positions from the previous year, concerns about the upcoming ISM numbers, and the job report's potential impact.

- The job report's strength will influence the Federal Reserve's actions, specifically regarding interest rate cuts. Gold's performance hinges on the direction of interest rates in the United States; a sustained drop could benefit the precious metal.

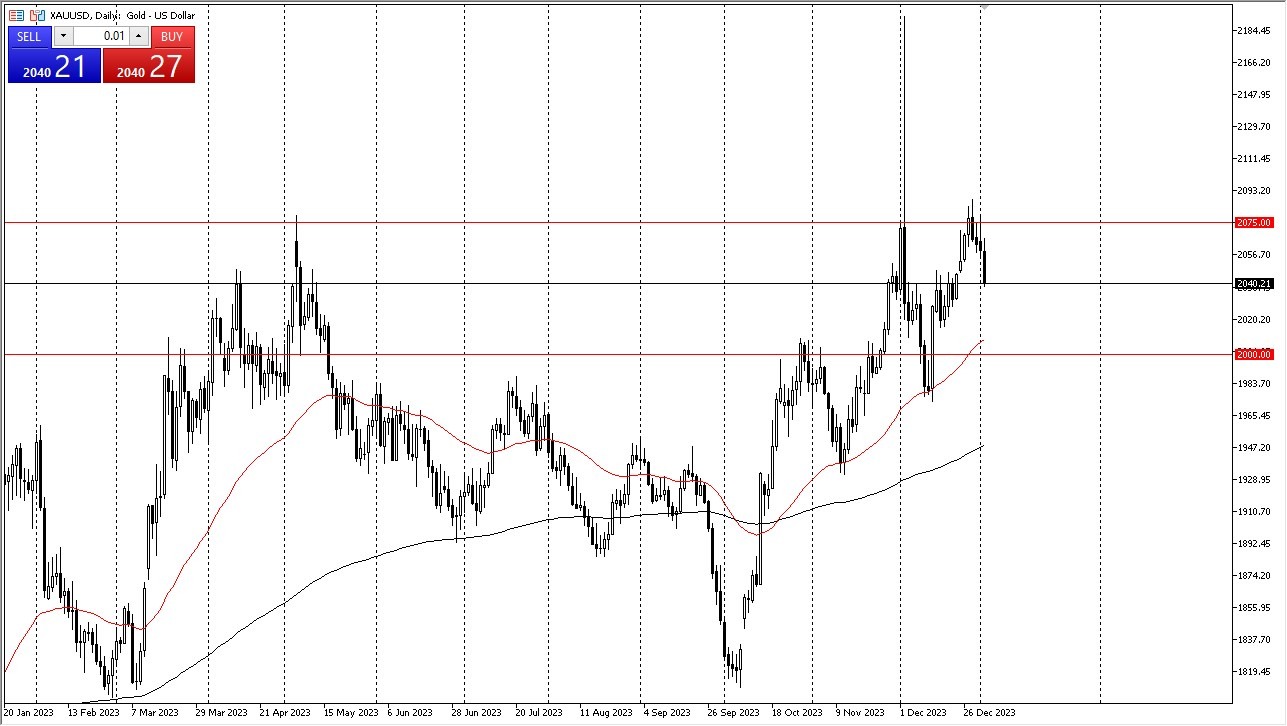

Nonetheless, there is substantial support beneath the current levels, discouraging short selling in the gold market. The 50-day Exponential Moving Average (EMA) and the $2,000 level both present attractive entry points for potential investors, assuming they are attainable. Additionally, there is minor support around the current market testing point near $2,040, warranting attention.

In the grand scheme, I do not intend to consider selling gold unless it experiences a significant drop below the $2,000 mark. Such a scenario could result in a $200 decline. At present, the market offers a favorable buy-on-the-dip trading environment, but prudence dictates not entering a substantial position immediately. Instead, it suggests that buying during price dips could yield positive results in the long run.

Looking to Buy on Dips

A noteworthy development to watch would be a turnaround and a close above the $2,075 level, signaling a positive trend. However, the primary focus should remain on monitoring interest rates in the United States and the strong inverse relationship between the 10-year yield and the gold market.

Top Regulated Brokers

Ultimately, gold's initial rally during Wednesday's early hours was followed by a retracement, indicating short-term challenges. These challenges relate to investors adjusting their positions, concerns about economic indicators, and the potential impact of the job report on Federal Reserve actions. Gold's performance remains closely tied to U.S. interest rates, which could influence its future trajectory. The presence of substantial support levels, such as the 50-day EMA and the $2,000 mark, discourages short selling. Buying on price dips appears to be a promising strategy, provided investors exercise caution and avoid large initial positions. A close above $2,075 could signal a positive trend but monitoring U.S. interest rates and their correlation with the gold market remains crucial. Overall, holding gold in a portfolio or trading account for the long term still presents a compelling case, and selling is not a current consideration.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.