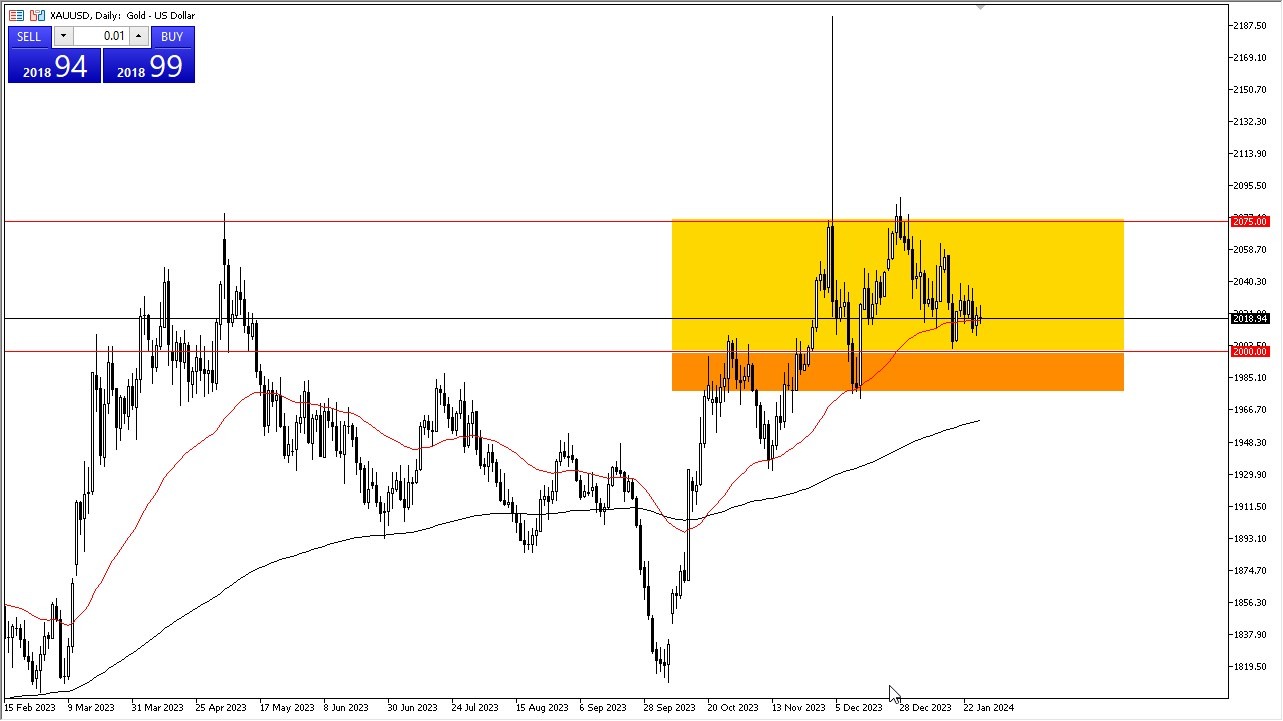

- Taking a look at the gold market and looking at the gold chart, you can see that we initially did try to rally a bit during the trading session on Friday but gave back the gains as we continue to hang around the 50 day EMA.

- The 50 day EMA of course is a indicator that a lot of people pay close attention to and with that being the case, I like the idea of hanging around here and building up momentum to perhaps try to go higher.

- Ultimately this is a market that has a lot of crosswinds at the moment that could continue to move the price of gold.

- After all geopolitical issues of course continue to be something that can move gold as it is considered to be a major safety asset.

Underneath the two thousand dollars level would offer a massive amount of support down to the $1,980 level. That is a major support level and support region that will continue to keep this market. If we turn around and break to the upside, the market then goes to the $2,040 level, breaking above that, then opens up the possibility of a move to the $2,060 level. After that, the $2075 level gets targeted as a potential resistance barrier and anything above there becomes more or less buy and hold. Gold of course is going to also pay attention to interest rates and if interest rates start to fall, that makes quite a bit of sense that gold would continue to move in a negative correlation. That's its longer term behavior.

Top Regulated Brokers

Anything below $1,980 would obviously be very negative, especially considering that the 200-day EMA is racing towards that level. And of course, the 200-day EMA is something that a lot of people are attracted to. Keep in mind that gold is very choppy. I think it remains so. And I do think that we're in a range. So, play it as such. The most important thing you can do is keep the positions reasonable in the gold market, as it is such a volatile asset to begin with. Nonetheless, I don’t have any interest in selling gold, and I think it’s probably only a matter of time before value hunters come in and pick up gold.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.