- The gold market displayed limited activity during Wednesday's early hours as buyers remained elusive.

- The impending release of the Consumer Price Index (CPI) and the Producer Price Index (PPI) figures in the coming days is anticipated to act as potential catalysts.

In the realm of gold trading, the early hours of Wednesday witnessed minimal movement, a reflection of the relatively sparse economic calendar. Attention is firmly paid to the CPI data set to be unveiled on Thursday and the PPI data scheduled for release on Friday. These figures hold significant sway over the bond market, which is the focal point of market analysis. Generally, higher interest rates work to the detriment of the gold market, while lower rates tend to be beneficial, particularly within the context of the United States.

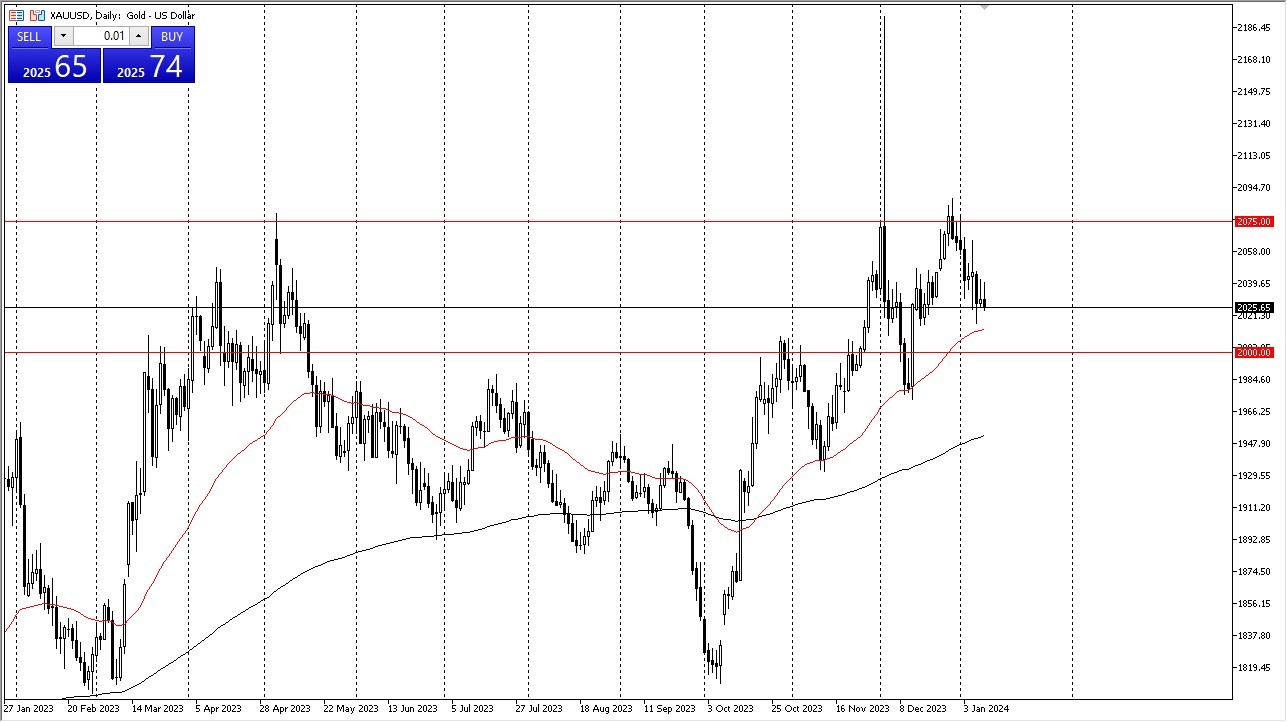

It's worth noting that while this correlation is not absolute, as there are instances when declining yields prompt investors to shift from gold to bonds to cover losses in their portfolios, it generally holds true. On the price chart, the 50-day Exponential Moving Average is positioned just below, serving as a potential support level. Further down, the $2,000 level presents additional support. Above, the $2,075 level is likely to pose a certain degree of resistance. A breach of this resistance could pave the way for further upward movement.

Range Bound Equilibrium

At present, the gold market finds itself in a state of equilibrium, awaiting a catalyst, which may materialize with the release of data on Thursday and Friday. The overarching sentiment remains bullish for gold, buoyed by an array of geopolitical concerns. Looking ahead, 2024 holds promise for gold, particularly if interest rates continue to decline, thereby bolstering its momentum. Nevertheless, it's imperative to exercise caution, recognizing that the gold market is not a one-sided venture. As such, approaching the market with patience and prudence is advisable.

Top Regulated Brokers

Ultimately, the gold market displayed limited activity in the early hours of Wednesday, as prospective buyers remained scarce. The impending release of the CPI and PPI figures is expected to provide the necessary impetus. In the realm of gold trading, the correlation between interest rates and gold's performance holds true, with higher rates typically working against gold and lower rates favoring it. The 50-day EMA and the $2,000 level act as support, while the $2,075 level serves as a resistance point. While the market appears to be in a state of equilibrium, the longer-term outlook remains bullish. Geopolitical concerns and the potential for declining interest rates in 2024 suggest a favorable environment for gold.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.