- The Euro has been experiencing a lack of clear direction in recent trading sessions.

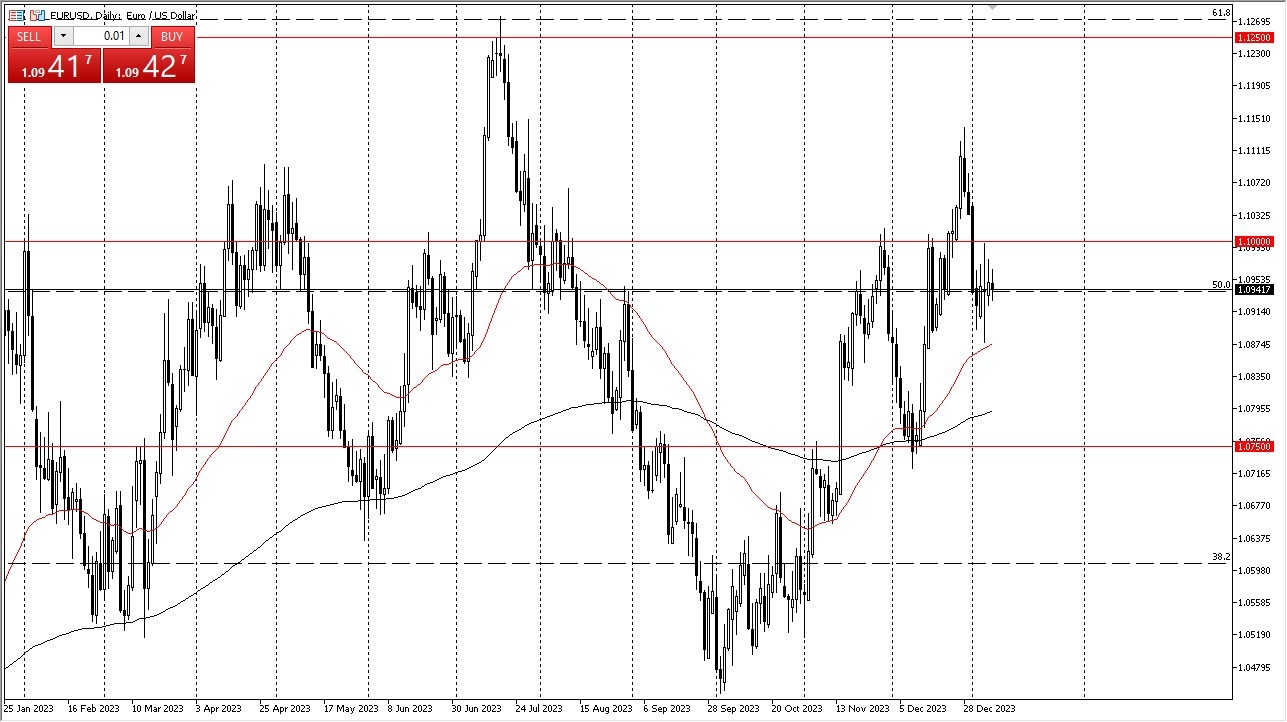

- The 1.10 level has consistently acted as a resistance point, making it a crucial factor to watch. A daily close above this level could potentially signal a shift in the market, with the Euro likely to benefit.

- In such a scenario, we could expect the Euro to target the 1.1140 level, which served as a previous peak. This is an area that is most certainly a target for the bulls, but whether or not they can muster up the momentum still remains to be seen.

Following this move, there may be an opportunity for the market to gather more momentum and aim for the 1.1250 level. This particular level has proven to be a significant resistance barrier, not only during last summer but also in historical data. However, the realization of this scenario largely depends on the overall performance of the US dollar, as well as the trajectory of interest rates in the United States.

On the Other Hand…

Conversely, if the market breaks below the 50-day Exponential Moving Average, currently situated around the 1.0870 level, it could initiate a deeper correction toward the 200-day EMA, located near the 1.08 level. Below that, the 1.0750 level is expected to offer support. This is an area that’s been important more than once, so I am going to be paying close attention to it if we get down there.

Top Regulated Brokers

In general, the Euro market appears to be characterized by choppy and unpredictable movements, which may not inspire confidence for significant investments at this time. For short-term traders focusing on range-bound strategies, there may be opportunities to engage with the market within the range of 1.10 and the 50-day EMA. However, beyond these parameters, there seems to be limited traction. Consequently, it may not be an optimal period for extensive trading activity in this market.

In light of things, the EUR/USD pair currently appears suitable for short-term trading, as it has demonstrated a consistent range over the past four to five trading sessions. Investors should closely monitor the 1.10 resistance level and the 50-day EMA for potential trading opportunities, while keeping an eye on broader economic factors influencing the US dollar's performance, especially the 10 year yield in the bond markets.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.