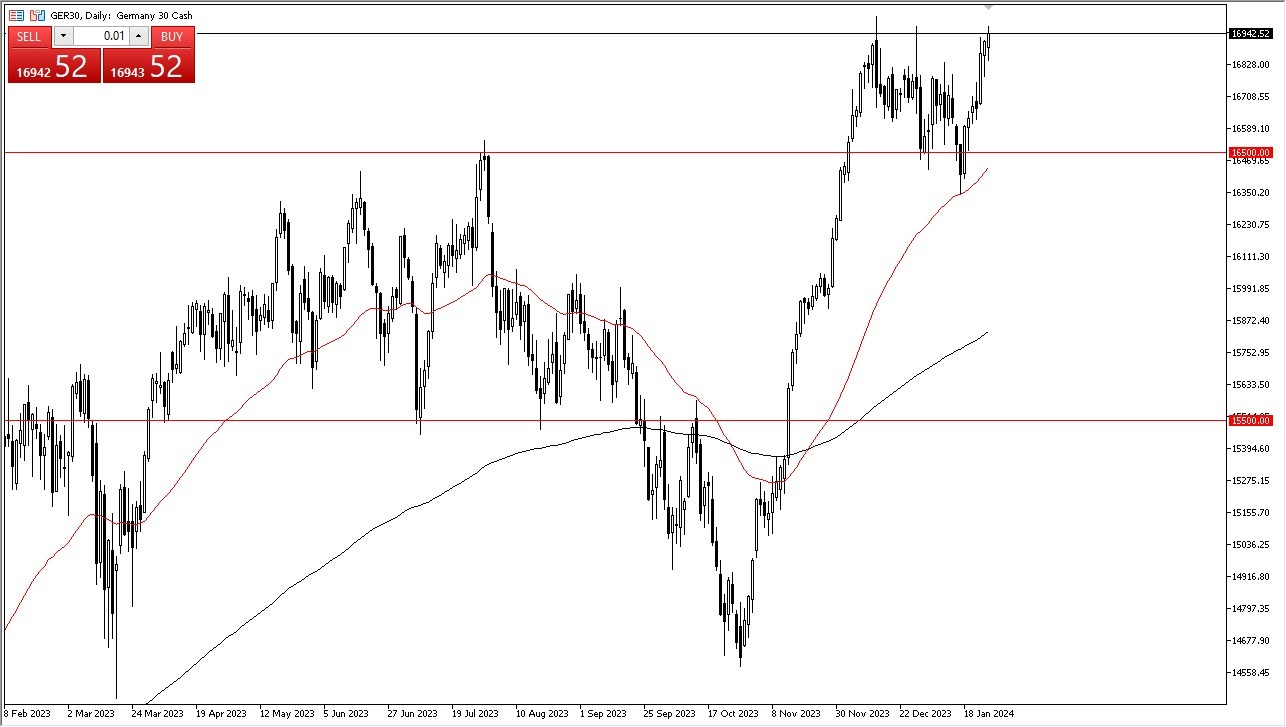

- The German DAX initially pulled back just a bit during the trading session on Friday, but then turned around to show signs of life again.

- It looks to me as if the market is trying to do everything it can to challenge the 17,000 euro level.

- And I think at this point, we will continue to respect it, at least in the short term.

- However, in the longer term if we do break above there then it opens up another 500 euros higher.

- It is very possible that short-term pullbacks present themselves as buying opportunities, and that's exactly how I would look at this market.

Bullish Flag?

We have seen a bit of a bullish flag somewhat kick off, and I do think that the buyers continue to flock towards the DAX, understanding that with Germany entering the recession, it's very likely that the ECB will begin to loosen monetary policy in the next several months. As a general rule, traders are trying to do everything they can to front run what the central banks are doing. And I think this is a scenario where you just look at this through the prism of volatility and of course, liquidity. If liquidity is going to continue to be pumped into the system, stocks typically go higher.

Top Regulated Brokers

The 50 day EMA is approaching the 16,500 euros level. So therefore, I think it's a bit of a floor in the market. In general, this is a market that I think will be choppy and noisy, but you cannot sell in this market. It's very difficult to imagine a scenario where you would get short. We would have to see some type of meltdown. And although not impossible, it seems very unlikely in this current trading environment. It's a completely risk-on environment as traders out there continue to bank on central bankers out there willing to help them out. This has been the game in New York for years, and the Europeans are now starting to trade the same way. I like the DAX overall, mainly because it has a lot of momentum, and the idea of liquidity being pumped into the markets. The markets will continue to look for higher levels, and therefore it is a market that will continue to see value hunters in this chart.

Ready to trade our DAX prediction? Here’s a list of some of the best CFD trading brokers to check out.