- The crude oil market has been somewhat choppy during the trading session here on Thursday, as we continue to grind back and forth.

- All things being equal, I think we are trying to sort out whether or not we are going to find buyers or sellers, but we are essentially in the middle of a larger consolidation region.

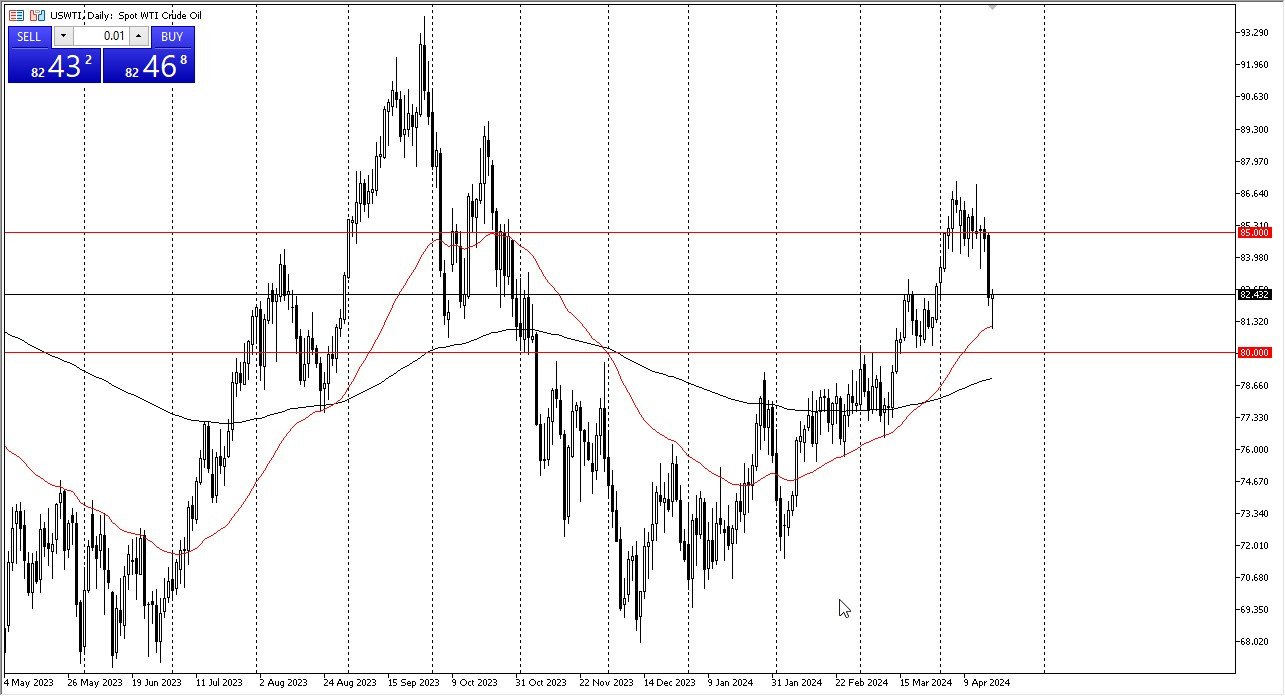

WTI Crude Oil

The $75 level above will continue to be a major resistance barrier right along with the 50 day EMA. Underneath the $68 level is significant support. All things being equal, I think the WTI crude oil market will continue to see a lot of volatility. There are a lot of questions about supply, as currently we are producing about three, maybe even four million barrels per day of excess capacity. At the same time though, we have a lot of concerns in the Middle East when it comes to conflict. And of course, the attacks in the Red Sea will continue to support the market. So, in general, I think we continue to go back and forth.

Top Regulated Brokers

Brent

Brent, very much the same situation where the $80 level is or the $80.50 level is a major resistance barrier, right along with the 50 day EMA, underneath the $72 level offer support. I do think in general though, most oil grades, including the two in this video, are more or less the buy on the dip variety due to the fact that they have sold off so drastically. Furthermore, if central banks around the world start to cut interest rates, the idea of course is going to be that economies may start to take off again. And if that's the case, we should eventually see demand return. Remember, oil traders are trying to think of the future, and that's part of the noise that we see in this general vicinity.

Looking out into the future, it’s very likely that we will eventually rally, but in the short term we are going to have to deal with a lot of confusion and choppy behavior. In general, I don’t have the interest in shorting oil, although I do recognize that it may take longer than most people anticipate turning things around and rallying for a bigger move. Because of this, I continue to employ a short-term “by on the dip” type of strategy.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.