- Bitcoin is experiencing upward pressure, with the potential for a breakout in the near future.

- However, short-term pullbacks may still occur.

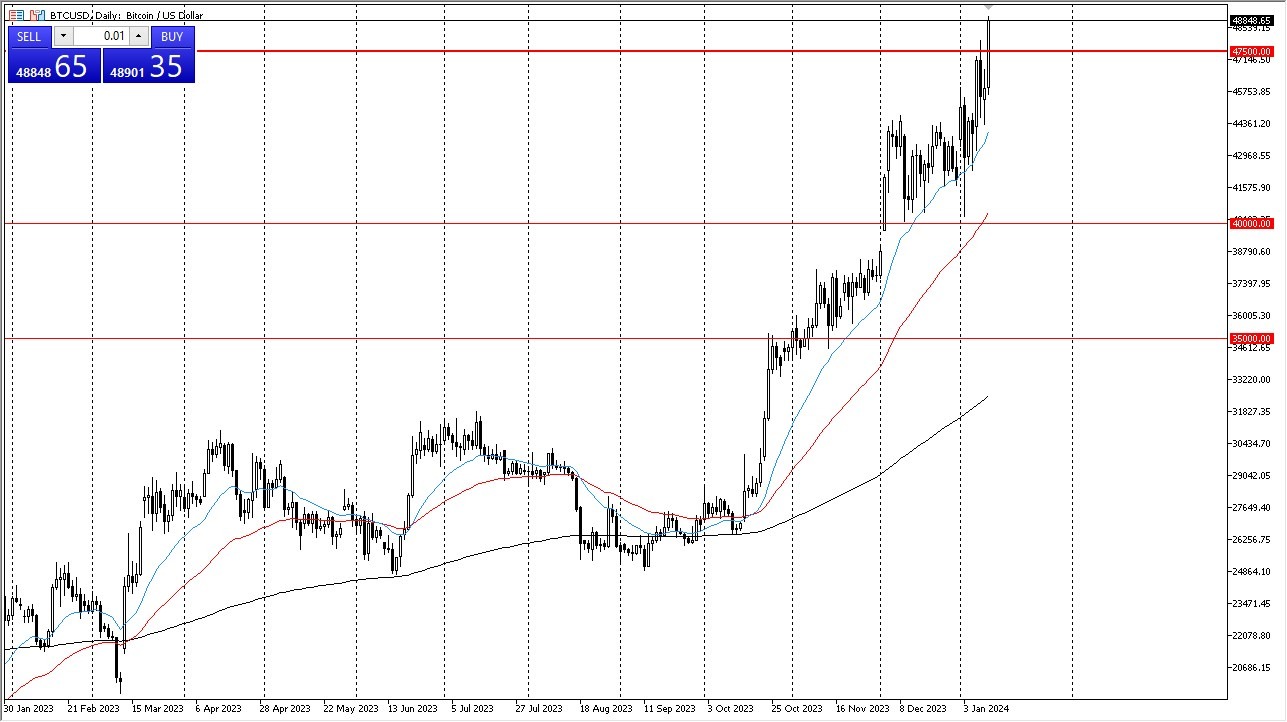

- Currently, Bitcoin is hovering around the critical $47,500 level, which has proven significant multiple times in the past.

The recent rally to this level is not surprising, as Bitcoin appears determined to break through. Investors are eyeing opportunities to buy during short-term pullbacks, particularly when Bitcoin nears the 20-day Exponential Moving Average and the $40,000 level. The $40,000 level also coincides with the 50-day EMA, adding further significance to this price point.

The ETF…

The bullish sentiment surrounding Bitcoin is partly driven by the anticipation of a Bitcoin Exchange-Traded Fund (ETF), which is expected to attract institutional investors. However, this development has been on the horizon for some time, and its impact on the market may already be priced in. To propel Bitcoin past the $50,000 level, a catalyst is now needed.

Beyond $50,000, the $52,000 mark has consistently acted as resistance on the weekly chart and would become the ultimate target in the event of a breakout. In light of these factors, selling Bitcoin at this juncture does not seem advisable, despite some profit-taking activities by certain individuals. It's crucial to recognize the prevailing bullish sentiment in the market, and therefore it is not a market that can be shorted soon. Bitcoin will continue to find buyers, but we may have to work off some froth first. The markets will continue to attract more buyers, but there has been a lot of momentum expended already.

Top Regulated Brokers

If Bitcoin drops below the $40,000 level, the next substantial support level to watch is $35,000. A move below this point would signal a shift in the trend, but currently, such a scenario appears unlikely. Consequently, value-seeking investors and long-term believers in Bitcoin will probably continue to support cryptocurrency.

At the end of the day, Bitcoin is under upward pressure, with the potential for a breakout above the $47,500 level. While short-term pullbacks may occur, the overall market sentiment remains bullish, fueled in part by the anticipation of a Bitcoin ETF. Investors should exercise caution but recognize the prevailing bullish trend in Bitcoin, with $52,000 serving as a significant target in the event of a breakout.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.