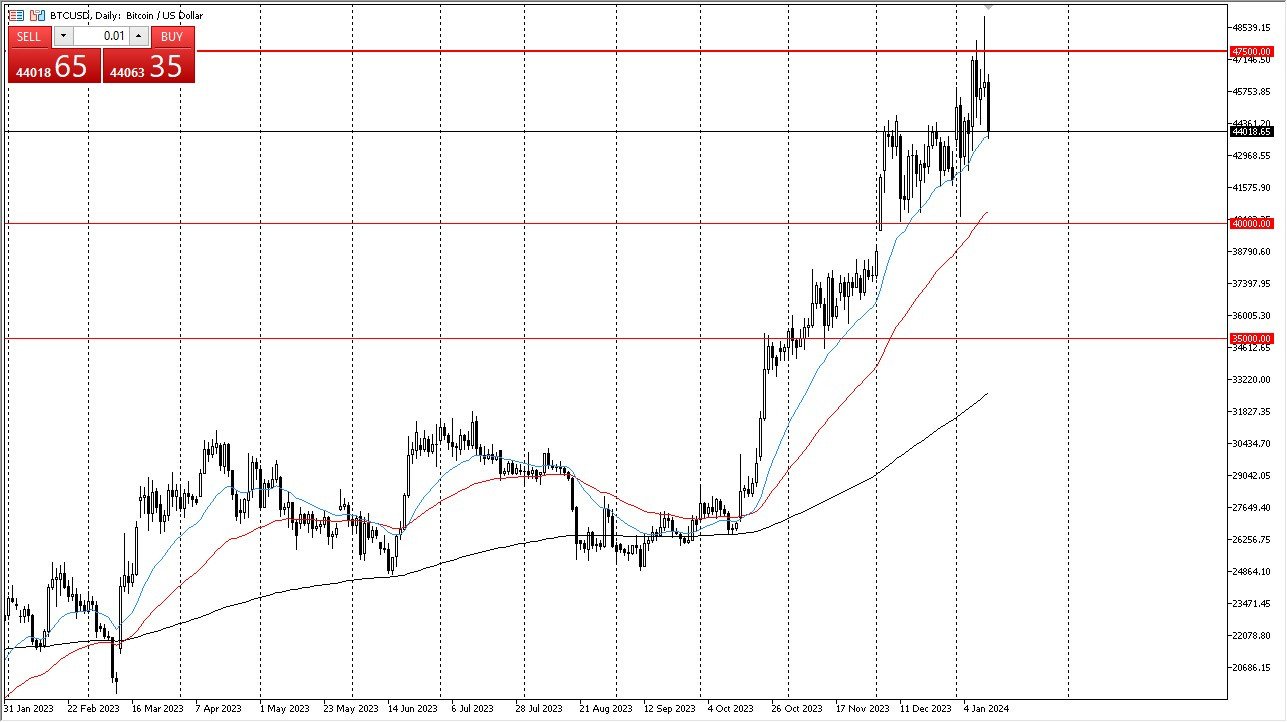

- In Friday's trading session, Bitcoin exhibited a back-and-forth movement, indicating uncertainty in the market.

- The $47,500 level poses a significant resistance, having already been breached.

- The key question now is whether Bitcoin can ascend further, but later in the day, it looks like we are starting to see selling pressure, albeit short-term in nature I suspect.

Looking for Potential Pullbacks

The introduction of a Bitcoin ETF, while highly anticipated, hasn't sparked much enthusiasm in the market. This lack of excitement is reasonable given the rapid 80% gain achieved in just about two months. After all, markets cannot go straight up in the air forever, despite the fact that a lot of the Bitcoin maximalists seem to believe that. We don’t have any real use for Bitcoin yet, but it’s obvious that a lot of money is going to be flowing into the market.

Top Regulated Brokers

Currently, potential pullbacks are the focal points for those seeking to capitalize on the value of Bitcoin. The overall sentiment remains bullish. However, a glance at the weekly chart reveals the significance of the $47,500 level as a previous resistance point. Some degree of exhaustion in the market is expected. Beneath this level, there exists the 20-day EMA, the 50-day EMA, and the $40,000 level, all poised to provide support. Bitcoin must either consolidate and seek a catalyst for an upward breakout or retrace, attracting investors willing to fuel its ascent. This phase can be characterized as a period of adjustment following the news of the ETF's impending arrival, which had already been factored into prices.

Nevertheless, it is crucial to acknowledge that selling Bitcoin in the near future is unwise due to its inherent strength. Instead, the prudent approach is to view it as a market poised for an eventual breakout. Investors should seize opportunities presented by any pullbacks. Only if Bitcoin dips below the $35,000 level should concerns about a significant selloff be a thing. Because of this, I think this is a market that continues to attract a lot of attention as the excitement of the new ETF continues to reach fever pitch, and of course a lot of people will be looking to take advantage of any value that’s offered. The market has rallied 80% in the last several months, so it’s likely that we see a little bit of hesitation, but it clearly is in a very bullish state of affairs.

Ready to trade Bitcoin USD? Here are the best MT4 crypto brokers to choose from.