- In the recent trading session on Thursday, Bitcoin exhibited a rather stagnant performance, with minimal activity.

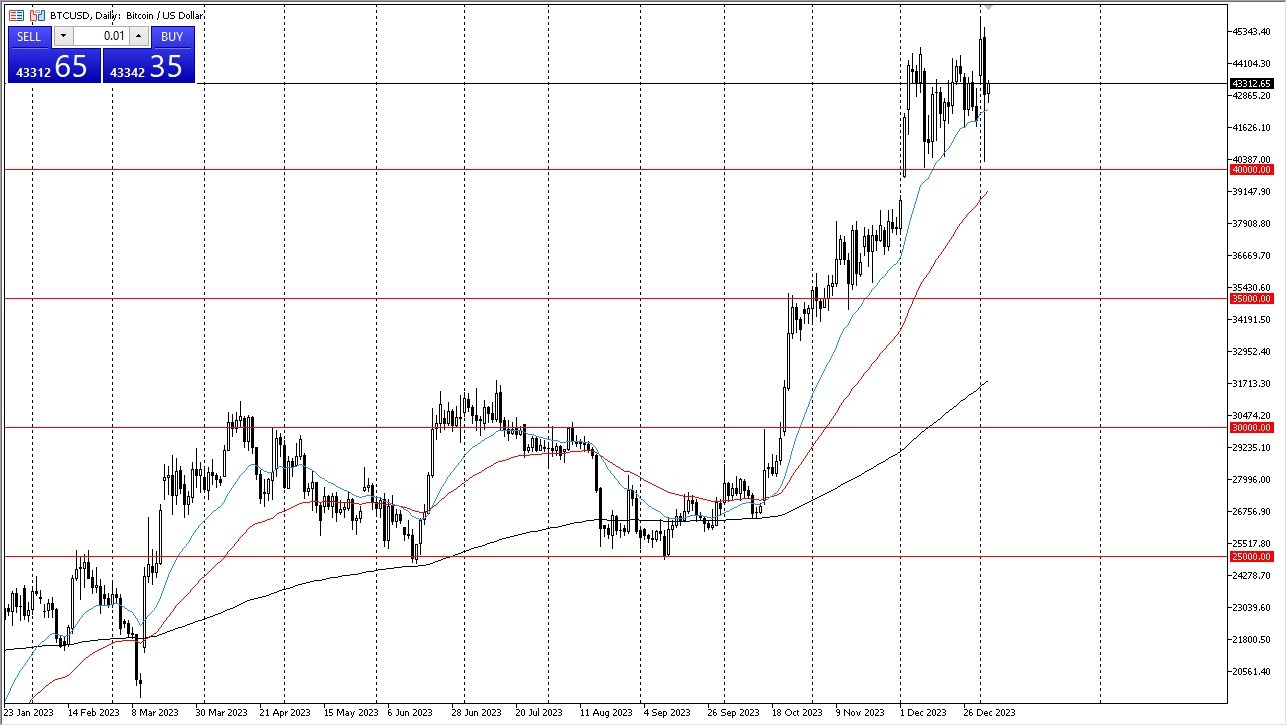

- It currently maintains a position above the 20-day Exponential Moving Average. If it were to break below this EMA, there is the possibility of a decline towards the 40,000 level.

- It's worth noting that the 40,000 level coincides with the 50-day EMA, which has previously acted as a support zone.

Conversely, if Bitcoin were to make gains, the $45,000 mark would likely serve as a significant resistance point. Breaking above this level could potentially pave the way for a move towards the 47,500 level, a development that appears plausible shortly.

Jobs Report

In the immediate term, market observers are closely monitoring the jobs report, as it has a consequential impact on the bond market, with lower yields benefiting Bitcoin. A positive correlation exists between economic stability in the United States and the interest in Bitcoin as an investment option, particularly when individuals are willing to take on more financial risk. Additionally, there's anticipation surrounding the potential release of a Bitcoin Exchange-Traded Fund in the coming months. However, it's important to remain cautious, as this event could either drive demand or result in a "sell the news" scenario, catching some traders off guard. In such a case, the market may experience a sudden sell-off, potentially leading to an opportunity for value-oriented investors to buy at lower price levels.

Top Regulated Brokers

Bitcoin is currently in an upward trajectory, and this implies that short-term declines can be viewed as opportunities for accumulation. The recent price action on Wednesday underscores the validity of this strategy. It's essential to manage your position size judiciously in light of potential volatility. Overall, the prevailing sentiment suggests that Bitcoin is poised for further upward movement. Consequently, we may also observe a weakening of the US dollar as Bitcoin's ascent continues.

However, it's worth mentioning that the real potential for substantial gains might be found in alternative cryptocurrencies, or "altcoins." These coins have a considerable gap to bridge in terms of market capitalization when compared to Bitcoin, but also have a lot of catching up to do. Regardless, Bitcoin will continue to play a pivotal role in shaping the broader cryptocurrency landscape, and its performance will serve as an indicator of what lies ahead for the entire market.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.