- Bitcoin has reached the lower boundary of its established range and is currently showing signs of a recovery.

- However, this phase raises several questions for the cryptocurrency.

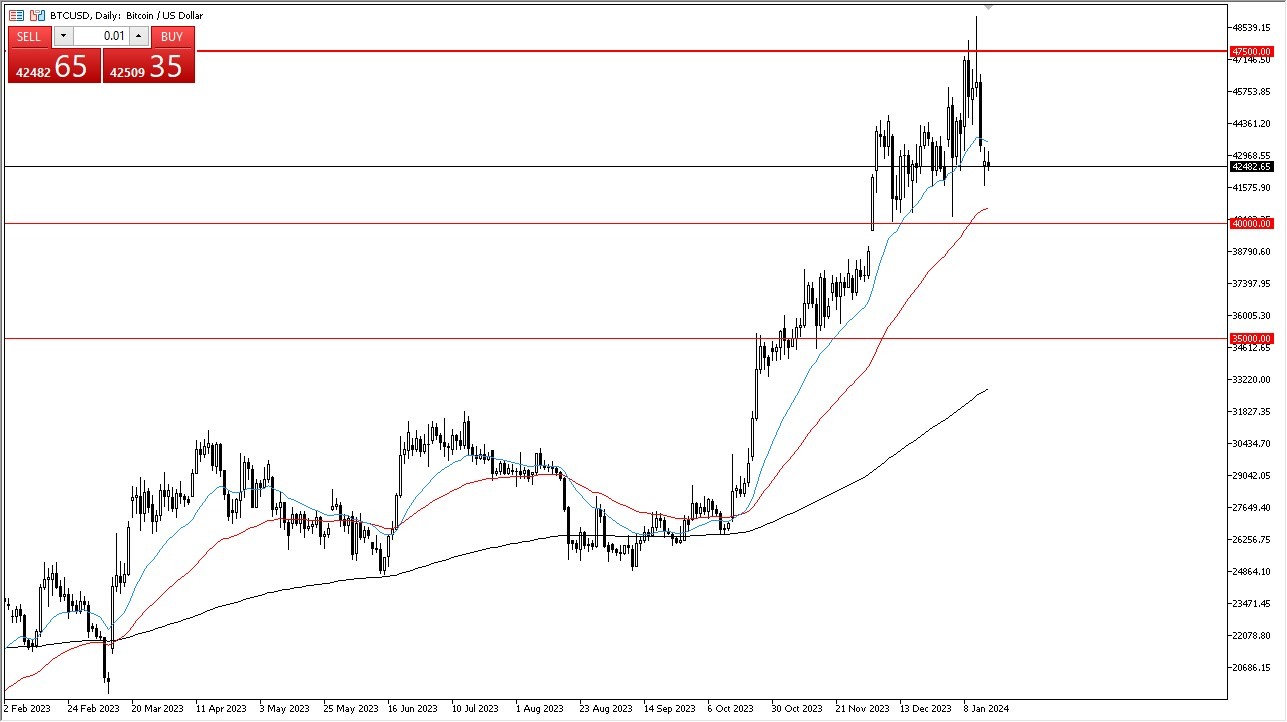

In the trading session on Tuesday, Bitcoin experienced a minor pullback but subsequently witnessed an influx of buyers seizing the opportunity presented by the dip. The cryptocurrency market is particularly noteworthy right now due to the buzz surrounding the impending Bitcoin ETF. Nevertheless, since the announcement, the market has been predominantly bearish.

The $47,500 price level represents a substantial resistance zone, which has historically proven to be formidable over an extended period. This level holds significance in the realm of technical analysis, and its breach would require significant effort. Consequently, investors should anticipate continued price fluctuations and heightened volatility.

Technical Analysis Outlook

Top Regulated Brokers

From a technical analysis perspective, the 50-day Exponential Moving Average (EMA) is situated slightly below the current price and just above the $40,000 level. The $40,000 mark serves as a historical support level and carries the weight of being a round number, attracting considerable attention. It is likely to function as short-term support. In the event of a break below $40,000, the potential for a descent to the $38,000 level, and subsequently the $35,000 level, comes into view.

All factors considered, a decisive break above the prior week's shooting star, which pierced the $47,500 level, could propel the market towards the $52,000 mark. While a bullish sentiment prevails for Bitcoin, the current phase introduces intriguing dynamics. The introduction of the Bitcoin ETF may simplify shorting Bitcoin for institutional traders, resembling traditional stock market behavior. Consequently, Bitcoin's behavior by year-end is expected to deviate from familiar patterns, marking a notable shift in its trading landscape.

At the end of the day, Bitcoin price has touched the lower limit of its established trading range and exhibits signs of a rebound. However, uncertainties surround its trajectory. The market faces formidable resistance at the $47,500 level, with ongoing choppiness and volatility expected. The $40,000 level, supported by historical significance, could serve as a short-term support zone. A breakdown below $40,000 might lead to further declines. Conversely, breaking above the recent shooting star may drive Bitcoin towards the $52,000 level. The introduction of the Bitcoin ETF introduces new dynamics and may reshape Bitcoin's behavior in the coming months.

Ready to trade Bitcoin USD? Here are the best MT4 crypto brokers to choose from.