- The Australian dollar initially attempted to rise on Wednesday but quickly relinquished its gains as the US dollar staged a recovery.

- Given the circumstances, it might be prudent to stay on the sidelines and await developments in the coming pips.

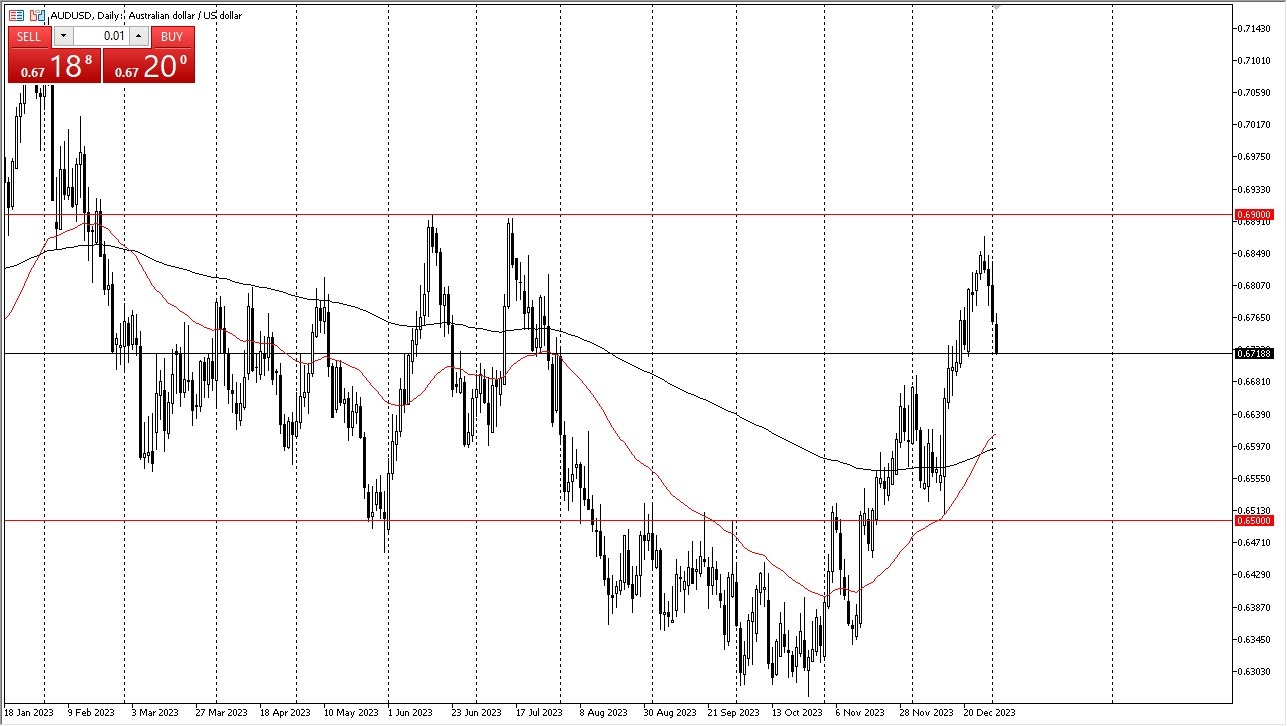

Key events on the horizon include the ISM numbers, which can exert influence, and the upcoming jobs report scheduled for Friday. The pivotal question revolves around whether we have reached the peak of the trading range and are now in a breakdown phase, or if this is simply a pullback from an overbought condition. Either scenario is plausible at this point, and the trajectory of the US dollar will be heavily influenced by the 10-year yield.

Currently, the US dollar appears to have been oversold, creating an interesting dynamic to observe. It's important to note that the Federal Reserve has adjusted its dot plots, suggesting the possibility of rate cuts in the next year. However, the rationale behind such cuts is a subject of speculation. It may not solely be due to inflation concerns but could be rooted in broader economic factors.

Short-Term Corrections and Golden Cross Implications

In such a scenario, the Australian dollar, which is closely linked to commodities, economic growth, and risk appetite, may face a downturn. Consequently, numerous questions require consideration. In the short term, the correction appears to be a response to the overbought conditions, with the 0.6680 level emerging as an area of interest that is fast approaching.

Top Regulated Brokers

A potential rebound from this level could see a return to the 0.69 level. Additionally, longer-term traders are showing interest in the "golden cross," an event that recently occurred. This suggests that the downside potential may be somewhat limited unless significant shifts occur in the bond markets.

Ultimately, the Australian dollar initially attempted to rally but retraced due to the US dollar's recovery. Given the upcoming economic events and uncertainties, it may be prudent to adopt a cautious stance and await further developments. The US dollar's performance will be influenced by the 10-year yield, and the rationale behind potential Federal Reserve rate cuts remains a matter of conjecture. The Australian dollar's ties to commodities, economic growth, and risk appetite introduce complexity to its outlook. Short-term correction appears to be a response to overbought conditions, with the 0.6680 level serving as an area of interest. A rebound from this level could target the 0.69 level. Longer-term traders are also monitoring the "golden cross" event, suggesting limited downside potential unless significant changes occur in the bond markets.

Ready to trade our Forex daily analysis and predictions? Check out the best forex trading platform Australia worth using.