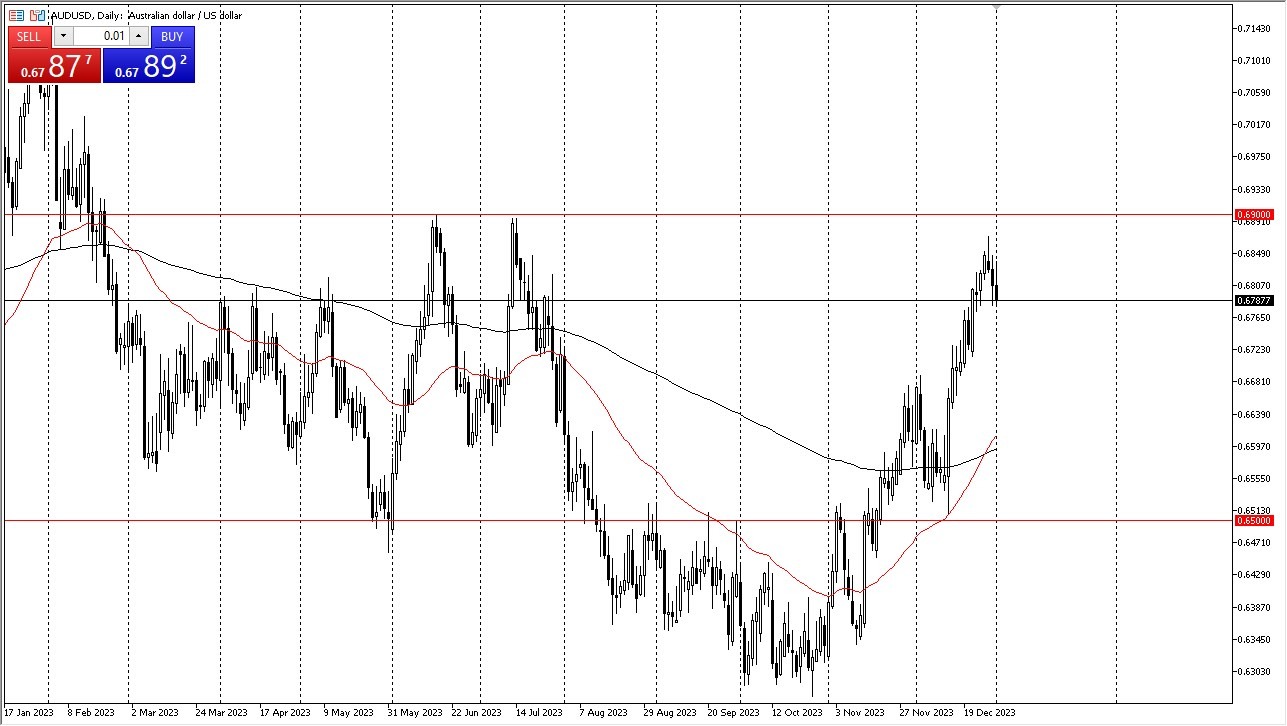

- Looking at the Australian dollar's recent performance, it initially attempted to rise during Tuesday's trading session but has since experienced a significant decline.

- This downward movement may seem like an overdue correction, given the currency's recent strength. However, it's important to note that this doesn't necessarily indicate a drastic breakdown.

- Instead, it suggests a natural need for some profit-taking, especially considering the market's proximity to its established trading range.

The 0.69 level above has acted as a significant resistance barrier, and the market's failure to breach it is not surprising given the current overextension. A pullback to the 0.67 level seems reasonable, and possibly even down to 0.66. This would be a strong move, but it is very possible at this point in time. The US dollar continues to be the driver overall, and this will be the case going forward in not only this pair, but also most FX pairs.

For longer-term traders, a crucial indicator to watch is the 50-day Exponential Moving Average crossing above the 200-day EMA, forming what experts refer to as the "Golden Cross." While this signal often occurs later in a trend, it can lead to sustained upward momentum over several months if it indeed materializes. It's worth noting that the Federal Reserve's plan to cut rates in 2024 is anticipated, but recent statements from Federal Reserve governors suggest a possible shift in that sentiment.

Traders Should Proceed with Caution

In any case, the market's recent overextension implies a need for a corrective pullback, as observed in current trends. Whether you decide to take a short position is a personal decision, but keep in mind that there is considerable underlying momentum. Therefore, any selling pressure is likely to be short-lived. Additionally, it's important to exercise caution as the upcoming jobs report on Friday could have a significant impact on the market's direction.

Top Regulated Brokers

At the end of the day, the recent downward movement in the Australian dollar appears to be a natural correction following a period of overextension. While it may lead to a pullback to the 0.67 or even 0.66 levels, the overall market sentiment remains influenced by factors like the Golden Cross formation and the Federal Reserve's rate-cut expectations. Traders should proceed with caution, keeping an eye on key indicators and upcoming economic events as they make their decisions in this dynamic trading environment.

At the end of the day, the recent downward movement in the Australian dollar appears to be a natural correction following a period of overextension. While it may lead to a pullback to the 0.67 or even 0.66 levels, the overall market sentiment remains influenced by factors like the Golden Cross formation and the Federal Reserve's rate-cut expectations. Traders should proceed with caution, keeping an eye on key indicators and upcoming economic events as they make their decisions in this dynamic trading environment.

Ready to trade our daily Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.