As November comes to a close some speculators within the USD/ZAR may feel slightly angry regarding the results of the currency pair. However, they should not. Inexperienced traders within the USD/ZAR if they are wagering on the currency from afar – outside of South Africa – should do some reading about the state of affairs in South Africa before trying to speculate on the value of the currency pair. This because while the USD/ZAR is a major Forex pair it also remains troubled by domestic winds that blow in rather conflicting directions within South Africa.

Top Regulated Brokers

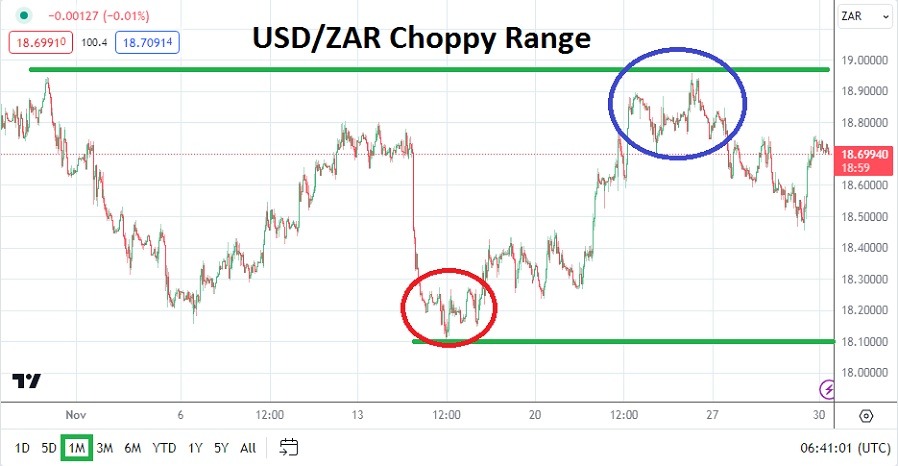

The USD/ZAR reached its high for the month in November quiet recently, on the 24th, when it touched the 18.95700 vicinity but this proved to be a very momentary glitch. This USD/ZAR hit the 18.94800 level on the 31st of October. The currency pair did hit a low of nearly 18.11050 on the 15th of November. Before that on the 6th of November the USD/ZAR touched a low around the 18.15040 mark, before hitting a high around 18.80000 on the 10th and then seeing a strong move lower. As of this writing the USD/ZAR is near the 18.68100 ratio with typical quick fluctuations being demonstrated.

Highs and Lows in Known Range for USD/ZAR

Instead of taking on a consistent downturn like many other currency pairs teamed against the USD in November, the USD/ZAR has struggled as behavioral sentiment is surrounded by doubts. The problem for the South African Rand is that domestic economic issues continue to haunt the economic landscape.

Loadshedding has become problematic again; manufacturers in South Africa are struggling with the inability of Eskom – the state run electrical entity – to provide secure energy supply. Corruption within the organization and its ties to government leadership have been questioned for years by the people of South Africa who suffer and watch as production problems within their businesses falter, this affects the USD/ZAR.

Not only is electrical supply a problem, but port congestion in places like Durban and Cape Town are creating massive problems for importers and exporters who watch as delays of shipments cause chaos within the manufacturing and agriculture sectors as an example. The choppiness of the USD/ZAR while showing the ability to trade lower and mirror the broad forex market, is also having its value questioned by sudden glitches of nervous sentiment from financial institutions who understand South Africa’s internal problems.

- The choppy range within the USD/ZAR remains troublesome, opening the door for wagers from speculators who believe resistance will provide downwards pressure and lower support will create upwards impetus.

- Yes, the USD/ZAR has traded below 18.0000, but the last time it did this was in mid-July and early August of this year.

- If domestic concerns can ease in South Africa, there is a chance the USD/ZAR could re-establish pushes lower which would challenge depths again.

- Behavioral sentiment in the USD/ZAR is important and it clearly remains fragile.

- Intriguingly gold is well above 2000.00 USD per ounce and this in theory should be helping the USD/ZAR move lower, but that has certainly not played out yet either.

Ready to trade our Forex forecast for the coming month? We’ve shortlisted the best Forex trading brokers in the industry for you.