- The USD/JPY showed initial strength on Wednesday, with market participants closely monitoring the Federal Reserve's forthcoming statement.

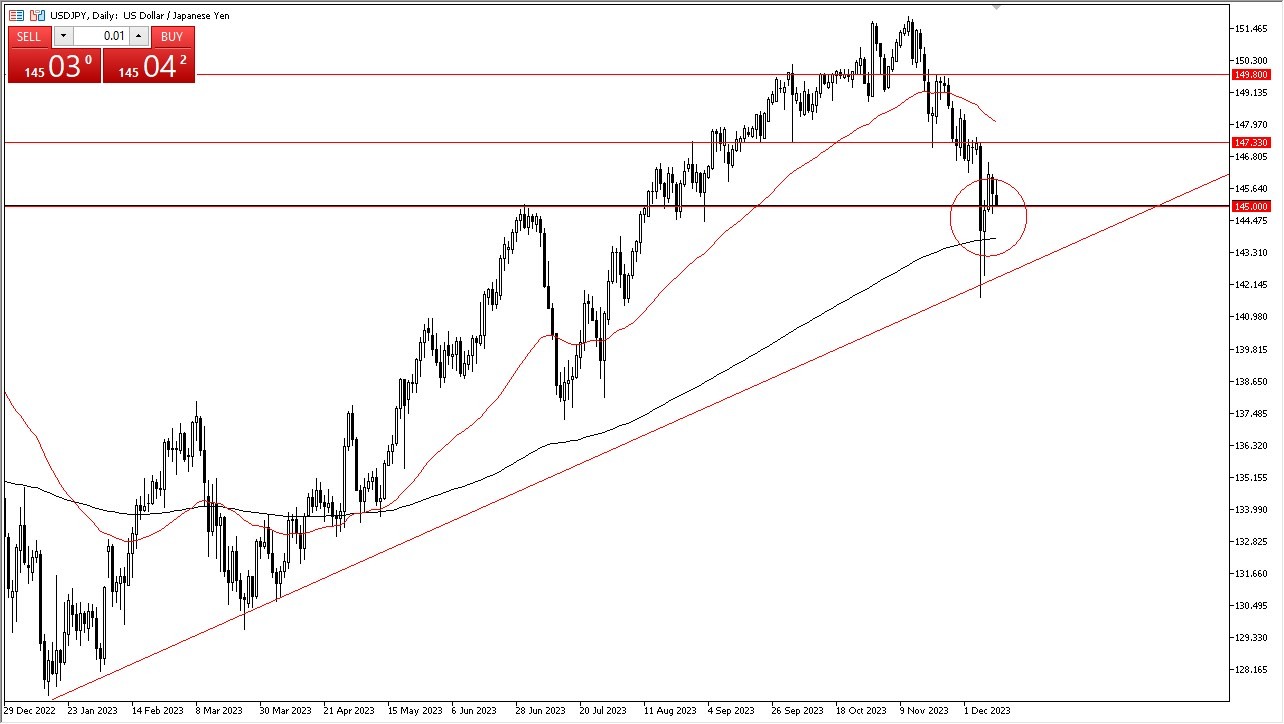

- The 200-Day Exponential Moving Average is currently providing support, highlighting the ¥145 level as a significant psychological threshold and a magnet for price movements.

Top Regulated Brokers

This market scenario suggests an ongoing search for stability, heavily influenced by central bank activities. The near-term focus is on the Federal Reserve's stance and the subsequent market response. However, this attention will soon shift to the Bank of Japan, which is expected to announce its monetary policy decision next week. These back-to-back central bank decisions are crucial in shaping market expectations for the upcoming months. With numerous questions and variables at play, predicting the market's direction becomes increasingly challenging.

A key point of interest is whether the market will maintain its current levels or face a downturn. If there is a break below last week's lows, the market could experience significant negative momentum, with the ¥140 level emerging as an immediate support point. Conversely, a surge above the ¥146.50 level could drive the market towards the previous selloff point at ¥147.33, followed by the 50-Day EMA.

The market dynamics also hinge on the Federal Reserve's policy approach. An unexpected dovish turn could trigger a substantial selloff. Meanwhile, the Bank of Japan's upcoming decision is eagerly anticipated, as there are expectations for the Japanese central bank to start normalizing interest rates. This potential policy shift has contributed to the yen's recent appeal to buyers. However, whether this trend will sustain or change remains uncertain.

Liquidity Issues

As the end of the year approaches, these central bank decisions will provide vital clues about the future course of the USD/JPY pair. Market participants should brace for potential volatility and significant movements in response to these policy announcements. The interplay between the Federal Reserve and the Bank of Japan's decisions will be critical in determining the direction of the currency pair.

In summary, the USD/JPY market is currently navigating a period of anticipation and uncertainty, with key influences coming from central bank policies. The 200-Day EMA and the ¥145 level are significant markers, providing support and acting as a focal point for traders. The forthcoming statements and decisions from the Federal Reserve and the Bank of Japan are expected to be pivotal in shaping the market's direction in the near term, with potential implications for the broader currency markets as the year draws to a close.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.