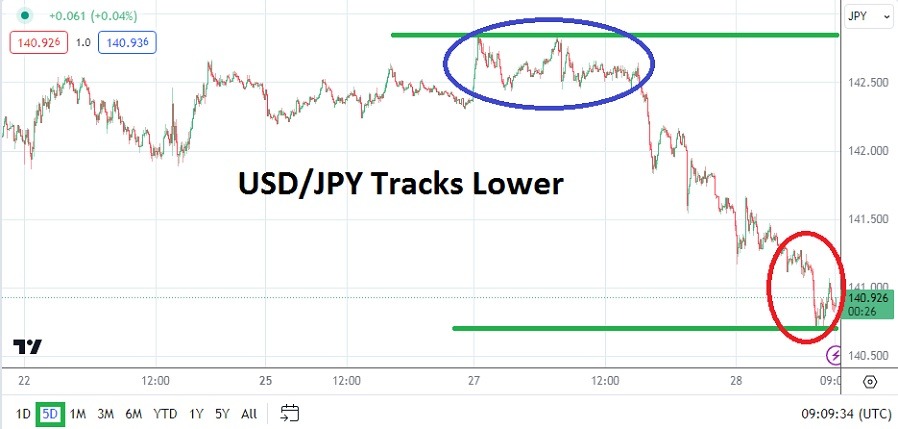

The USD/JPY has delivered another strong leg down this morning and the current value of 140.950 is noteworthy. On the 14th of December the USD/JPY was able to test the 141.000 mark as momentum lower hit the currency pair, this in the wake of the U.S Federal Reserve’s change of rhetoric regarding monetary policy.

Top Regulated Brokers

USD/JPY Strong Lower Move and Holiday Trading

Holiday markets are certainly being seen in Forex, but this morning’s Retail Sales report from Japan came in stronger than anticipated, and so did Industrial Production readings. These two reports likely helped stir the notion the BoJ may have to seriously consider raising its lending rate sometime in 2024. Even though the data was published during the ‘holiday season’ enough Japanese financial institutions are active – this compared to their counterparts in Europe and the U.S. – to have sparked another selling surge in the USD/JPY this morning.

The ability to fall below the 141.000 level and strength to sustain prices under this mark today is rather significant. Light trading volumes will prevail the remainder of the day and tomorrow, but enough large players are involved in the USD/JPY to cause Forex volatility. If the USD/JPY stays under the 141.000 mark it may spark additional bearish traders to leap into the currency pair.

USD/JPY Considerations Moving Forward

- The bearish trend of the USD/JPY is intriguing and the rather strong trajectory which effectively began in the middle of November appears to have solidified.

- Short-term traders must remain careful because of holiday trading conditions; those looking for more downside price action should stay realistic with their wagers.

The last time the USD/JPY traded at its current price levels in a sustained manner was in late July, and this was after it was coming off lows which had tested the 137.200 to 140.000 range from mid-July until late in the month. Risk management in the USD/JPY will be important in the near-term; because enough speculators of the currency pair are involved within the marketplace to cause additional volatility.

USD/JPY Short Term Outlook:

Current Resistance: 140.980

Current Support: 140.720

High Target: 141.270

Low Target: 140.030

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.