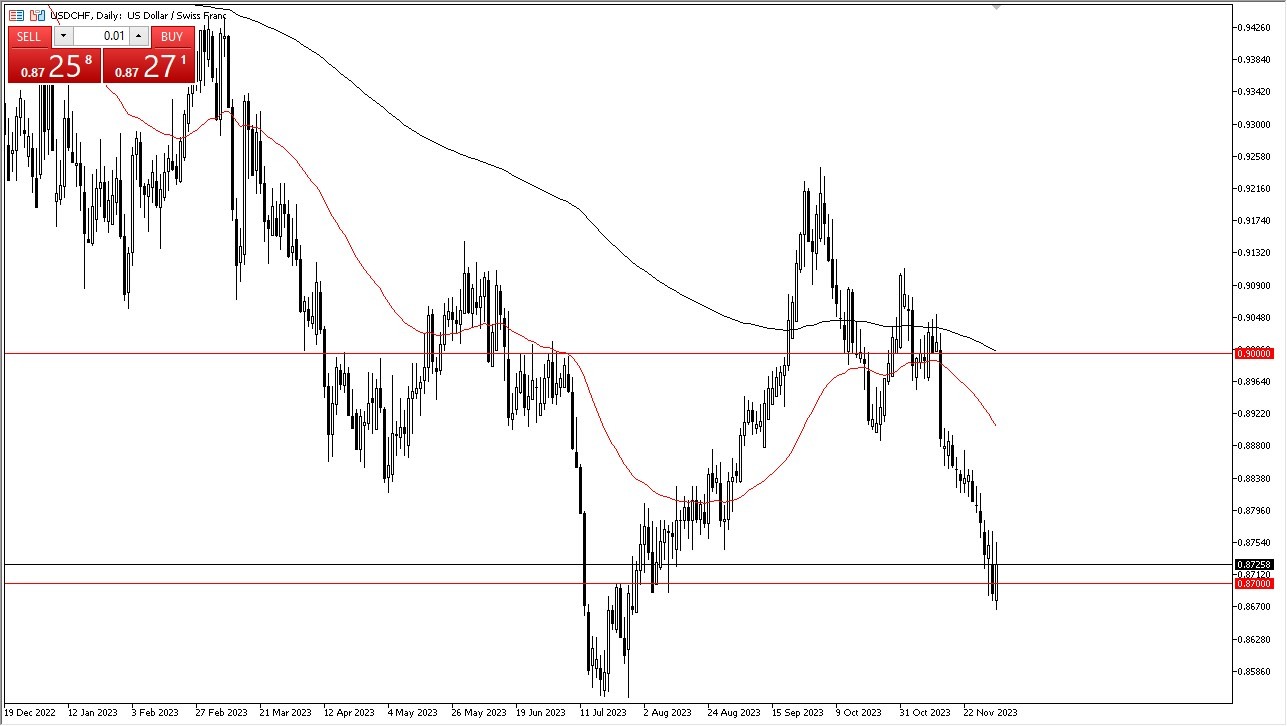

- The US dollar has bounced a bit during the trading session on Monday against the Swiss franc, as the 0.87 level has offered a significant amount of support.

- Furthermore, the interest rates in America have bounced a bit as well, so that does help the idea of the US dollar strengthening.

- However, I don’t necessarily think that this is an area that is a major floor in the market, but if we do turn around and break out to the upside, the 0.88 level is a breakout just waiting to happen.

Top Regulated Brokers

Underneath, the market is likely to continue to see a lot of choppy and volatility down to the 0.86 level, which was a major swing low previously. If we were to break down below there, then it opens up the possibility of a move down to the 0.85 level. Obviously, this is a market that has been very noisy for some time and of course very negative. It is oversold, so a little bit of recovery does make a certain amount of sense. However, it’s also worth noting this somewhere near the 0.8750 level we have fairly noisy resistance.

Monitoring US 10-Year Yield

All things being equal, you will have to keep an eye on the 10 year yield in the United States, as it seems to be driving almost everything out there at the moment. The trading environment right now is one of complete uncertainty, and as we go into the back half of December, there will be less liquidity. This could lead to extreme moves in the currency markets, so a bit of caution probably goes a long way. Position sizing is crucial, but it’s probably worth noting that we are at extremely oversold levels, and historically in this area of the Swiss franc starts to lose a little bit of strength.

While I’m not overly bullish on the US dollar in the short term, I do think that we are getting closer to the end now that we have been for some time. Any balance at this point in time would probably have something to do with economic concerns, and we certainly saw a lot of that creep into the market early on Monday, meaning that there is less confidence out there than the charts would suggest.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.