Top Regulated Brokers

Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the level at 29.30.

- Place a stop loss point to close below the 29.10 support level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance level at 29.55.

Best-selling entry points

- Entering a sell deal with a pending order from the 29.50 level.

- The best points to place a stop loss are closing the highest level of 29.65.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 29.20.

The USD/TRY rose during early trading on Thursday, as the pair continued to achieve new levels daily during the current week. The dollar rose against the Turkish lira, approaching levels of 29.45 liras per dollar during early European trading.

Investors followed the latest reports, which include expectations that the Turkish government will raise the minimum wage during 2024 in response to the high levels of inflation that the government and the central bank are struggling to control. The latest reports included the Turkish government’s intention to raise the minimum wage by 49 percent, as it is expected to reach 17 thousand Turkish liras, which is approximately 580 US dollars, while the government had raised that minimum by 100 percent during 2023 on two occasions.

Through this increase, the Turkish government seeks to achieve more popularity ahead of the local elections scheduled for the first quarter of the year. This comes at a time when international reports suggest that these increases will make it difficult for the Turkish Central Bank, which seeks to reduce inflation, which has reached 61 percent according to the latest data.

On the official level, this increase aims to absorb the negative impact of the decline in the value of Turkey and the rise in commodity prices, while this increase may cause increased spending and increased demand, which threatens to increase inflation, especially since a third of workers in Turkey already receive the minimum wage, meaning they will be among the beneficiary groups. From the increase.

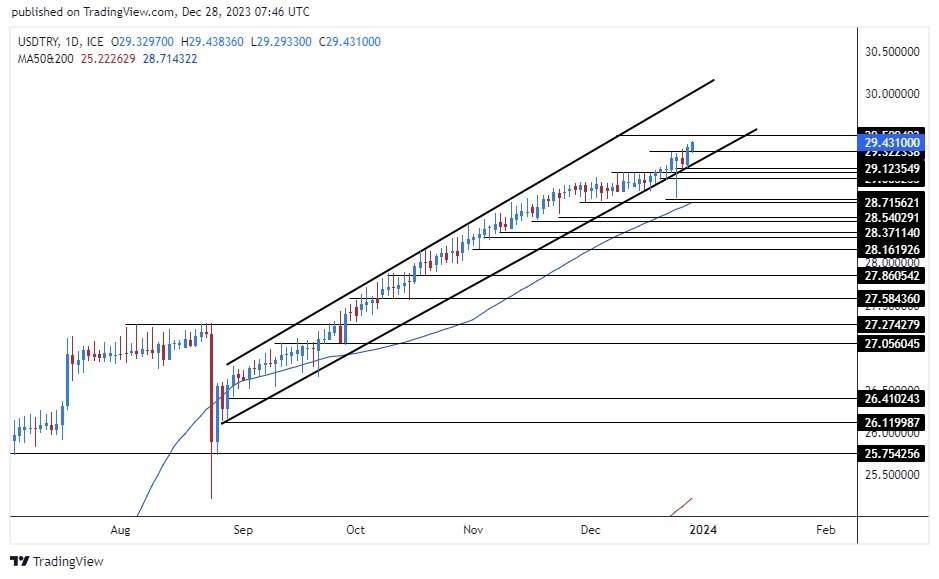

TRY/USD Technical Analysis

The pair continued to rise during trading this morning, as the price recorded its highest levels ever at 29.43. The pair maintained its trading. The price continues to move within a large price channel in today's time frame, reflecting the strong general upward trend that the pair has been following over several months. This is confirmed by the bullish crossover of the 50 and 200 moving averages, respectively, on the daily time frame, as well as on the four-hour time frame, in a reflection of buyers’ control over the price.

If the dollar continues against the lira, the pair will target the resistance levels, which are concentrated at the levels of 29.50 and 29.75, respectively, while on the other hand, if the pair declines, it will target the levels of 29.25 and 29.05, respectively. The Turkish Lira price forecast includes the pair's continued rise as it targets the upper border of the price channel shown in the chart. Please adhere to the mentioned recommendation points and maintain capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.