Top Regulated Brokers

Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

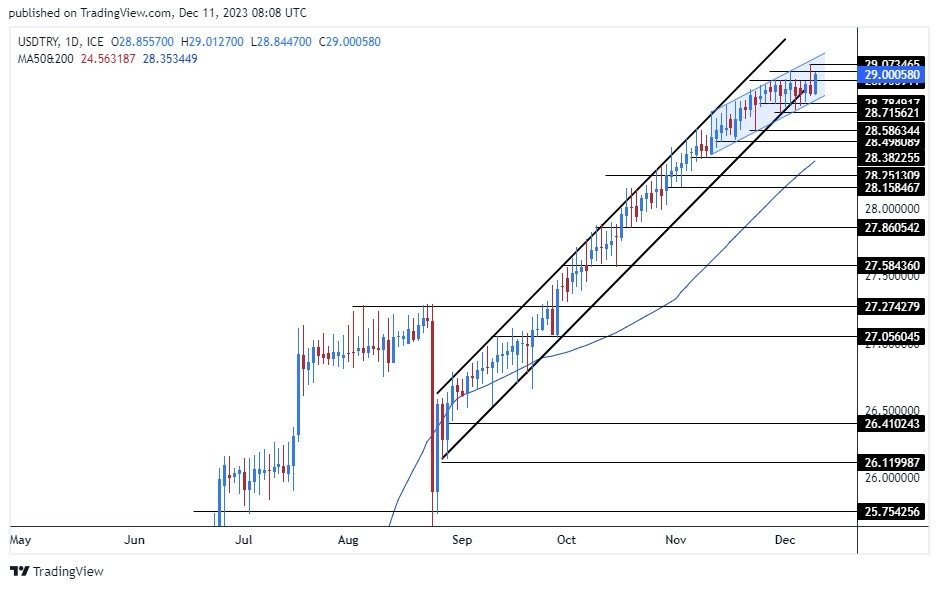

- Entering a buy deal with a pending order from the 28.75 level.

- Place a stop loss closing point below the support levels at 28.60.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance levels at 29.10.

Best-selling entry points

- Entering a sell deal with a pending order from the 29.00 level.

- The best points to place a stop loss are closing the highest level of 29.15.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 28.75

The Turkish lira declined against the dollar during early trading on Monday morning, as the pair approached its lowest levels recorded during the past week. Data issued at the end of last week revealed that the volume of deposits in the banking sector in the country increased by about 1.19 billion liras, bringing the total to 6 trillion and 14 billion liras at the end of the first week of this December. At the same time, the interest rate on deposits reached 49.3 in The hundred.

Meanwhile, investors followed the statements of the Governor of the Turkish Central Bank, Hafiza Ghaya Arkan, during the end of last week, which revealed the central bank’s plans that aim to raise production in sectors that support the current account balance, as the central bank is working to facilitate advance loans to those sectors, which will be reflected.

On the exchange rate of the lira and the slowdown in inflation. Arkan also revealed the bank's intention to increase the rediscount limit, which had previously been raised to reach 10 billion liras during July. The Turkish Central Bank Governor also said that the bank raised the value of interest-free loans to exporters by tenfold amid plans to increase those loans.

TRY/USD Technical Analysis

On the technical level, dollar trading rose against the Turkish lira as the price continued to move near its highest levels ever, which it had previously recorded earlier last week at 29.02. The pair maintained its trading within the ascending price channel on today's time frame, shown in the chart. While the pair's rise is observed to slow down as the pair enters a less severe trading wave in a smaller price channel shown in the chart, the upper border of which the pair was unable to break.

If the pair declines, it will target support levels concentrated at 28.71 and 28.65, respectively. On the other hand, if the price rises, it will target the resistance levels, which are concentrated at 29.00 and 29.10, respectively. At the same time, the price is trading above the 50 and 200 moving averages on the daily time frame, as well as on the four-hour time frame, indicating the control of buyers within the general upward trend that the pair is recording in the long term. The change in monetary policy may prepare the pair to record an upward wave, but at a slower pace. Please adhere to the numbers in the recommendation, with the need to maintain capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.