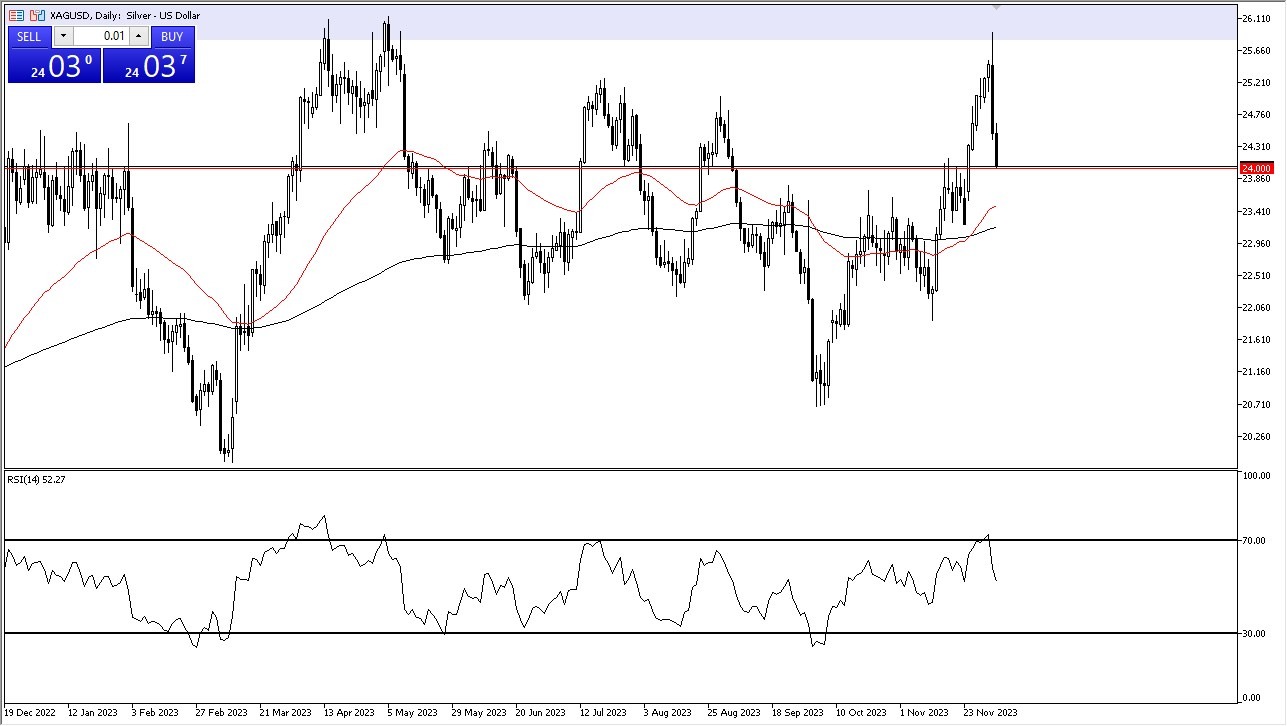

- In the world of retail trading, a common pitfall is the reliance on candlestick charts for price prediction and candlestick patterns. This approach led to considerable losses for many traders last Monday when precious metals unexpectedly surged.

- As witnessed in the market recently, a significant downturn followed the initial spike.

- In line with my previous day's analysis, this trend suggests a potential further decline. The candlestick pattern observed on Monday is typically not an isolated occurrence, indicating broader market movements.

Top Regulated Brokers

The current trajectory seems to be heading towards the $24 mark, a noteworthy level due to its psychological significance and historical resistance. At this point, if a rebound occurs, it could present a viable entry point for purchasing silver. However, it is crucial to note that silver trading is closely aligned with bond market trends, particularly the 10-year yield in the United States. Traders without insight into this area might find themselves navigating without clear direction. This market condition might attract traders seeking ‘cheap silver,’ likely around the $24 level or possibly near the 50-Day EMA.

Should there be a reversal with prices exceeding $25 without first retreating, it would be a strong bullish indicator. However, the market has been overbought in recent days, leading to a significant selloff and an apparent need for value reinstatement in the market.

Cautionary Strategies Amidst Short-Term Volatility

Given these conditions, traders should exercise caution with their position sizing, acknowledging the potential volatility in the short term. It is essential to monitor the market closely under these circumstances. While the prospect of buying silver might be tempting, patience could yield a more opportune moment. The current market scenario underscores the importance of cautious trading strategies and a keen understanding of interconnected market forces.

At the end of the day, I think this is a market that could hurt a lot of people. The precious metals markets are certainly bullish overall, but they have been overbought for some time now, and this massive drop from the high makes sense. I will be looking at the $24 level as a potential entry point as well. Afterall, the markets do tend to like round figures, and it is worth noting that the market has a lot of people standing on the outside, wanting to get involved. Pay attention to bond yields, as if they continue to drop in the US, it could help metals overall, including silver.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.