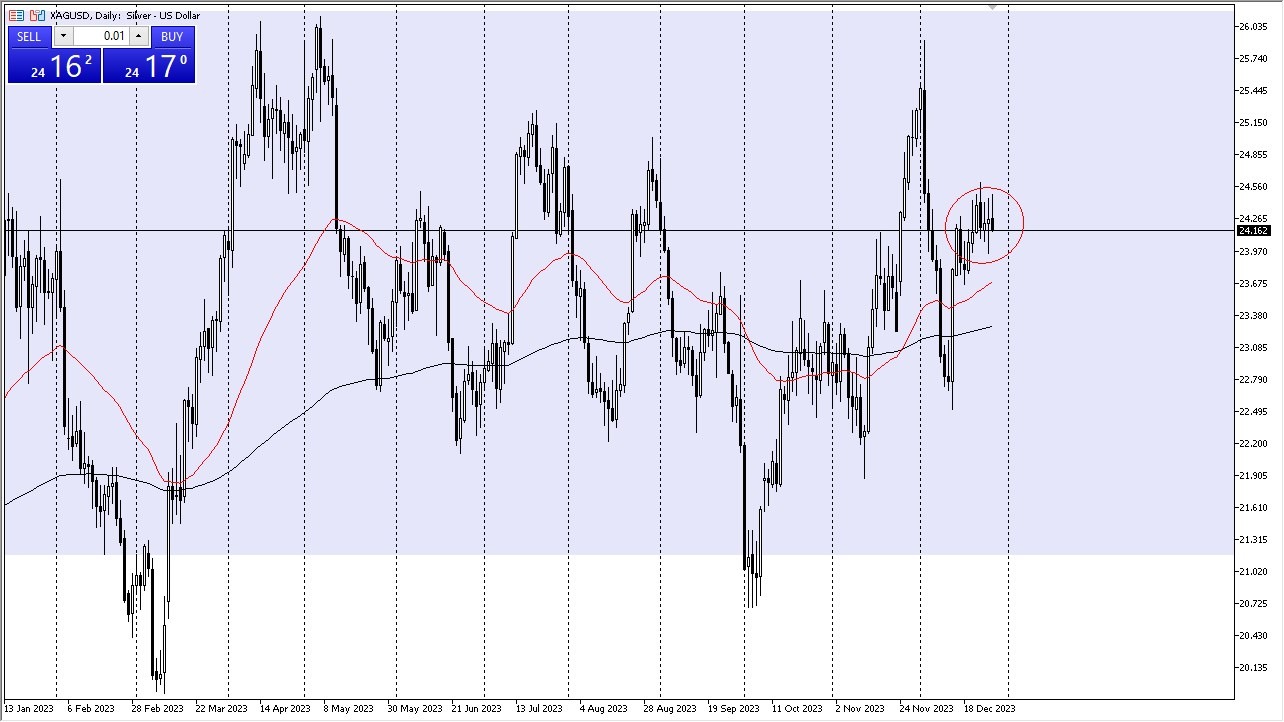

- Silver's performance on Thursday featured an initial rally attempt followed by signs of hesitation, resulting in the utilization of the $24 level as a support zone.

- Additionally, the 50-day Exponential Moving Average is noteworthy in this context, as it frequently functions as a dynamic level of support and resistance.

- The recent uptick in the 50-day EMA suggests a potential return to this pattern.

Top Regulated Brokers

The market's recent choppiness can be attributed, in part, to the current timeframe between Christmas and New Year's Day. During this period, market liquidity experiences a notable impact, and traders should be attuned to this aspect. It's important to acknowledge that silver is inherently volatile, and this week's conditions make it particularly challenging for participants in both futures and CFD markets.

The bond market also exerts an influence on silver's performance. Higher interest rates typically act as a headwind for silver, but recent developments, including a decline in interest rates in the United States following the latest Federal Reserve meeting, favor silver's prospects. In light of these factors, it is conceivable that silver could target the $26 level shortly, though this may transpire in January.

Buying Dips as a Short-Term Trader

From a short-term perspective, any pullback at this juncture is seen as an opportunity to buy, as reflected on short-term charts. However, a breach of the 50-day EMA could potentially alter this scenario, potentially leading to a retracement towards the $22.80 level, which served as a recent consolidation point.

It is pertinent to bear in mind that silver is sensitive not only to interest rate dynamics but also to its industrial use cases. In the event of an economic downturn or recession, silver could face adverse consequences.

At the end of the day, Thursday's performance in the silver market included an initial rally followed by a period of hesitation, with the $24 level serving as support. The 50-day EMA's potential resurgence as dynamic support adds another layer of significance. Market participants should remain cognizant of the current holiday season's impact on liquidity. Silver's prospects are currently bolstered by declining interest rates, potentially paving the way for a move towards the $26 level in the coming weeks. However, the metal's sensitivity to industrial demand and economic conditions should not be overlooked, as these factors can influence its trajectory.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.