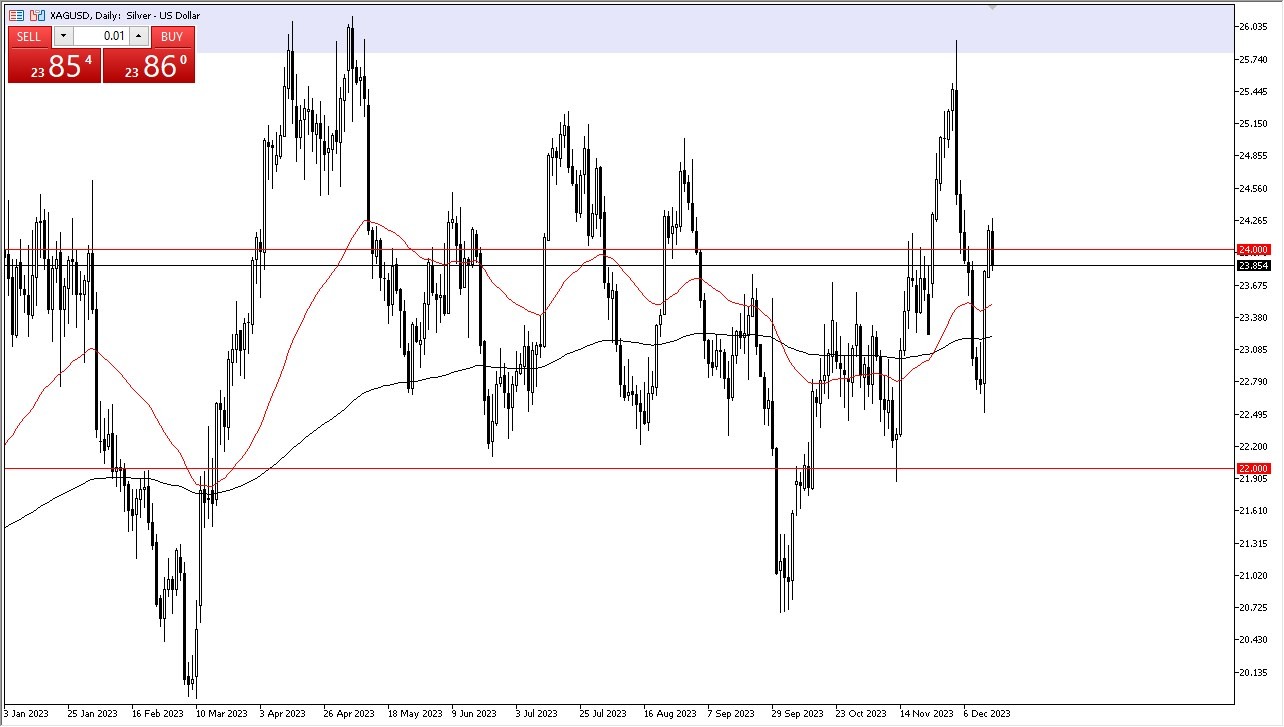

- The silver market showed some resilience during Friday's trading session as it dipped slightly before bouncing back from the $24 level.

- This level holds significant importance due to its psychological significance and its history as a resistance zone.

Top Regulated Brokers

The silver market, like its precious metal counterpart gold, remains highly sensitive to fluctuations in bond yields. Recent wild swings in bond yields have raised the attractiveness of precious metals. Both gold and silver have experienced upward surges, and this trend appears set to continue.

However, it's essential to acknowledge that the market has witnessed a degree of overextension in recent days. Consequently, some hesitation and consolidation around the $24 level should not come as a surprise. This level will likely garner considerable attention from market participants and serve as a short-term floor as the market attempts to stabilize and absorb recent volatility.

A potential catalyst for further silver price gains would be a breakout above the $24.33 level. Such a move could pave the way for silver to rally further, with potential targets at $24.50 and even $25. After that, we will be looking at the possibility of reaching the $26 level, an area that has been a lot of trouble for bulls in the past.

If Rates Rise…

Conversely, should silver experience downside moves and close below the $24 level, support may emerge around the $23.75 level. Further support could be found at the 50-day Exponential Moving Average, which currently hovers around $23.50. Having said that, it is obvious that most traders are focusing on fundamentals rather than technical analysis now.

It's important to highlight that the silver market is renowned for its extraordinary volatility, and traders must exercise caution. The inherent volatility of silver has led to unexpected outcomes for some traders, emphasizing the need for prudent risk management.

In summary, the silver market continues to demonstrate resilience amidst market volatility. The $24 level plays a pivotal role as both a psychological support and a resistance-turned-support zone. With silver's sensitivity to bond yields, the market's upward momentum remains intact. While a degree of consolidation may be expected, selling in this market may be challenging given the current momentum. Patient buyers should consider potential pullbacks as opportunities, but risk management remains paramount in navigating the silver market's inherent volatility.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.