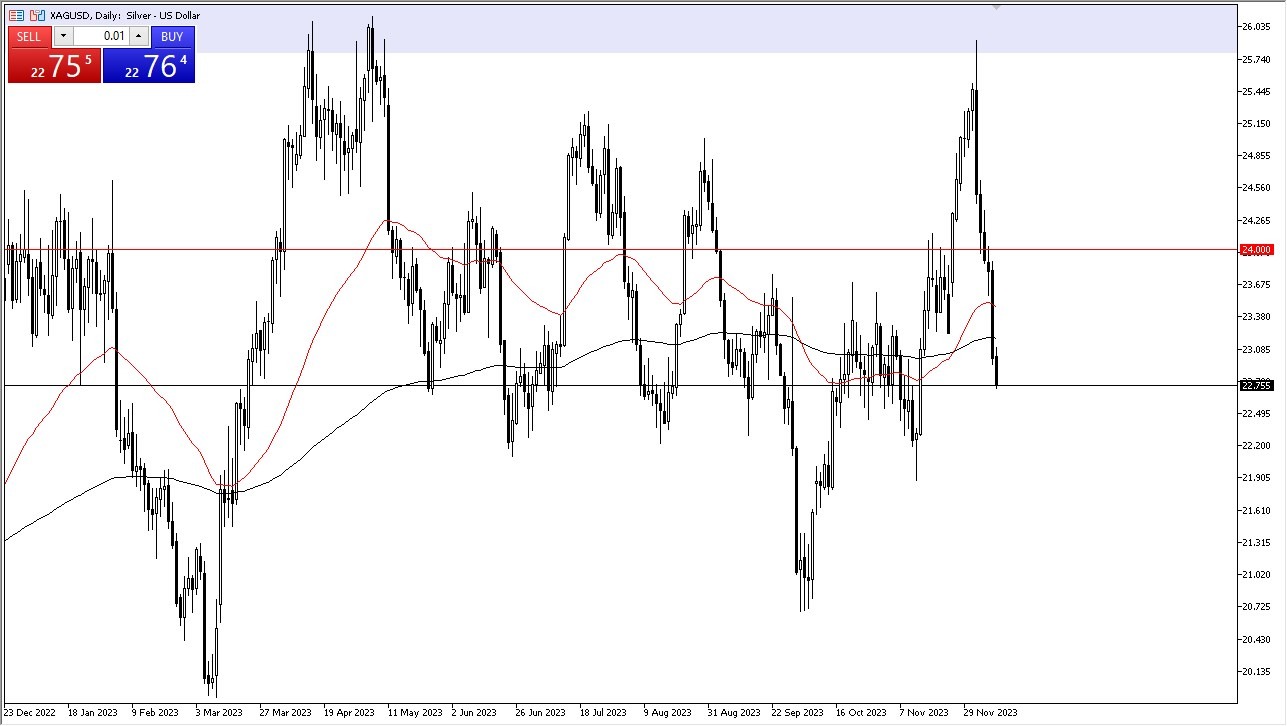

- Silver experienced a significant downturn once again during Monday's trading session, as buyers remained elusive in this market.

- The extent of this selloff prompts curiosity regarding its eventual resolution.

- Notably, the $22 price level beneath us is expected to offer substantial support, and it appears likely that we will attempt to descend towards that level. Current rallies warrant skepticism, and as long as gold continues its decline, the prospects for silver appear equally dim.

Top Regulated Brokers

It is crucial to note that central banks, including the European Central Bank, Federal Reserve, Bank of England, Swiss National Bank, and several minor ones, are scheduled to convene this week. Consequently, the interest rate markets are poised for heightened volatility. Should this materialize, it is probable that silver will bear the brunt of such turbulence, given its pronounced sensitivity to interest rates.

Moreover, it is essential to recognize that silver holds a dual status as both an industrial and a precious metal. Consequently, a portion of the selling pressure may stem from widespread expectations of an impending global economic downturn. Within this context, the market remains inherently cautious regarding any potential rallies. Consequently, a follow-through is likely required for buyers to regain confidence and explore opportunities to acquire silver at reduced prices.

Be Cautious

Irrespective of the unfolding situation, one must exercise caution and avoid excessive leverage. Silver traditionally exhibits remarkable volatility even under the best of conditions. Given the current circumstances and with the approach of the holiday season, liquidity concerns loom large. Thus, the market demands a careful approach. Nevertheless, it stands to reason that a value trade may emerge sooner or later.

Ultimately, the silver market sustained a significant downturn on Monday, characterized by a lack of buying interest. The $22 support level holds critical significance, and it appears increasingly likely that we will target this level in our descent. Skepticism surrounds any current rally attempts, particularly with gold's concurrent decline. The impending central bank meetings portend heightened interest rate market volatility, which could adversely impact silver, given its susceptibility to such fluctuations. Additionally, silver's status as an industrial and precious metal introduces more complexities than say, gold, with some selling attributed to prevailing expectations of a global economic downturn. Buyers may require a follow-through signal to rebuild confidence and explore silver's potential as a value investment. Caution, particularly concerning leverage, is paramount, given silver's inherent volatility, which could be exacerbated by impending liquidity issues associated with the holiday season.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.