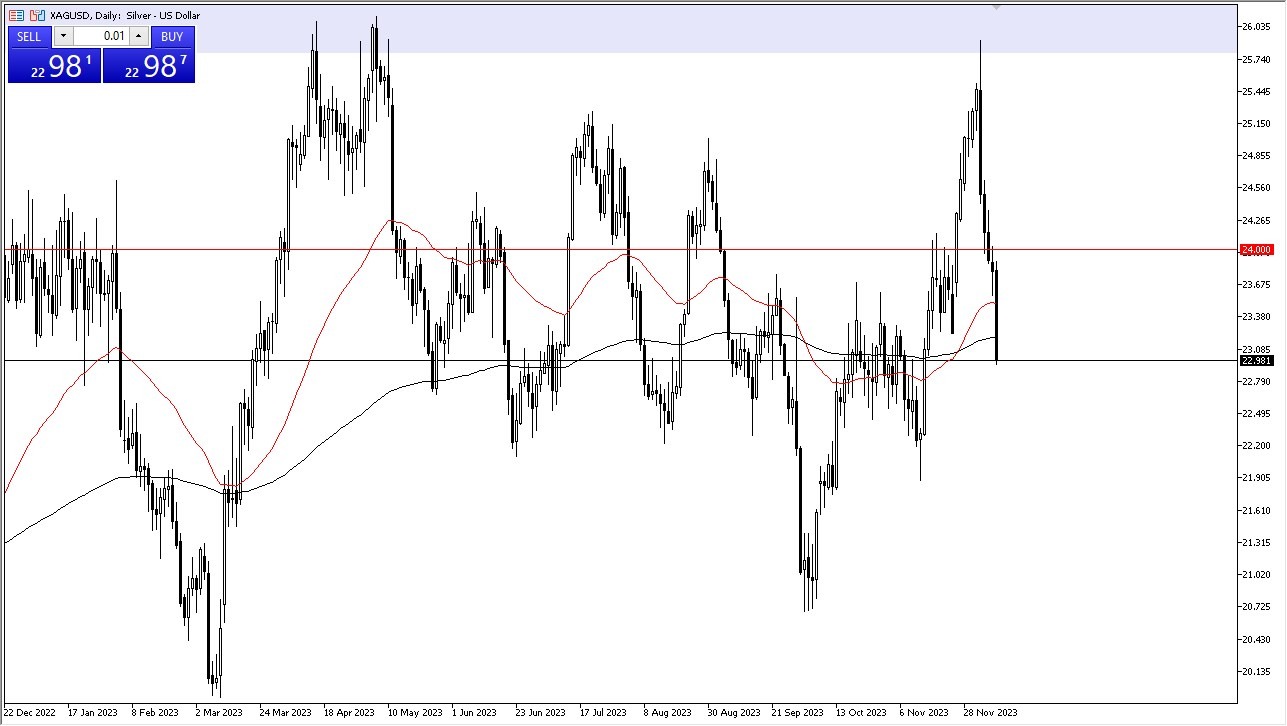

- Silver witnessed a substantial decline during Friday's trading session, signaling what appears to be a gloomy outlook for the metal.

- The breach of the 200-Day Exponential Moving Average continues to exert downward pressure, and the repeated breaches of a significant support level compound the bearish sentiment.

- Silver now faces a daunting task to restore confidence, and if interest rates persist in their ascent, fueled by robust job figures, silver may find itself on the receiving end of further losses. Silver can be quite dangerous, and this is going to be one of those times I believe.

Top Regulated Brokers

In this environment, the prospect of entering a long position in this market seems increasingly implausible. The precious metals sector, as a whole, appears to be grappling with the repercussions of an excessively rapid surge, followed by a conspicuous downward shift, particularly evident in the $26 region. Ultimately, the prevailing scenario suggests that silver could potentially regress to the prior support level, residing near the $21 mark. After that, the most obvious place to look at is the $20 level.

Silver, often characterized by its pronounced volatility, distinguishes itself as a commodity market with a propensity for turbulence. Additionally, the cost associated with trading silver futures presents another deterrent, prompting traders to exercise caution. The prevailing sentiment seems to align with a bearish outlook, as market participants appear to be stacking their bets on the downside.

Technical Analysis Looks Somehow Worse Now

The breach of the 200-Day EMA is likely to draw the attention of technical traders, further intensifying selling pressures. Given the current circumstances, those contemplating an investment in precious metals might find gold to be a more stable alternative, as it is notably less volatile than silver. Silver's sensitivity to interest rates, the US dollar, and industrial demand sets it apart from gold, necessitating a cautious approach to navigating the silver market. Hence, prudence emerges as the key guiding principle in this turbulent environment.

In the end, silver's precipitous decline has cast a pall over its prospects, with the breach of the 200-Day EMA and repeated support level failures amplifying bearish sentiment. Navigating the silver market demands caution, given its proclivity for noise and the elevated costs associated with futures trading. In the current landscape, silver's sensitivity to a multitude of factors underscores the importance of prudence when considering involvement in this particular market.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.