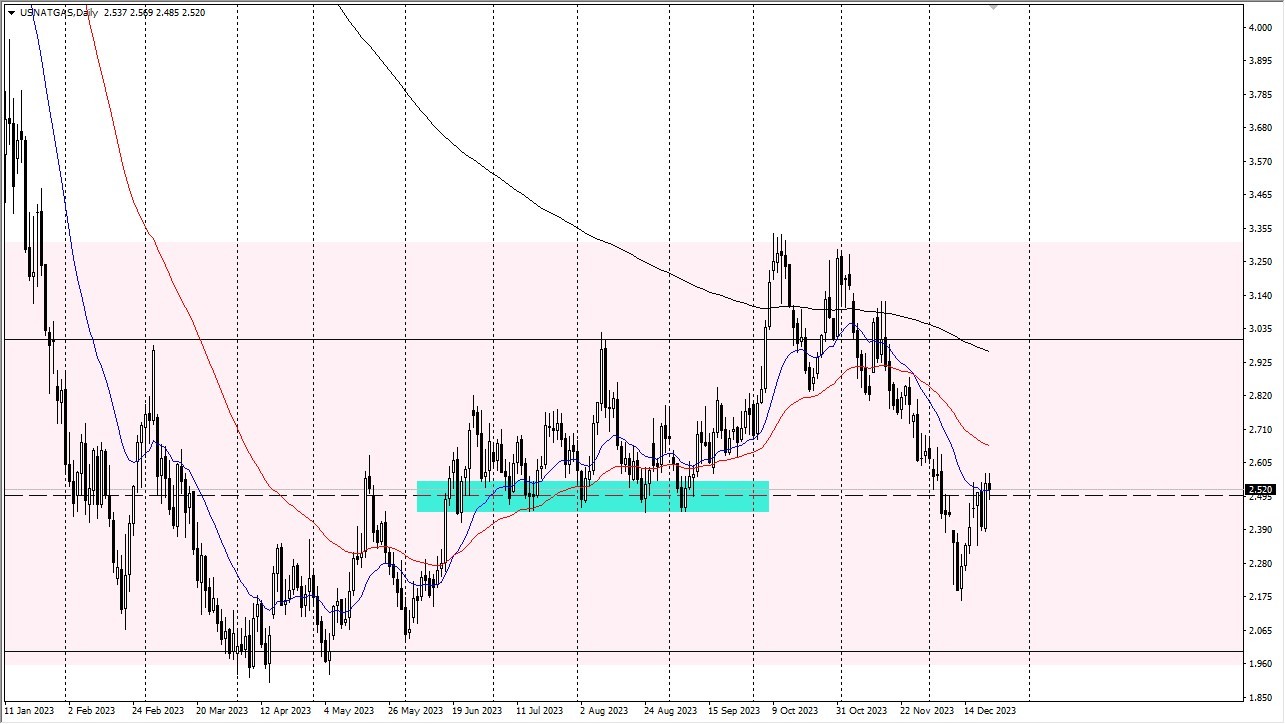

Natural gas markets experienced a minor retreat during Friday's trading session, as they navigate the holiday season while hovering around the $2.50 level. The 20-Day Exponential Moving Average remains a significant indicator that commands the attention of many traders, contributing to a degree of market volatility.

Top Regulated Brokers

Throughout this winter, natural gas markets have demonstrated underperformance, making it intriguing to observe how this trend unfolds in the coming weeks. In the immediate term, the lens through which we must view this market is influenced by liquidity concerns. Moreover, it's important to recognize that natural gas markets often respond to short-term fluctuations and news developments. These markets are closely linked to weather patterns in the northeastern part of the United States, a notoriously unpredictable factor. Notably, there has been a notable absence of snowfall thus far.

50-Day EMA Coming?

- If we breach the recent highs witnessed over the last two days, the market will probably target the 50-day EMA.

- The 50-day EMA holds significance for a considerable number of traders, and surpassing this level could pave the way for an advance toward the $2.75 mark.

- Conversely, if we witness a downturn that takes us below the $2.39 level, we will likely descend toward the $2.20 range, an area where the market has exhibited some turbulence previously.

It's crucial to approach this market with a high degree of caution in terms of position sizing. Additionally, given the current point on the calendar and the advancing stage of winter, one must exercise prudence. Futures contracts are gradually shifting their focus towards the spring season. In light of these factors, while a short-term bounce may be plausible, it is crucial to be vigilant and consider it as more of a short-term maneuver rather than a sustainable trend.

In conclusion, the natural gas markets encountered a modest pullback as they entered the holiday season. The $2.50 level and the 20-day EMA remain key reference points for traders, introducing an element of market volatility. Despite underperforming during this winter, the market's direction in the coming weeks will be interesting to watch. It's essential to be mindful of the unpredictable nature of weather patterns and exercise caution in terms of position sizing. With the winter season progressing, futures contracts are already transitioning towards spring, further emphasizing the need for a cautious approach.

Ready to trade FX Natural Gas? Here are the best commodity trading platforms to choose from.