- Gold markets experienced a relatively calm trading session on Tuesday, a stark contrast to the tumultuous movements seen on Monday.

- The volatility of Monday's session was reminiscent of the extremes witnessed during the Great Financial Crisis 15 years ago, hinting at underlying disruptions in the market, the specifics of which remain unclear.

- Often, the underlying causes of such drastic market movements become apparent only after considerable time has passed.

Top Regulated Brokers

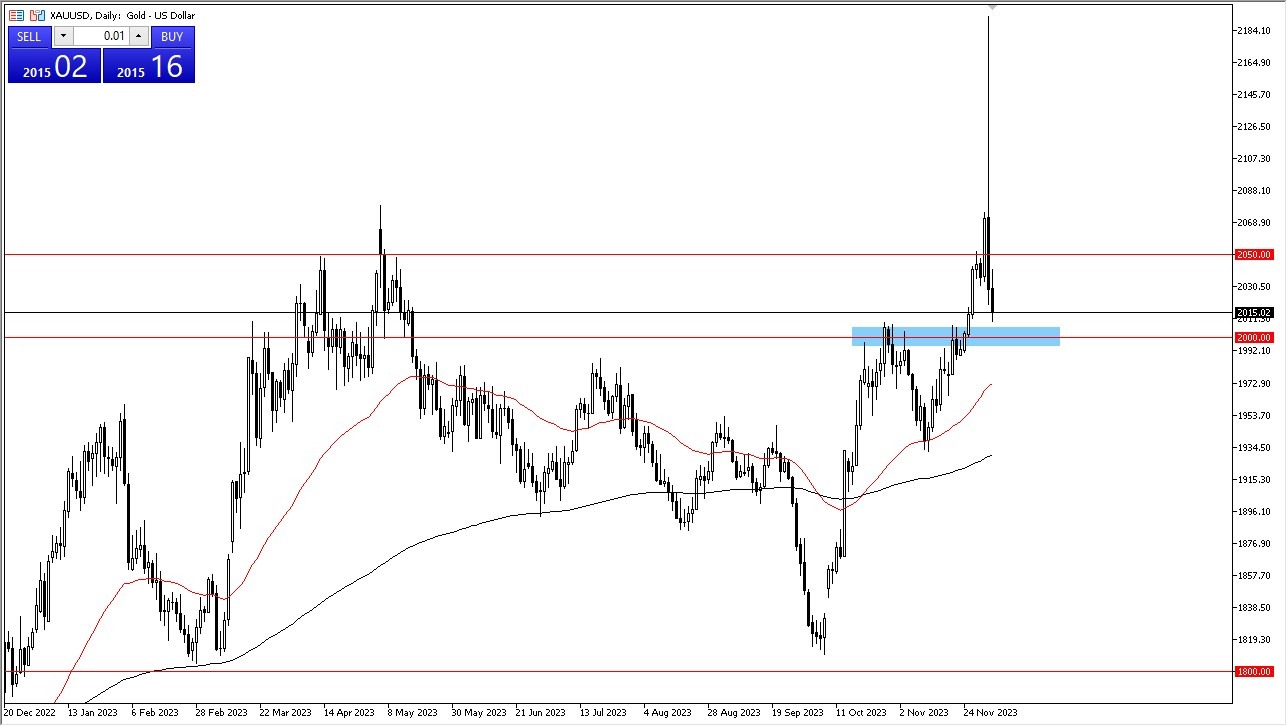

Given this backdrop, there's a degree of caution in approaching the gold market. While the strategy of buying on dips remains appealing, the current market conditions raise questions about whether there has been a sufficient dip to warrant significant investment. The $2000 level, being a round number with psychological importance and a history as a resistance barrier, stands out as a particularly interesting entry point. To capitalize on this, a continuation of the current pullback, followed by a rebound, is necessary. The aim is to capture the rebounding side of the market movement – the "other side of the V." Shorting the market doesn't seem like a viable strategy at the moment, given the prevailing bullish sentiment and the significant influence of bond markets.

Caution Amidst Potential Breakout and the Impact of Non-Farm Payroll

- On the flip side, if gold breaks above the $2050 level and sustains this on a daily closing basis, it might necessitate entering the market at higher levels than preferred.

- Caution is paramount in such a scenario. Additionally, the upcoming Non-Farm Payroll announcement on Friday is another critical factor to monitor, as it could significantly influence market dynamics.

- The size of Monday's shooting star candlestick is so large that it almost overshadows the traditional interpretation of this formation.

In this context, finding value in the gold market is essential, but so is waiting for stability and calm to return to the market. This period of relative tranquility is necessary for traders to regain confidence in initiating new positions. In the meantime, a cautious approach, potentially involving a brief period of inactivity, is advisable unless the desired market bounce materializes. This strategy reflects the need for prudence in a market that, despite its recent quietude, has demonstrated the potential for significant volatility. As the market evolves, staying attuned to these shifts and responding with measured steps will be crucial for navigating the gold market effectively.

Potential signal: I am waiting for a bounce to buy a small position in the gold market. A daily close above $2025 would be enough to push me back in. I would have a stop at the $1993 level. Target is $2109.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.