- The gold markets made an initial attempt to push higher during Thursday's trading session, as market participants grappled with the ongoing uncertainty surrounding the precious metal's direction.

- Recent bouts of volatility have left investors on edge, leading to a somewhat predictable effort to alleviate some of the prevailing apprehension.

- The week commenced with a resounding surge in gold prices, only to reverse course and experience a subsequent downturn.

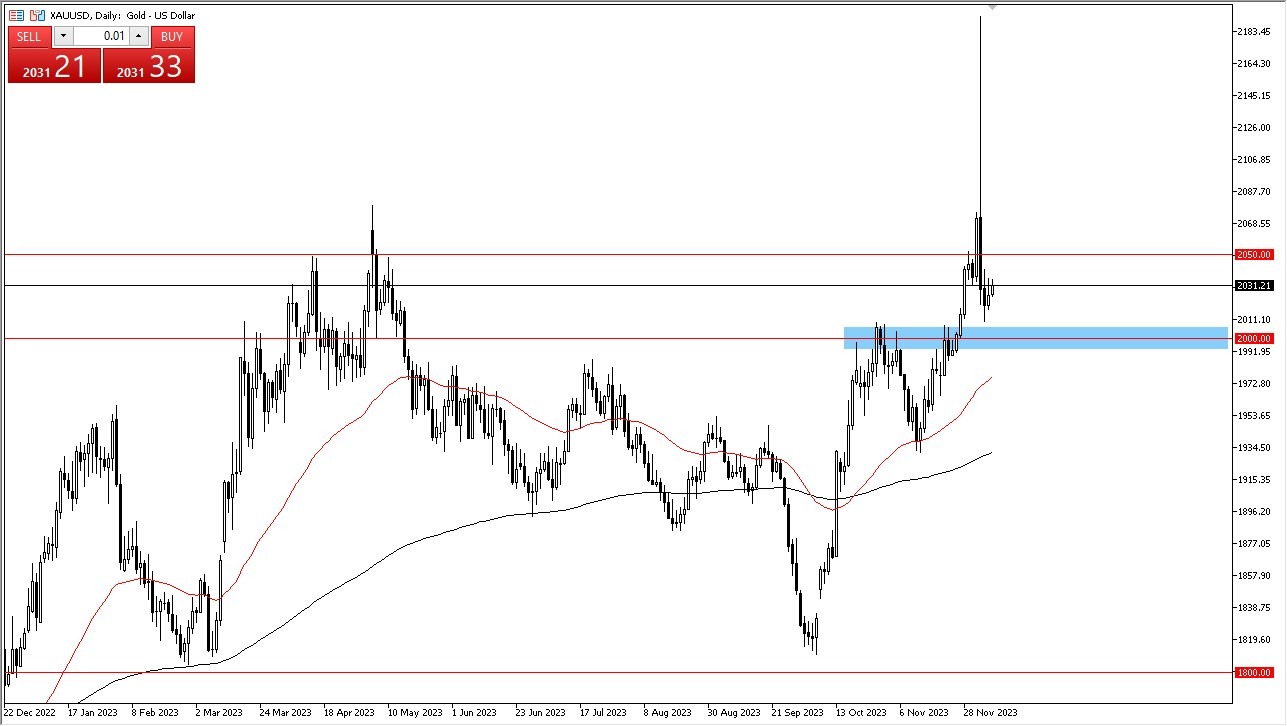

- Nevertheless, there are indications that a consolidation phase is underway, with a defined range emerging between the $2000 support level and the $2050 resistance level.

Top Regulated Brokers

An initial analysis of the chart makes it very clear that the $2000 mark is now a focal point for market observers. This level is noteworthy not only for its prior role as a formidable resistance but also for its newfound significance as a support level. Furthermore, it holds psychological weight as a prominent, round figure, and one can surmise that a multitude of options barriers are situated around this juncture. In sum, exercising prudence in this intricate environment is imperative, but the prevailing sentiment leans towards a bullish stance on gold, as opposed to a bearish tone.

Gold Serves Two Purposes At The Moment

When looking at the current dynamics of the gold market, it becomes apparent that gold serves a dual purpose – a safe-haven asset and a hedge against declining interest rates. In light of this, it is reasonable to expect ongoing volatility in the market. Adding to the complexity, Friday's looming Non-Farm Payroll announcement is anticipated to exert significant influence on interest rates in the United States, which, in turn, will ripple through the gold market. Furthermore, geopolitical tensions on the global stage could act as a catalyst for a surge in gold prices, warranting close monitoring.

In general, the prevailing sentiment does not favor shorting gold in the near term. However, it is essential to exercise vigilance, as a breach below the critical $2000 support level and the 50-Day Exponential Moving Average could necessitate a reassessment of the situation. At present, the prevailing momentum does not seem to favor such a scenario. In the grander scheme, if the $2050 resistance level is surmounted once more, the trajectory points towards further upward movement in gold prices.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.