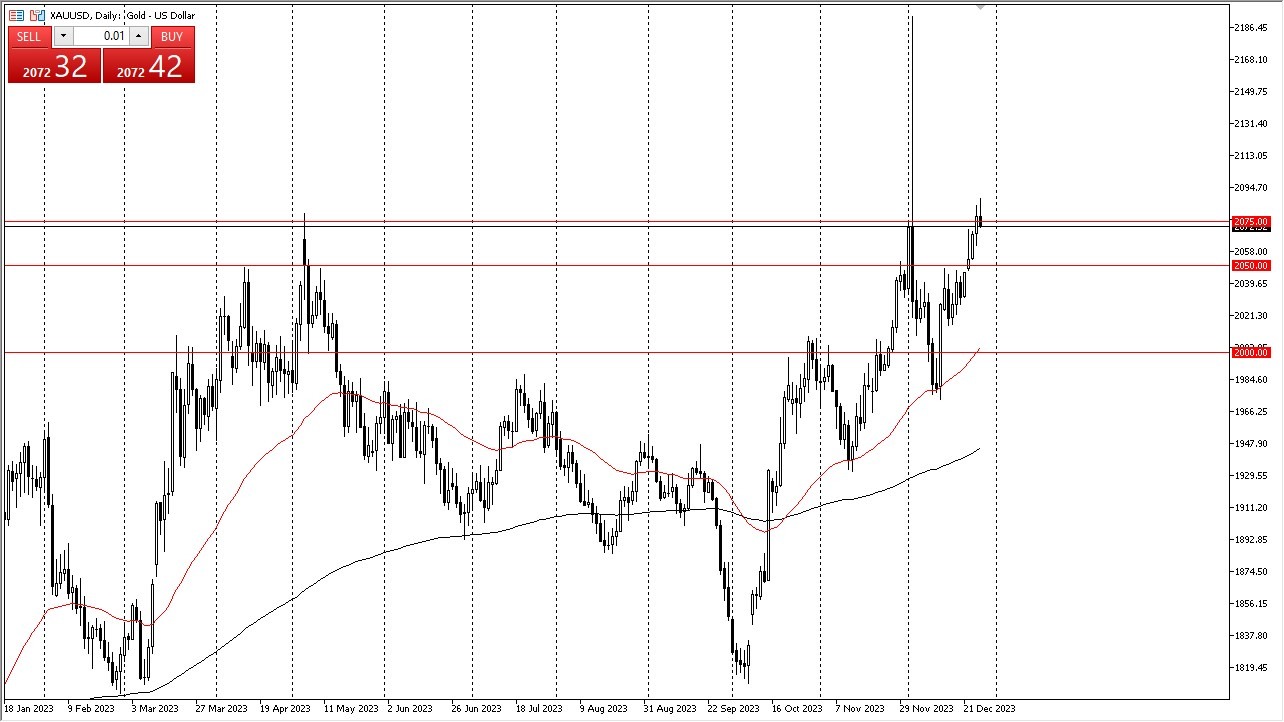

- The gold market displayed an initial attempt at a rally during Thursday's trading session but subsequently retreated, indicating a degree of caution as it approached the $2,075 level.

- Nonetheless, this represents a breakout from previous levels, and we anticipate a continuation of this upward momentum shortly.

Top Regulated Brokers

Over time, we anticipate that gold will retrace its path to reach the peak observed in the candlestick on December 4th. This market is expected to maintain its characteristic behavior of being attractive for buyers during dips, particularly as interest rates in the United States continue their descent. The inverse relationship between gold and interest rates means that declining rates tend to push gold prices higher.

Looking beneath the surface, the $2,050 level is expected to serve as a supportive region due to its previous role as resistance. In the event of a breakdown below this level, there may be a potential decline to $2,000. However, significant concerns about this market's performance would only arise if gold were to break below the $2,000 threshold. It is worth noting that the 50-day Exponential Moving Average closely aligns with this level, providing an additional layer of support. This dual support, combined with a buffer of approximately $75, is likely to sustain bullish sentiment in this market.

‘Tis the Season…. for slow markets

It is important to consider the seasonality factor at this time of the year, as the market tends to experience liquidity challenges. This can introduce a degree of unpredictability to the price movements, and traders should remain mindful of this aspect.

Looking ahead to 2024, several factors suggest a favorable outlook for gold. Geopolitical concerns, the ongoing decline in interest rates in the United States, and the potential for other central banks to adopt looser monetary policies all contribute to this positive outlook. While the journey may present some bumps along the way, it is anticipated that gold will eventually revisit its previous highs.

Ultimately, the gold market's recent performance has demonstrated signs of a breakout, with expectations of further upward movement. The buy-on-dip strategy remains relevant, particularly in the context of declining interest rates. Support levels exist at $2,050 and $2,000, with the 50-day EMA providing additional reinforcement. As we look ahead, 2024 appears promising for gold, fueled by geopolitical factors and monetary policy considerations, though seasonal liquidity challenges may introduce some fluctuations in the short term.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.