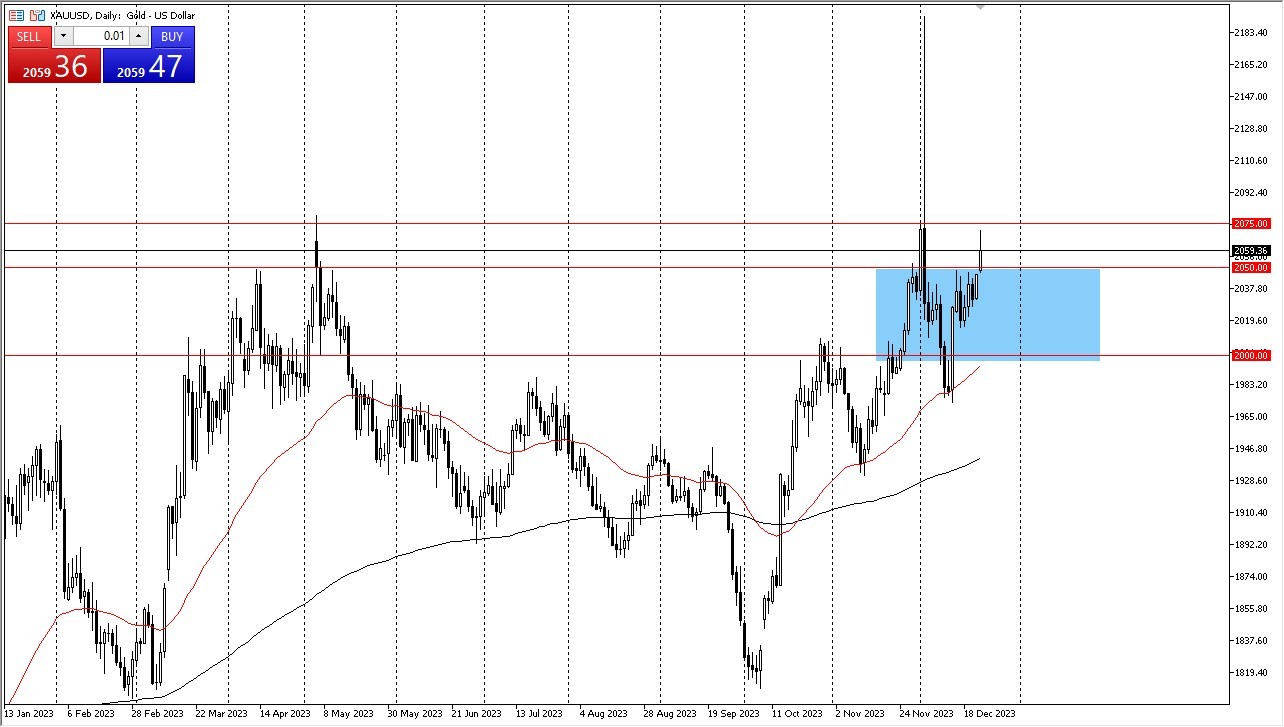

- Gold demonstrated notable strength on Friday, as it surged above the $2,050 level, signaling a potential for further gains. In simpler terms, this means that gold's price is likely to continue rising, and any temporary price drops could be opportunities for buyers.

- The $2,050 level is now expected to act as solid support after we spent some time trading between $2,000 and $2,050.

- Although I had initially anticipated a breakout after the holiday season, the market has shown its intentions by moving higher sooner.

Top Regulated Brokers

Even if the price drops below $2,050, there's a strong likelihood of continued buying interest, reinforcing my stance against selling gold. Additionally, there are multiple factors favoring a rise in gold prices, especially as interest rates continue to decrease in the United States. Gold tends to move in the opposite direction of the 10-year U.S. Treasury yield, so it's essential to closely monitor the bond market. While the market's movements are influenced by these dynamics, it's crucial to remember that liquidity tends to decrease during the holiday season. The upcoming week might be turbulent, but I believe it's only a matter of time before we reach the $2,075 level.

A Breakout Coming?

Once we successfully break above $2,075, it could pave the way for further gains, with the potential to test the significant spike in price that occurred during the volatile trading session on December 4. At this point, I view any price pullbacks as valuable opportunities, and I anticipate that many traders will share this sentiment. Furthermore, the $2,000 level beneath the current price represents robust support and serves as a critical foundation for the market's current trend, particularly with the 50-Day Exponential Moving Average approaching this general area.

At the end of the day, Friday's rally in gold indicates its potential for further upward movement. Investors should consider any short-term price drops as chances to buy. The $2,050 level is now a key support level, and the broader market dynamics, including declining U.S. interest rates, support the case for higher gold prices. While market activity may be volatile in the coming week due to holiday-related liquidity issues, I believe it's only a matter of time before we reach the $2,075 level, opening up the path for more significant gains in the gold market.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.