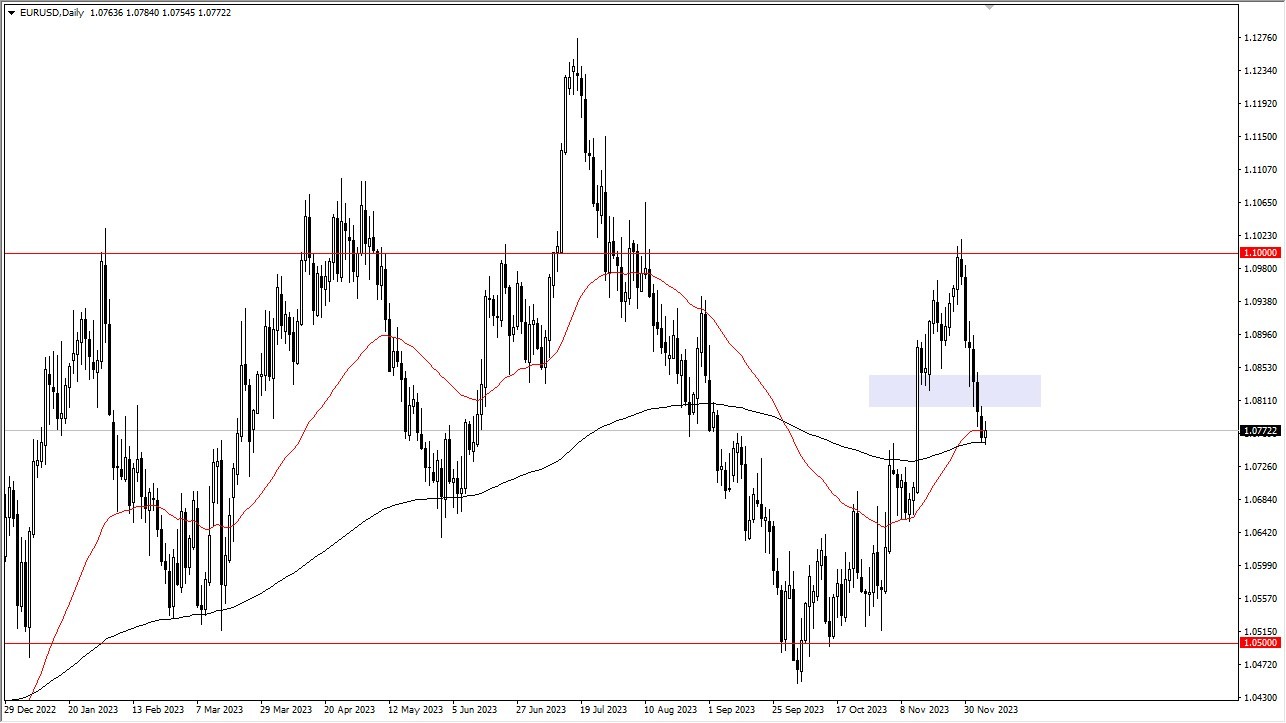

- The EUR/USD exhibited a back-and-forth pattern during Thursday's trading session, with its focus honed on the 200-Day EMA, and indicator that people sometimes pay close attention to.

- Simultaneously, the market found itself testing the 1.0750 level, a juncture that had previously generated noteworthy price fluctuations.

- All factors considered, this scenario underscores a situation where the euro is poised for a holding pattern, awaiting developments in the United States bond markets.

- Recent times have seen interest rates play a pivotal role in currency markets, as traders grapple with the Federal Reserve's stance on monetary policy - whether it will lean towards easing or maintain a more conservative approach.

Top Regulated Brokers

Furthermore, the recent decline in interest rates may suggest market expectations of an impending economic downturn, which tends to bolster the US dollar's appeal as a safe haven. This dynamic manifests in heightened demand for US bonds, subsequently driving yields down and increasing the need for US dollars.

Complex Situation in the EU

Adding to the complexity of the situation is the flow of capital into Europe, a region grappling with significant recessionary issues. Overall, the prevailing landscape indicates that traders are encountering short-term rallies, yet they remain situated in a region where support is likely to intervene. Notably, the upcoming Friday session holds potential significance, as employment data may influence the Federal Reserve's course of action, or at least the perception of what they may or may not do. The market will continue to see a lot of questions asked about the EU itself, and this is something that could favor the USD. Also, if the world plunges into a major recession, then it is likely that the USD could be a safe haven trade for traders in general.

In the end, the euro is currently navigating a challenging environment, and while it grapples with various factors, a notable level to watch is the 1.0850 mark. A breach of this level could signal a bullish upturn, although current momentum appears insufficient to facilitate such a move. It is conceivable that a substantially weaker employment report could inject the necessary impetus for volatility to return to the markets and could make this market move quite rapidly. However, we are getting close to the end of the year, and that could mean a drop in volume which can make markets hard to predict.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.